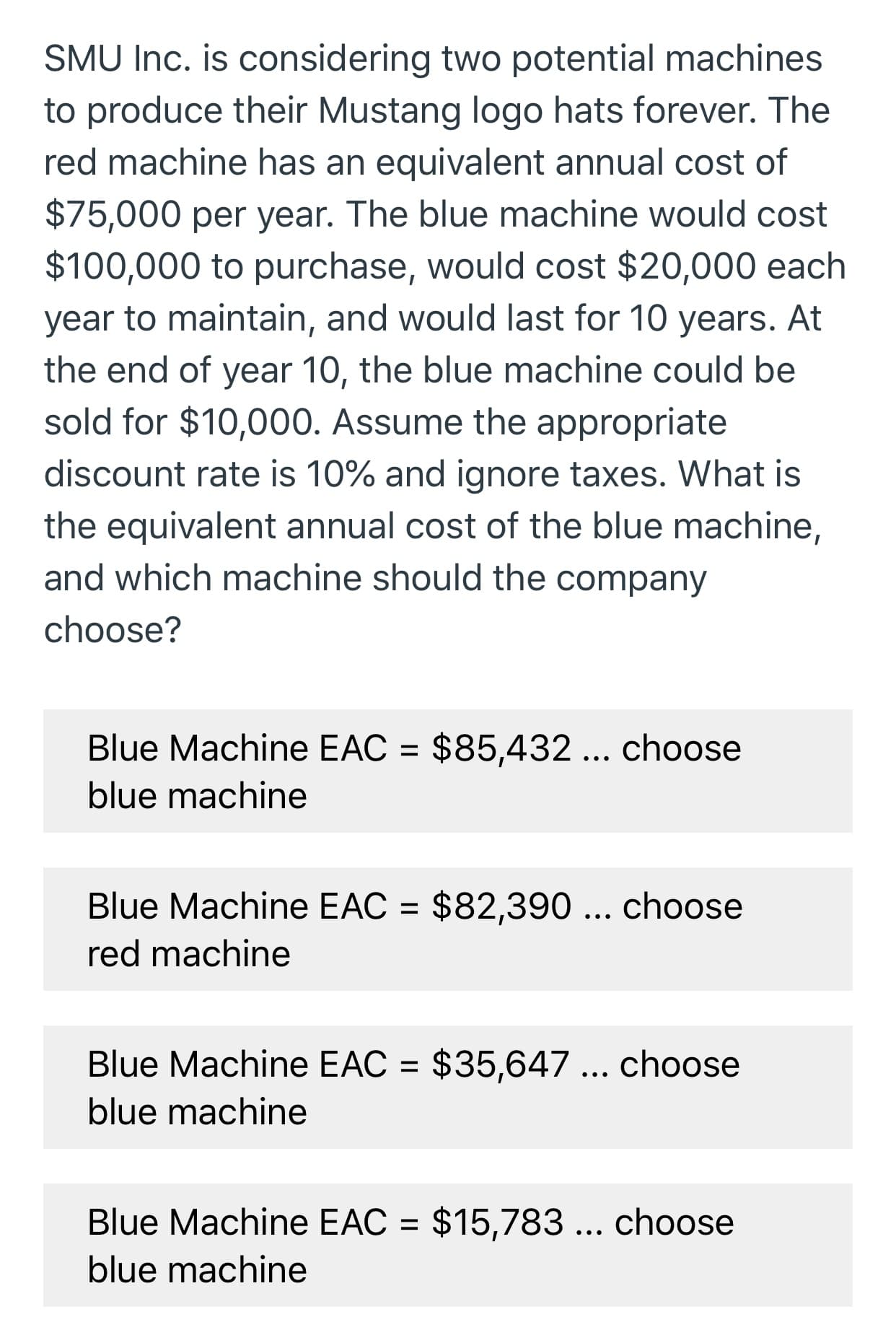

SMU Inc. is considering two potential machines to produce their Mustang logo hats forever. The red machine has an equivalent annual cost of $75,000 per year. The blue machine would cost $100,000 to purchase, would cost $20,000 each year to maintain, and would last for 10 years. At the end of year 10, the blue machine could be sold for $10,000. Assume the appropriate discount rate is 10% and ignore taxes. What is the equivalent annual cost of the blue machine, and which machine should the company choose? $85,432... choose Blue Machine EAC blue machine Blue Machine EAC $82,390... choose red machine $35,647 ... choose Blue Machine EAC blue machine $15,783... choose Blue Machine EAC blue machine

SMU Inc. is considering two potential machines to produce their Mustang logo hats forever. The red machine has an equivalent annual cost of $75,000 per year. The blue machine would cost $100,000 to purchase, would cost $20,000 each year to maintain, and would last for 10 years. At the end of year 10, the blue machine could be sold for $10,000. Assume the appropriate discount rate is 10% and ignore taxes. What is the equivalent annual cost of the blue machine, and which machine should the company choose? $85,432... choose Blue Machine EAC blue machine Blue Machine EAC $82,390... choose red machine $35,647 ... choose Blue Machine EAC blue machine $15,783... choose Blue Machine EAC blue machine

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 2P

Related questions

Question

Please show all equations and work as needed. Make the correct answer clear. If possible, please type work so it can be copied. Thank you.

Transcribed Image Text:SMU Inc. is considering two potential machines

to produce their Mustang logo hats forever. The

red machine has an equivalent annual cost of

$75,000 per year. The blue machine would cost

$100,000 to purchase, would cost $20,000 each

year to maintain, and would last for 10 years. At

the end of year 10, the blue machine could be

sold for $10,000. Assume the appropriate

discount rate is 10% and ignore taxes. What is

the equivalent annual cost of the blue machine,

and which machine should the company

choose?

$85,432... choose

Blue Machine EAC

blue machine

Blue Machine EAC $82,390... choose

red machine

$35,647 ... choose

Blue Machine EAC

blue machine

$15,783... choose

Blue Machine EAC

blue machine

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning