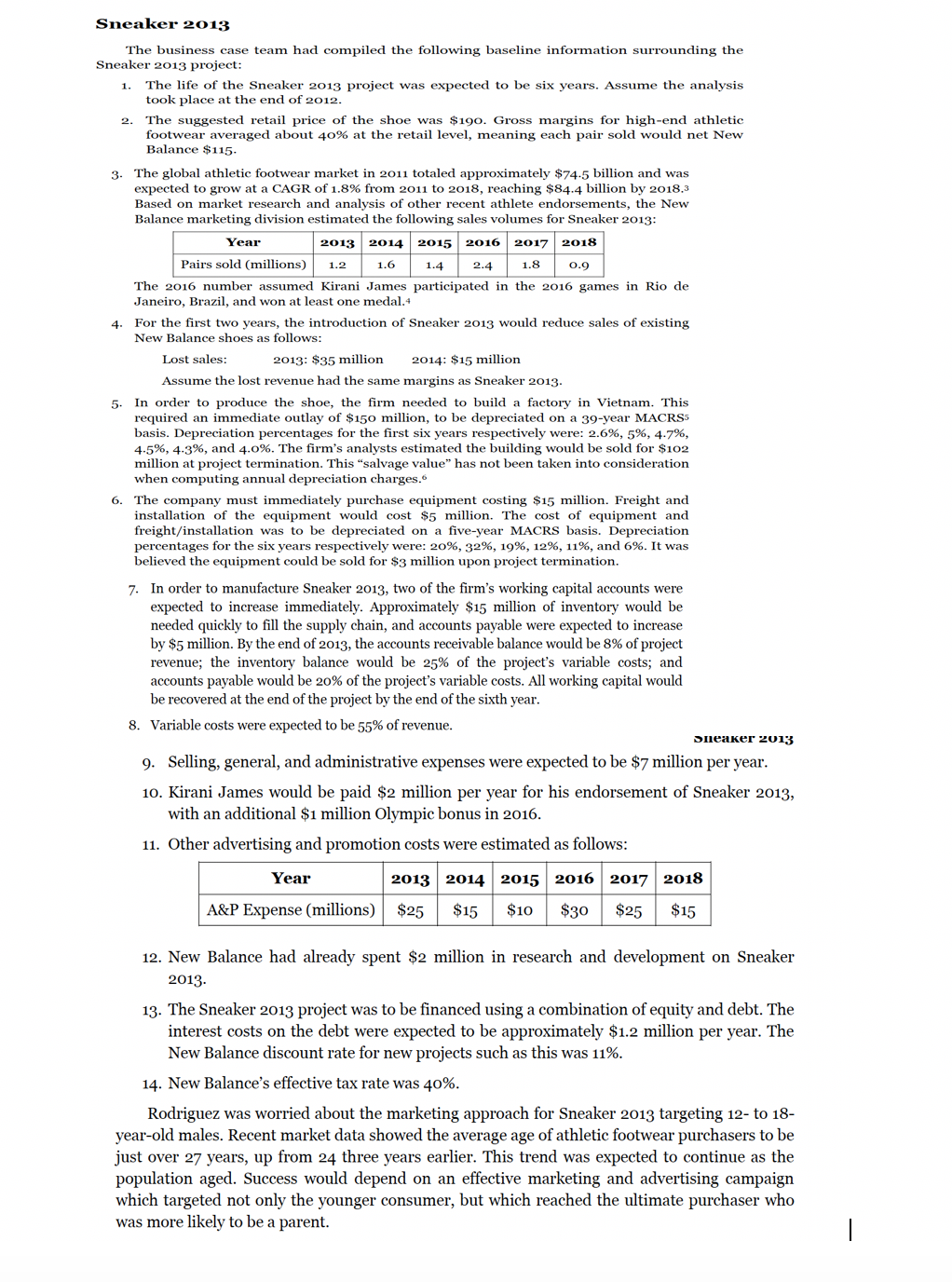

Sneaker 2013 The business case team had compiled the following baseline information surrounding the Sneaker 2013 project: The life of the Sneaker 2013 project was expected to be six years. Assume the analysis took place at the end of 2012. The suggested retail price of the shoe was $190. Gross margins for high-end athletic footwear averaged about 40% at the retail level, meaning each pair sold would net New Balance $115. 3. The global athletic footwear market in 2011 totaled approximately $74.5 billion and was expected to grow at a CAGR of 1.8% from 2011 to 2018, reaching $84.4 billion by 2018,3 Based on market research and analysis of other recent athlete endorsements, the New Balance marketing division estimated the following sales volumes for Sneaker 2013: 2014 2015 2016 2017 2018 Year 2013 Pairs sold (millions) 1.6 1.8 1.2 1.4 2.4 O.9 The 2016 number assumed Kirani James participated in the 2016 games in Rio de Janeiro, Brazil, and won at least one medal.4 4. For the first two years, the introduction of Sneaker 2013 would reduce sales of existing New Balance shoes as follows Lost sales 2014: $15 million 2013: $35 million Assume the lost revenue had the same margins as Sneaker 2013. 5. In order to produce the shoe, the firm needed to build required an immediate outlay of $150 million, to be depreciated on a 39-year MACRSs basis. Depreciation percentages for the first six years respectively were: 2.6%, 5%, 4.7%, 4.5%, 4.3%, and 4.0%. The firm's analysts estimated the building would be sold for $102 million at project termination. This "salvage value" has not been taken into consideration when computing annual depreciation charges. factory in Vietnam. This 6. The company must immediately purchase equipment costing $15 million. Freight and installation of the equipment would cost $5 million. The cost of equipment and freight/installation was to be depreciated on a five-year MACRS basis. Depreciation percentages for the six years respectively were: 20%, 32%, 19%, 12%, 11%, and 6%. It was believed the equipment could be sold for $3 million upon project termination 7. In order to manufacture Sneaker 2013, two of the firm's working capital accounts were expected to increase immediately. Approximately $15 million of inventory would be needed quickly to fill the supply chain, and accounts payable were expected to increase by $5 million. By the end of 2013, the accounts receivable balance would be 8% of project revenue; the inventory balance would be 25% of the project's variable costs; and accounts payable would be 20% of the project's variable costs. All working capital would be recovered at the end of the project by the end of the sixth year. Variable costs were expected to be 55% of revenue 8. SIneaKer 2013 9 Selling, general, and administrative expenses were expected to be $7 million per year 10. Kirani James would be paid $2 million per year for his endorsement of Sneaker 2013, with an additional $1 million Olympic bonus in 2016. 11. Other advertising and promotion costs were estimated as follows: Year 2013 2014 2015 2016 2017 2018 $10 A&P Expense (millions) $25 $15 $30 $25 $15 12. New Balance had already spent $2 million in research and development on Sneaker 2013. 13. The Sneaker 2013 project was to be financed using a combination of equity and debt. The interest costs on the debt were expected to be approximately $1.2 million per year. The New Balance discount rate for new projects such as this was 11%. 14. New Balance's effective tax rate was 40% Rodriguez was worried about the marketing approach for Sneaker 2013 targeting 12- to 18- year-old males. Recent market data showed the average age of athletic footwear purchasers to be just over 27 years, up from 24 three years earlier. This trend was expected to continue as the population aged. Success would depend on an effective marketing and advertising campaign which targeted not only the younger consumer, but which reached the ultimate purchaser who was more likely to be a parent

Sneaker 2013 The business case team had compiled the following baseline information surrounding the Sneaker 2013 project: The life of the Sneaker 2013 project was expected to be six years. Assume the analysis took place at the end of 2012. The suggested retail price of the shoe was $190. Gross margins for high-end athletic footwear averaged about 40% at the retail level, meaning each pair sold would net New Balance $115. 3. The global athletic footwear market in 2011 totaled approximately $74.5 billion and was expected to grow at a CAGR of 1.8% from 2011 to 2018, reaching $84.4 billion by 2018,3 Based on market research and analysis of other recent athlete endorsements, the New Balance marketing division estimated the following sales volumes for Sneaker 2013: 2014 2015 2016 2017 2018 Year 2013 Pairs sold (millions) 1.6 1.8 1.2 1.4 2.4 O.9 The 2016 number assumed Kirani James participated in the 2016 games in Rio de Janeiro, Brazil, and won at least one medal.4 4. For the first two years, the introduction of Sneaker 2013 would reduce sales of existing New Balance shoes as follows Lost sales 2014: $15 million 2013: $35 million Assume the lost revenue had the same margins as Sneaker 2013. 5. In order to produce the shoe, the firm needed to build required an immediate outlay of $150 million, to be depreciated on a 39-year MACRSs basis. Depreciation percentages for the first six years respectively were: 2.6%, 5%, 4.7%, 4.5%, 4.3%, and 4.0%. The firm's analysts estimated the building would be sold for $102 million at project termination. This "salvage value" has not been taken into consideration when computing annual depreciation charges. factory in Vietnam. This 6. The company must immediately purchase equipment costing $15 million. Freight and installation of the equipment would cost $5 million. The cost of equipment and freight/installation was to be depreciated on a five-year MACRS basis. Depreciation percentages for the six years respectively were: 20%, 32%, 19%, 12%, 11%, and 6%. It was believed the equipment could be sold for $3 million upon project termination 7. In order to manufacture Sneaker 2013, two of the firm's working capital accounts were expected to increase immediately. Approximately $15 million of inventory would be needed quickly to fill the supply chain, and accounts payable were expected to increase by $5 million. By the end of 2013, the accounts receivable balance would be 8% of project revenue; the inventory balance would be 25% of the project's variable costs; and accounts payable would be 20% of the project's variable costs. All working capital would be recovered at the end of the project by the end of the sixth year. Variable costs were expected to be 55% of revenue 8. SIneaKer 2013 9 Selling, general, and administrative expenses were expected to be $7 million per year 10. Kirani James would be paid $2 million per year for his endorsement of Sneaker 2013, with an additional $1 million Olympic bonus in 2016. 11. Other advertising and promotion costs were estimated as follows: Year 2013 2014 2015 2016 2017 2018 $10 A&P Expense (millions) $25 $15 $30 $25 $15 12. New Balance had already spent $2 million in research and development on Sneaker 2013. 13. The Sneaker 2013 project was to be financed using a combination of equity and debt. The interest costs on the debt were expected to be approximately $1.2 million per year. The New Balance discount rate for new projects such as this was 11%. 14. New Balance's effective tax rate was 40% Rodriguez was worried about the marketing approach for Sneaker 2013 targeting 12- to 18- year-old males. Recent market data showed the average age of athletic footwear purchasers to be just over 27 years, up from 24 three years earlier. This trend was expected to continue as the population aged. Success would depend on an effective marketing and advertising campaign which targeted not only the younger consumer, but which reached the ultimate purchaser who was more likely to be a parent

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 40P

Related questions

Question

Produce a projected capital budgeting cash flow statement for the Sneaker 2013 project

Answer the following

Here are the questions and I attached the infromation from the case. Any help would be great!

a. ) what is the projects initial (year 0) investment outlay?

b. ) what are the projects annual (year 2013-2018) net operaitng cash flows?

c.) what is the projects terminal (2018)non-operating cash flow?

d.) Does thte sneaker 2013 project appear viable from a quantitative standpoint? (estimate the payback period,

Transcribed Image Text:Sneaker 2013

The business case team had compiled the following baseline information surrounding the

Sneaker 2013 project:

The life of the Sneaker 2013 project was expected to be six years. Assume the analysis

took place at the end of 2012.

The suggested retail price of the shoe was $190. Gross margins for high-end athletic

footwear averaged about 40% at the retail level, meaning each pair sold would net New

Balance $115.

3. The global athletic footwear market in 2011 totaled approximately $74.5 billion and was

expected to grow at a CAGR of 1.8% from 2011 to 2018, reaching $84.4 billion by 2018,3

Based on market research and analysis of other recent athlete endorsements, the New

Balance marketing division estimated the following sales volumes for Sneaker 2013:

2014 2015 2016

2017 2018

Year

2013

Pairs sold (millions)

1.6

1.8

1.2

1.4

2.4

O.9

The 2016 number assumed Kirani James participated in the 2016 games in Rio de

Janeiro, Brazil, and won at least one medal.4

4. For the first two years, the introduction of Sneaker 2013 would reduce sales of existing

New Balance shoes as follows

Lost sales

2014: $15 million

2013: $35 million

Assume the lost revenue had the same margins as Sneaker 2013.

5. In order to produce the shoe, the firm needed to build

required an immediate outlay of $150 million, to be depreciated on a 39-year MACRSs

basis. Depreciation percentages for the first six years respectively were: 2.6%, 5%, 4.7%,

4.5%, 4.3%, and 4.0%. The firm's analysts estimated the building would be sold for $102

million at project termination. This "salvage value" has not been taken into consideration

when computing annual depreciation charges.

factory in Vietnam. This

6. The company must immediately purchase equipment costing $15 million. Freight and

installation of the equipment would cost $5 million. The cost of equipment and

freight/installation was to be depreciated on a five-year MACRS basis. Depreciation

percentages for the six years respectively were: 20%, 32%, 19%, 12%, 11%, and 6%. It was

believed the equipment could be sold for $3 million upon project termination

7. In order to manufacture Sneaker 2013, two of the firm's working capital accounts were

expected to increase immediately. Approximately $15 million of inventory would be

needed quickly to fill the supply chain, and accounts payable were expected to increase

by $5 million. By the end of 2013, the accounts receivable balance would be 8% of project

revenue; the inventory balance would be 25% of the project's variable costs; and

accounts payable would be 20% of the project's variable costs. All working capital would

be recovered at the end of the project by the end of the sixth year.

Variable costs were expected to be 55% of revenue

8.

SIneaKer 2013

9

Selling, general, and administrative expenses were expected to be $7 million per year

10. Kirani James would be paid $2 million per year for his endorsement of Sneaker 2013,

with an additional $1 million Olympic bonus in 2016.

11. Other advertising and promotion costs were estimated as follows:

Year

2013 2014 2015 2016 2017 2018

$10

A&P Expense (millions)

$25

$15

$30

$25

$15

12. New Balance had already spent $2 million in research and development on Sneaker

2013.

13. The Sneaker 2013 project was to be financed using a combination of equity and debt. The

interest costs on the debt were expected to be approximately $1.2 million per year. The

New Balance discount rate for new projects such as this was 11%.

14. New Balance's effective tax rate was 40%

Rodriguez was worried about the marketing approach for Sneaker 2013 targeting 12- to 18-

year-old males. Recent market data showed the average age of athletic footwear purchasers to be

just over 27 years, up from 24 three years earlier. This trend was expected to continue as the

population aged. Success would depend on an effective marketing and advertising campaign

which targeted not only the younger consumer, but which reached the ultimate purchaser who

was more likely to be a parent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning