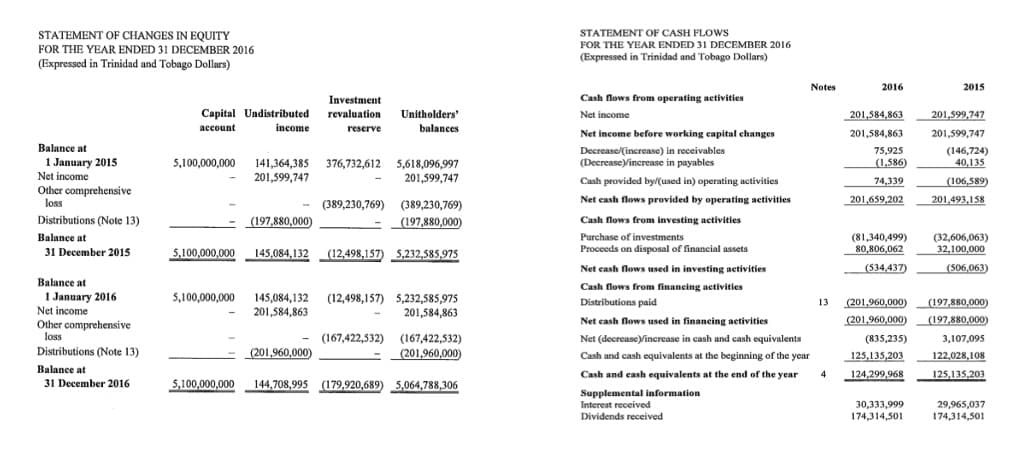

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2016 The is a equity mutual fund domiciled in Trinidad and Tobago. It manages an estimated $5.1 billion (TTD) in assets (as at 2016-12-31). (Expressed in Trinidad and Tobago Dollars) According to the fund's prospectus, its investment objective is "to hold the Initial Assets (40,072,299 Reputable Bank Limited ("RBL") Shares representing 25% of the issued share capital of RBL and the Trinidad and Tobago Government Securities with aggregate face value of aggregate face value of $702,866,700. TTD) and the Additional RBL Shares (additional RBL shares acquired in accordance with the fund's trust deed], for a period of ten (10) years. These assets will be in the form of Note 2016 2015 Investment income Dividend income 174,314,501 30,111,762 174,314,501 Interest income 30,258,074 1. The RBL Shares 2. The Government Securities Total investment income 204,572,575 204,426,263 The Fund is not a performance driven fund hence this investment objective will not change. The Fund does not have the power to borrow cash or provide a security interest over any of the assets of the Fund. Expenses Fees and expenses 9. 2,987,712 2,826,516 Total expenses 2,987,712 2,826,516 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2016 (Exprossed in Trinidad and Tobago Dollars) Net income 201,584,863 201,599,747 2016 2015 Other comprehensive income Notes Assets 125,135,202 5,087,501,844 16,106,063 S317,946 Items that may be reclassified subsequently to profit or loss: Unrealised loss on revaluation Cash and cash equivalents Available-for-sale financial assets 124,299,968 4,920,079,312 4 Held-to-maturity financial assets Interost receivable 16,640,499 5,242,021 (167,422,532) (389,230,769) Total comprehensive income/(loss) 34,162,331 (187,631,022) Total assets 5.066,261,80C 5,234,061,0oss Liabilities Aconued expenses 1,473,494 1,475,O80 1,473,494 1,475,O80 Equity Capital account Undistributed income Investment revaluation reserve 5,100,000,000 144,708,995 (179,920,689) 5,100,000,000 145,084,132 (12,498,157) 5,064,788,306 5,232,585,975 Total liabilities and equity 5,066,261,800 5,234,061,055 Number of units 204,000,000 204,000,000 Net ansets value per unit $24.83 $25.66

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2016 The is a equity mutual fund domiciled in Trinidad and Tobago. It manages an estimated $5.1 billion (TTD) in assets (as at 2016-12-31). (Expressed in Trinidad and Tobago Dollars) According to the fund's prospectus, its investment objective is "to hold the Initial Assets (40,072,299 Reputable Bank Limited ("RBL") Shares representing 25% of the issued share capital of RBL and the Trinidad and Tobago Government Securities with aggregate face value of aggregate face value of $702,866,700. TTD) and the Additional RBL Shares (additional RBL shares acquired in accordance with the fund's trust deed], for a period of ten (10) years. These assets will be in the form of Note 2016 2015 Investment income Dividend income 174,314,501 30,111,762 174,314,501 Interest income 30,258,074 1. The RBL Shares 2. The Government Securities Total investment income 204,572,575 204,426,263 The Fund is not a performance driven fund hence this investment objective will not change. The Fund does not have the power to borrow cash or provide a security interest over any of the assets of the Fund. Expenses Fees and expenses 9. 2,987,712 2,826,516 Total expenses 2,987,712 2,826,516 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2016 (Exprossed in Trinidad and Tobago Dollars) Net income 201,584,863 201,599,747 2016 2015 Other comprehensive income Notes Assets 125,135,202 5,087,501,844 16,106,063 S317,946 Items that may be reclassified subsequently to profit or loss: Unrealised loss on revaluation Cash and cash equivalents Available-for-sale financial assets 124,299,968 4,920,079,312 4 Held-to-maturity financial assets Interost receivable 16,640,499 5,242,021 (167,422,532) (389,230,769) Total comprehensive income/(loss) 34,162,331 (187,631,022) Total assets 5.066,261,80C 5,234,061,0oss Liabilities Aconued expenses 1,473,494 1,475,O80 1,473,494 1,475,O80 Equity Capital account Undistributed income Investment revaluation reserve 5,100,000,000 144,708,995 (179,920,689) 5,100,000,000 145,084,132 (12,498,157) 5,064,788,306 5,232,585,975 Total liabilities and equity 5,066,261,800 5,234,061,055 Number of units 204,000,000 204,000,000 Net ansets value per unit $24.83 $25.66

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 27P

Related questions

Question

Good day,

To work out the

![STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 2016

The is a equity mutual fund domiciled in Trinidad and Tobago. It manages

an estimated $5.1 billion (TTD) in assets (as at 2016-12-31).

(Expressed in Trinidad and Tobago Dollars)

According to the fund's prospectus, its investment objective is "to hold the Initial Assets (40,072,299

Reputable Bank Limited ("RBL") Shares representing 25% of the issued share capital of RBL and the

Trinidad and Tobago Government Securities with aggregate face value of aggregate face value of

$702,866,700. TTD) and the Additional RBL Shares (additional RBL shares acquired in accordance

with the fund's trust deed], for a period of ten (10) years. These assets will be in the form of

Note

2016

2015

Investment income

Dividend income

174,314,501

30,111,762

174,314,501

Interest income

30,258,074

1. The RBL Shares

2. The Government Securities

Total investment income

204,572,575

204,426,263

The Fund is not a performance driven fund hence this investment objective will not change. The Fund

does not have the power to borrow cash or provide a security interest over any of the assets of the Fund.

Expenses

Fees and expenses

9.

2,987,712

2,826,516

Total expenses

2,987,712

2,826,516

STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2016

(Exprossed in Trinidad and Tobago Dollars)

Net income

201,584,863

201,599,747

2016

2015

Other comprehensive income

Notes

Assets

125,135,202

5,087,501,844

16,106,063

S317,946

Items that may be reclassified

subsequently to profit or loss:

Unrealised loss on revaluation

Cash and cash equivalents

Available-for-sale financial assets

124,299,968

4,920,079,312

4

Held-to-maturity financial assets

Interost receivable

16,640,499

5,242,021

(167,422,532)

(389,230,769)

Total comprehensive income/(loss)

34,162,331

(187,631,022)

Total assets

5.066,261,80C

5,234,061,0oss

Liabilities

Aconued expenses

1,473,494

1,475,O80

1,473,494

1,475,O80

Equity

Capital account

Undistributed income

Investment revaluation reserve

5,100,000,000

144,708,995

(179,920,689)

5,100,000,000

145,084,132

(12,498,157)

5,064,788,306

5,232,585,975

Total liabilities and equity

5,066,261,800

5,234,061,055

Number of units

204,000,000

204,000,000

Net ansets value per unit

$24.83

$25.66](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Feb787866-00cb-430f-aa58-286b3423d73c%2F8c31aece-646b-4e9a-b51d-071155239c7e%2Fdbx21u.jpeg&w=3840&q=75)

Transcribed Image Text:STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 2016

The is a equity mutual fund domiciled in Trinidad and Tobago. It manages

an estimated $5.1 billion (TTD) in assets (as at 2016-12-31).

(Expressed in Trinidad and Tobago Dollars)

According to the fund's prospectus, its investment objective is "to hold the Initial Assets (40,072,299

Reputable Bank Limited ("RBL") Shares representing 25% of the issued share capital of RBL and the

Trinidad and Tobago Government Securities with aggregate face value of aggregate face value of

$702,866,700. TTD) and the Additional RBL Shares (additional RBL shares acquired in accordance

with the fund's trust deed], for a period of ten (10) years. These assets will be in the form of

Note

2016

2015

Investment income

Dividend income

174,314,501

30,111,762

174,314,501

Interest income

30,258,074

1. The RBL Shares

2. The Government Securities

Total investment income

204,572,575

204,426,263

The Fund is not a performance driven fund hence this investment objective will not change. The Fund

does not have the power to borrow cash or provide a security interest over any of the assets of the Fund.

Expenses

Fees and expenses

9.

2,987,712

2,826,516

Total expenses

2,987,712

2,826,516

STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2016

(Exprossed in Trinidad and Tobago Dollars)

Net income

201,584,863

201,599,747

2016

2015

Other comprehensive income

Notes

Assets

125,135,202

5,087,501,844

16,106,063

S317,946

Items that may be reclassified

subsequently to profit or loss:

Unrealised loss on revaluation

Cash and cash equivalents

Available-for-sale financial assets

124,299,968

4,920,079,312

4

Held-to-maturity financial assets

Interost receivable

16,640,499

5,242,021

(167,422,532)

(389,230,769)

Total comprehensive income/(loss)

34,162,331

(187,631,022)

Total assets

5.066,261,80C

5,234,061,0oss

Liabilities

Aconued expenses

1,473,494

1,475,O80

1,473,494

1,475,O80

Equity

Capital account

Undistributed income

Investment revaluation reserve

5,100,000,000

144,708,995

(179,920,689)

5,100,000,000

145,084,132

(12,498,157)

5,064,788,306

5,232,585,975

Total liabilities and equity

5,066,261,800

5,234,061,055

Number of units

204,000,000

204,000,000

Net ansets value per unit

$24.83

$25.66

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning