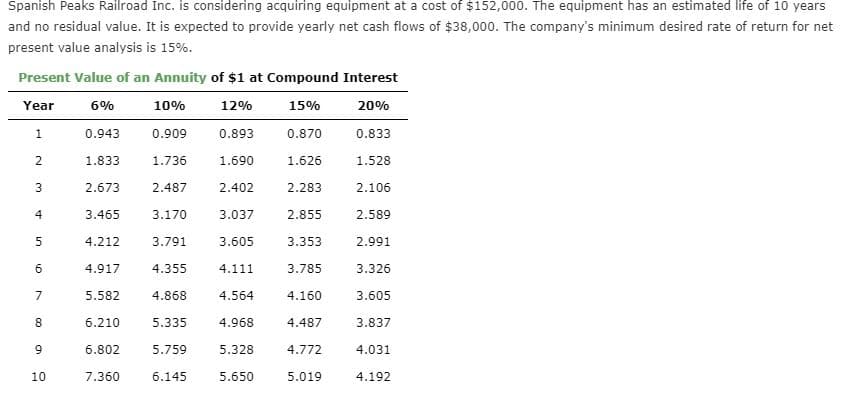

Spanish Peaks Railroad Inc. is considering acquiring equipment at a cost of $152,000. The equipment has an estimated lifte of 10 years and no residual value. It is expected to provide yearly net cash flows of $38,000. The company's minimum desired rate of return for net present value analysis is 15%. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 0.833 1.528 0.943 0.909 0.893 0.870 1.833 1.736 1.626 1.690 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.353 2.991 4.917 4.355 4.111 3.785 3.326

Spanish Peaks Railroad Inc. is considering acquiring equipment at a cost of $152,000. The equipment has an estimated lifte of 10 years and no residual value. It is expected to provide yearly net cash flows of $38,000. The company's minimum desired rate of return for net present value analysis is 15%. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 0.833 1.528 0.943 0.909 0.893 0.870 1.833 1.736 1.626 1.690 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.353 2.991 4.917 4.355 4.111 3.785 3.326

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 19EA: Redbird Company is considering a project with an initial investment of $265,000 in new equipment...

Related questions

Question

Average

Can you help with A & C?

Transcribed Image Text:Spanish Peaks Railroad Inc. is considering acquiring equipment at a cost of $152,000. The equipment has an estimated lifte of 10 years

and no residual value. It is expected to provide yearly net cash flows of $38,000. The company's minimum desired rate of return for net

present value analysis is 15%.

Present Value of an Annuity of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

0.833

1.528

0.943

0.909

0.893

0.870

1.833

1.736

1.626

1.690

2.673

2.487

2.402

2.283

2.106

3.465

3.170

3.037

2.855

2.589

4.212

3.791

3.605

3.353

2.991

4.917

4.355

4.111

3.785

3.326

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning