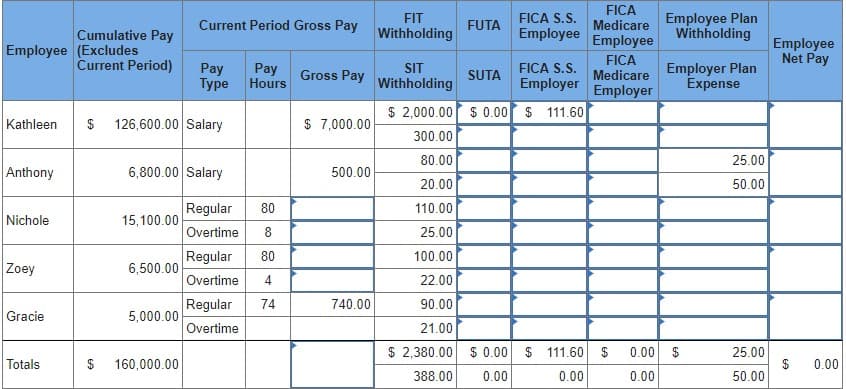

Stark Company has five employees. Employees paid by the hour earn $10 per hour for the regular 40-hour workweek and $15 per hour beyond the 40 hours per week. Hourly employees are paid every two weeks, but salaried employees are paid monthly on the last biweekly payday of each month. FICA Social Security taxes are 6.2% of the first $128,400 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. The company has a benefits plan that includes medical insurance, life insurance, and retirement funding for employees. Under this plan, employees must contribute 5% of their gross income as a payroll withholding, which the company matches with double the amount. Following is the partially completed payroll register for the biweekly period ending August 31, which is the last payday of August. a. Complete this payroll register by filling in all cells for the pay period ended August 31. b, c, d & e. Prepare the August 31 journal entry to: b. Record the accrued biweekly payroll and related liabilities for deductions. c. Record the employer's cash payment of the net payroll of part b. d. Record the employer's payroll taxes including the contribution to the benefits plan. e. Pay all liabilities (except for the net payroll in part ) for this biweekly period.

Stark Company has five employees. Employees paid by the hour earn $10 per hour for the regular 40-hour workweek and $15 per hour beyond the 40 hours per week. Hourly employees are paid every two weeks, but salaried employees are paid monthly on the last biweekly payday of each month. FICA Social Security taxes are 6.2% of the first $128,400 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. The company has a benefits plan that includes medical insurance, life insurance, and retirement funding for employees. Under this plan, employees must contribute 5% of their gross income as a payroll withholding, which the company matches with double the amount. Following is the partially completed payroll register for the biweekly period ending August 31, which is the last payday of August. a. Complete this payroll register by filling in all cells for the pay period ended August 31. b, c, d & e. Prepare the August 31 journal entry to: b. Record the accrued biweekly payroll and related liabilities for deductions. c. Record the employer's cash payment of the net payroll of part b. d. Record the employer's payroll taxes including the contribution to the benefits plan. e. Pay all liabilities (except for the net payroll in part ) for this biweekly period.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section13.2: Recording Employer Payroll Taxes

Problem 1OYO

Related questions

Question

100%

Transcribed Image Text:FICA

Medicare

FICA S.S.

Employee Plan

Withholding

FIT

Current Period Gross Pay

FUTA

Withholding

Cumulative Pay

Employee (Excludes

Current Period)

Employee

Employee

Employee

Net Pay

Pay

Туре

FICA

Medicare

Employer

SIT

Pay

Hours

FICA S.S.

Employer Plan

Expense

Gross Pay

SUTA

Withholding

Employer

$ 2,000.00 $ 0.00 $ 111.60

Kathleen

$

126,600.00 Salary

$ 7,000.00

300.00

80.00

25.00

Anthony

6,800.00 Salary

500.00

20.00

50.00

Regular

80

110.00

Nichole

15,100.00

Overtime

8

25.00

Regular

80

100.00

Zoey

6,500.00

Overtime

4

22.00

Regular

74

740.00

90.00

Gracie

5,000.00

Overtime

21.00

$ 2,380.00 $ 0.00 $ 111.60 $

0.00 $

25.00

$

50.00

Totals

$

160,000.00

0.00

388.00

0.00

0.00

0.00

%24

Transcribed Image Text:Stark Company has five employees. Employees paid by the hour earn $10 per hour for the regular 40-hour workweek and $15 per

hour beyond the 40 hours per week. Hourly employees are paid every two weeks, but salaried employees are paid monthly on the

last biweekly payday of each month. FICA Social Security taxes are 6.2% of the first $128,400 paid to each employee, and FICA

Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. The

company has a benefits plan that includes medical insurance, life insurance, and retirement funding for employees. Under this plan,

employees must contribute 5% of their gross income as a payroll withholding, which the company matches with double the amount.

Following is the partially completed payroll register for the biweekly period ending August 31, which is the last payday of August.

a. Complete this payroll register by filling in all cells for the pay period ended August 31.

b, c, d & e. Prepare the August 31 journal entry to:

b. Record the accrued biweekly payroll and related liabilities for deductions.

c. Record the employer's cash payment of the net payroll of part b.

d. Record the employer's payroll taxes including the contribution to the benefits plan.

e. Pay all liabilities (except for the net payroll in part d) for this biweekly period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning