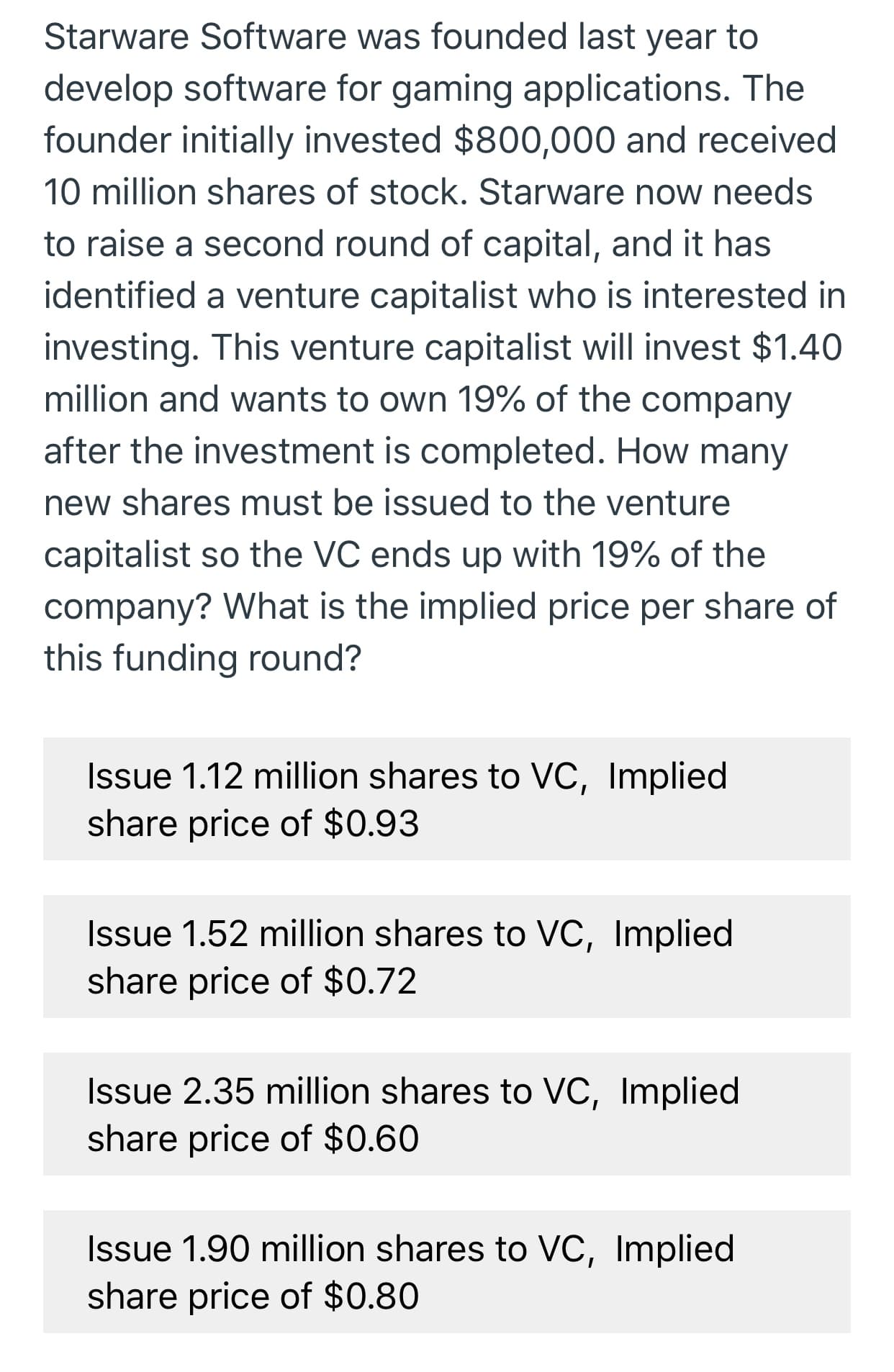

Starware Software was founded last to year develop software for gaming applications. The founder initially invested $800,000 and received 10 million shares of stock. Starware now needs to raise a second round of capital, and it has identified a venture capitalist who is interested in investing. This venture capitalist will invest $1.40 million and wants to own 19% of the company after the investment is completed. How many new shares must be issued to the venture capitalist so the VC ends up with 19% of the company? What is the implied price per share of this funding round? Issue 1.12 million shares to VC, Implied share price of $0.93 Issue 1.52 million shares to VC, Implied share price of $0.72 Issue 2.35 million shares to VC, Implied share price of $0.60 Issue 1.90 million shares to VC, Implied share price of $0.80

Starware Software was founded last to year develop software for gaming applications. The founder initially invested $800,000 and received 10 million shares of stock. Starware now needs to raise a second round of capital, and it has identified a venture capitalist who is interested in investing. This venture capitalist will invest $1.40 million and wants to own 19% of the company after the investment is completed. How many new shares must be issued to the venture capitalist so the VC ends up with 19% of the company? What is the implied price per share of this funding round? Issue 1.12 million shares to VC, Implied share price of $0.93 Issue 1.52 million shares to VC, Implied share price of $0.72 Issue 2.35 million shares to VC, Implied share price of $0.60 Issue 1.90 million shares to VC, Implied share price of $0.80

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter18: Initial Public Offerings, Investment Banking, And Capital Formation

Section: Chapter Questions

Problem 9MC

Related questions

Question

100%

Please show all equations and work as needed. Make the correct answer clear. If possible, please type work so it can be copied. Thank you.

Transcribed Image Text:Starware Software was founded last

to

year

develop software for gaming applications. The

founder initially invested $800,000 and received

10 million shares of stock. Starware now needs

to raise a second round of capital, and it has

identified a venture capitalist who is interested in

investing. This venture capitalist will invest $1.40

million and wants to own 19% of the company

after the investment is completed. How many

new shares must be issued to the venture

capitalist so the VC ends up with 19% of the

company? What is the implied price per share of

this funding round?

Issue 1.12 million shares to VC, Implied

share price of $0.93

Issue 1.52 million shares to VC, Implied

share price of $0.72

Issue 2.35 million shares to VC, Implied

share price of $0.60

Issue 1.90 million shares to VC, Implied

share price of $0.80

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning