Squeak eClean produces commercial sanitizer used to clean tanker trucks that haul liquid food products such as milk. This sanitizer a commodity like any other and at the wholesale level, there are many domestic and foreign producers that compete vigorously. Suppose you have the following estimated market demand and supply functions for the sanitizer. Od=248.08 +2.2Y-0.6Pc+ 1.2 Ps - 4P Qs = −10+2P In these equations, Q measures output in gallons per month (in 1,000's), P is the price per gallon of the sanitizer, Y is annual average household income (in 1,000's), Pc is an index of commodity prices, and Ps is the average price per gallon of other types of sanitizer. After gathering the latest data, you find that average household income is $36,400, the current level of the commodity price index is 110.6, and the average price per gallon of other types of sanitizers is $48.50. a. How much revenue will this tax raise for the government? b. How much of the tax burden is borne by buyers? How much is borne by sellers? c. What is the deadweight loss for society from this tax?

Squeak eClean produces commercial sanitizer used to clean tanker trucks that haul liquid food products such as milk. This sanitizer a commodity like any other and at the wholesale level, there are many domestic and foreign producers that compete vigorously. Suppose you have the following estimated market demand and supply functions for the sanitizer. Od=248.08 +2.2Y-0.6Pc+ 1.2 Ps - 4P Qs = −10+2P In these equations, Q measures output in gallons per month (in 1,000's), P is the price per gallon of the sanitizer, Y is annual average household income (in 1,000's), Pc is an index of commodity prices, and Ps is the average price per gallon of other types of sanitizer. After gathering the latest data, you find that average household income is $36,400, the current level of the commodity price index is 110.6, and the average price per gallon of other types of sanitizers is $48.50. a. How much revenue will this tax raise for the government? b. How much of the tax burden is borne by buyers? How much is borne by sellers? c. What is the deadweight loss for society from this tax?

Chapter14: Environmental Economics

Section: Chapter Questions

Problem 1SQP

Related questions

Question

You need to answer the first few questions to answer the last. I split up because of number of questions I can ask at once but the question couldn't be answered otherwise

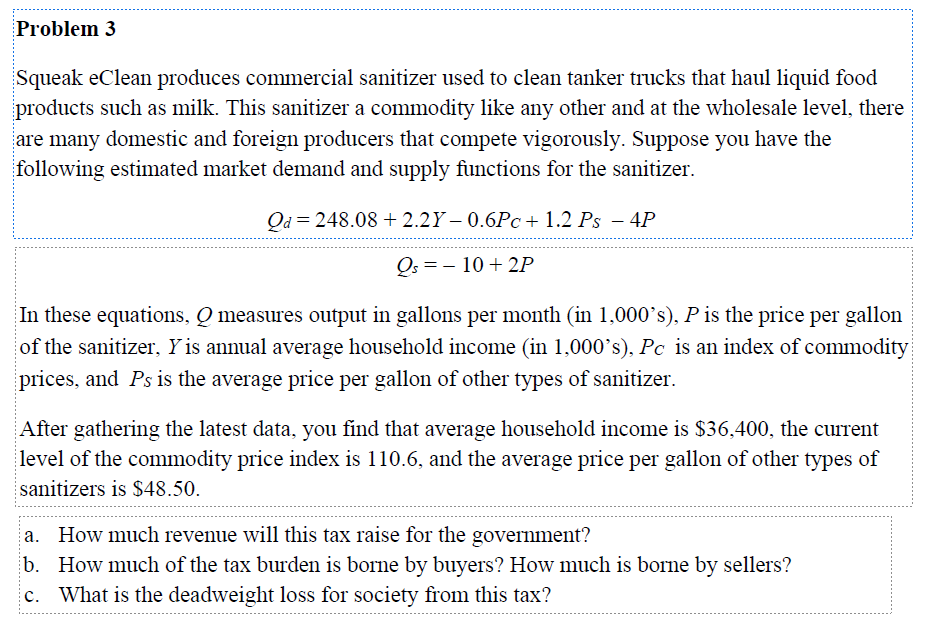

Transcribed Image Text:Problem 3

Squeak eClean produces commercial sanitizer used to clean tanker trucks that haul liquid food

products such as milk. This sanitizer a commodity like any other and at the wholesale level, there

are many domestic and foreign producers that compete vigorously. Suppose you have the

following estimated market demand and supply functions for the sanitizer.

Qd = 248.08 +2.2Y-0.6Pc + 1.2 Ps - 4P

Qs = -10 +2P

In these equations, Q measures output in gallons per month (in 1,000's), P is the price per gallon

of the sanitizer, Y is annual average household income (in 1,000's), Pc is an index of commodity

prices, and Ps is the average price per gallon of other types of sanitizer.

After gathering the latest data, you find that average household income is $36,400, the current

level of the commodity price index is 110.6, and the average price per gallon of other types of

sanitizers is $48.50.

a. How much revenue will this tax raise for the government?

b. How much of the tax burden is borne by buyers? How much is borne by sellers?

c. What is the deadweight loss for society from this tax?

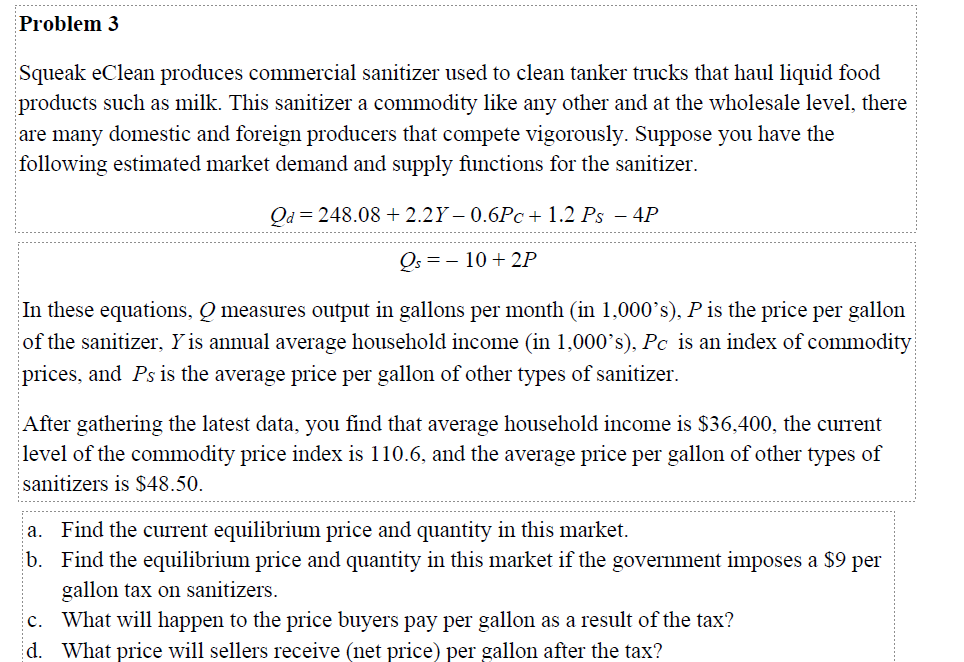

Transcribed Image Text:Problem 3

Squeak eClean produces commercial sanitizer used to clean tanker trucks that haul liquid food

products such as milk. This sanitizer a commodity like any other and at the wholesale level, there

are many domestic and foreign producers that compete vigorously. Suppose you have the

following estimated market demand and supply functions for the sanitizer.

Qd=248.08 +2.2Y – 0.6Pc+ 1.2 Ps − 4P

Qs = 10 +2P

In these equations, Q measures output in gallons per month (in 1,000's), P is the price per gallon

of the sanitizer, Y is annual average household income (in 1,000's), Pc is an index of commodity

prices, and Ps is the average price per gallon of other types of sanitizer.

After gathering the latest data, you find that average household income is $36,400, the current

level of the commodity price index is 110.6, and the average price per gallon of other types of

sanitizers is $48.50.

a. Find the current equilibrium price and quantity in this market.

b. Find the equilibrium price and quantity in this market if the government imposes a $9 per

gallon tax on sanitizers.

c. What will happen to the price buyers pay per gallon as a result of the tax?

d. What price will sellers receive (net price) per gallon after the tax?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you