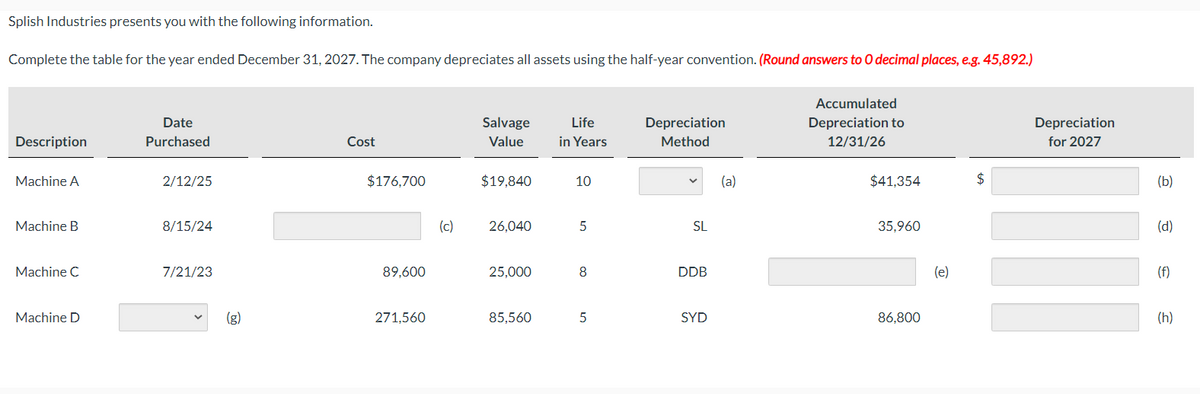

Splish Industries presents you with the following information. Complete the table for the year ended December 31, 2027. The company depreciates all assets using the half-year convention. (Round answers to O decimal places, e.g. 45,892.) Description Machine A Machine B Machine C Machine D Date Purchased 2/12/25 8/15/24 7/21/23 Cost $176,700 89,600 271,560 (c) Salvage Value $19,840 26,040 25,000 85,560 Life in Years 10 5 8 5 Depreciation Method SL DDB SYD (a) Accumulated Depreciation to 12/31/26 $41,354 35,960 86,800 (e) $ Depreciation for 2027 (b) (d) (f) (h)

Splish Industries presents you with the following information. Complete the table for the year ended December 31, 2027. The company depreciates all assets using the half-year convention. (Round answers to O decimal places, e.g. 45,892.) Description Machine A Machine B Machine C Machine D Date Purchased 2/12/25 8/15/24 7/21/23 Cost $176,700 89,600 271,560 (c) Salvage Value $19,840 26,040 25,000 85,560 Life in Years 10 5 8 5 Depreciation Method SL DDB SYD (a) Accumulated Depreciation to 12/31/26 $41,354 35,960 86,800 (e) $ Depreciation for 2027 (b) (d) (f) (h)

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 2CPA: Cox Construction, a company in its 10th year of business, purchased a piece of equipment on April 1,...

Related questions

Question

Ee 155.

Transcribed Image Text:Splish Industries presents you with the following information.

Complete the table for the year ended December 31, 2027. The company depreciates all assets using the half-year convention. (Round answers to O decimal places, e.g. 45,892.)

Description

Machine A

Machine B

Machine C

Machine D

Date

Purchased

2/12/25

8/15/24

7/21/23

(g)

Cost

$176,700

89,600

271,560

(c)

Salvage

Value

$19,840

26,040

25,000

85,560

Life

in Years

10

5

8

5

Depreciation

Method

SL

DDB

SYD

(a)

Accumulated

Depreciation to

12/31/26

$41,354

35,960

86,800

(e)

$

Depreciation

for 2027

(b)

(d)

(f)

(h)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 9 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning