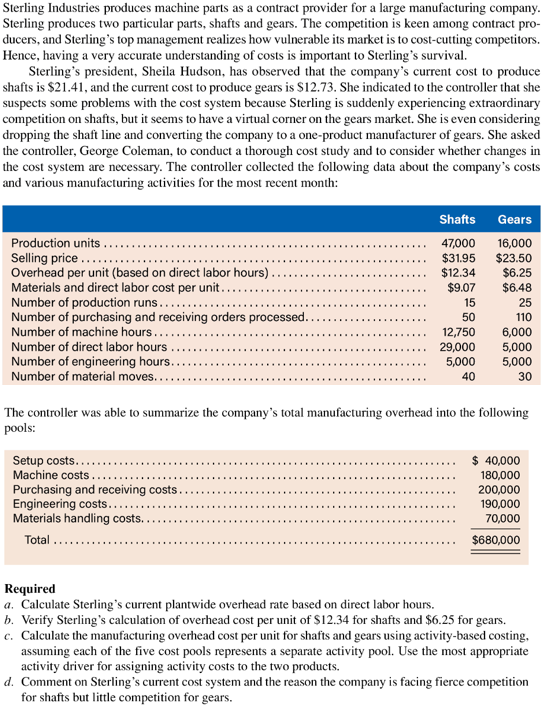

Sterling Industries produces machine parts as a contract provider for a large manufacturing company Sterling produces two particular parts, shafts and gears. The competition is keen among contract pro- ducers, and Sterling's top management realizes how vulnerable its market is to cost-cutting competitors Hence, having a very accurate understanding of costs is important to Sterling's survival Sterling's president, Sheila Hudson, has observed that the company's current cost to produce shafts is $21.41, and the current cost to produce gears is S12.73. She indicated to the controller that she suspects some problems with the cost system because Sterling is suddenly experiencing extraordinary competition on shafts, but it seems to have a virtual corner on the gears market. She is even considering dropping the shaft line and converting the company to a one-product manufacturer of gears. She asked the controller, George Coleman, to conduct a thorough cost study and to consider whether changes in the cost system are necessary. The controller collected the following data about the company's costs and various manufacturing activities for the most recent month Shafts Gears Production units Selling price Overhead per unit (based on direct labor hours). Materials and direct labor cost per unit.... Number of production runs......... Number of purchasing and receiving orders processed.. Number of machine hours... 47,000 $31.95 $12.34 $9.07 16,000 $23.50 $6.25 $6.48 15 25 110 6,000 5,000 5,000 50 12,750 29,000 5,000 Number of direct labor hours Number of engineering hours.. Number of material moves.. 40 30 The controller was able to summarize the company's total manufacturing overhead into the following pools: Setup costs... Machine costs Purchasing and receiving costs Engineering costs.. Materials handling costs.. 40,000 180,000 200,000 190,000 70,000 Total $680,000 Required a. Calculate Sterling's current plantwide overhead rate based on direct labor hours b. Verify Sterling's calculation of overhead cost per unit of $12.34 for shafts and $6.25 for gears. c. Calculate the manufacturing overhead cost per unit for shafts and gears using activity-based costing assuming each of the five cost pools represents a separate activity pool. Use the most appropriate activity driver for assigning activity costs to the two products. d. Comment on Sterling 's current cost system and the reason the company is facing fierce competition for shafts but little competition for gears

Sterling Industries produces machine parts as a contract provider for a large manufacturing company Sterling produces two particular parts, shafts and gears. The competition is keen among contract pro- ducers, and Sterling's top management realizes how vulnerable its market is to cost-cutting competitors Hence, having a very accurate understanding of costs is important to Sterling's survival Sterling's president, Sheila Hudson, has observed that the company's current cost to produce shafts is $21.41, and the current cost to produce gears is S12.73. She indicated to the controller that she suspects some problems with the cost system because Sterling is suddenly experiencing extraordinary competition on shafts, but it seems to have a virtual corner on the gears market. She is even considering dropping the shaft line and converting the company to a one-product manufacturer of gears. She asked the controller, George Coleman, to conduct a thorough cost study and to consider whether changes in the cost system are necessary. The controller collected the following data about the company's costs and various manufacturing activities for the most recent month Shafts Gears Production units Selling price Overhead per unit (based on direct labor hours). Materials and direct labor cost per unit.... Number of production runs......... Number of purchasing and receiving orders processed.. Number of machine hours... 47,000 $31.95 $12.34 $9.07 16,000 $23.50 $6.25 $6.48 15 25 110 6,000 5,000 5,000 50 12,750 29,000 5,000 Number of direct labor hours Number of engineering hours.. Number of material moves.. 40 30 The controller was able to summarize the company's total manufacturing overhead into the following pools: Setup costs... Machine costs Purchasing and receiving costs Engineering costs.. Materials handling costs.. 40,000 180,000 200,000 190,000 70,000 Total $680,000 Required a. Calculate Sterling's current plantwide overhead rate based on direct labor hours b. Verify Sterling's calculation of overhead cost per unit of $12.34 for shafts and $6.25 for gears. c. Calculate the manufacturing overhead cost per unit for shafts and gears using activity-based costing assuming each of the five cost pools represents a separate activity pool. Use the most appropriate activity driver for assigning activity costs to the two products. d. Comment on Sterling 's current cost system and the reason the company is facing fierce competition for shafts but little competition for gears

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter10: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 17E: Materials used by the Instrument Division of Ziegler Inc. are currently purchased from outside...

Related questions

Question

Please answer last subpart labeled D.

Comment on Sterling's current cost system and the reason the company is facing fierce competition for shafts but little competition for gears.

Transcribed Image Text:Sterling Industries produces machine parts as a contract provider for a large manufacturing company

Sterling produces two particular parts, shafts and gears. The competition is keen among contract pro-

ducers, and Sterling's top management realizes how vulnerable its market is to cost-cutting competitors

Hence, having a very accurate understanding of costs is important to Sterling's survival

Sterling's president, Sheila Hudson, has observed that the company's current cost to produce

shafts is $21.41, and the current cost to produce gears is S12.73. She indicated to the controller that she

suspects some problems with the cost system because Sterling is suddenly experiencing extraordinary

competition on shafts, but it seems to have a virtual corner on the gears market. She is even considering

dropping the shaft line and converting the company to a one-product manufacturer of gears. She asked

the controller, George Coleman, to conduct a thorough cost study and to consider whether changes in

the cost system are necessary. The controller collected the following data about the company's costs

and various manufacturing activities for the most recent month

Shafts

Gears

Production units

Selling price

Overhead per unit (based on direct labor hours).

Materials and direct labor cost per unit....

Number of production runs.........

Number of purchasing and receiving orders processed..

Number of machine hours...

47,000

$31.95

$12.34

$9.07

16,000

$23.50

$6.25

$6.48

15

25

110

6,000

5,000

5,000

50

12,750

29,000

5,000

Number of direct labor hours

Number of engineering hours..

Number of material moves..

40

30

The controller was able to summarize the company's total manufacturing overhead into the following

pools:

Setup costs...

Machine costs

Purchasing and receiving costs

Engineering costs..

Materials handling costs..

40,000

180,000

200,000

190,000

70,000

Total

$680,000

Required

a. Calculate Sterling's current plantwide overhead rate based on direct labor hours

b. Verify Sterling's calculation of overhead cost per unit of $12.34 for shafts and $6.25 for gears.

c. Calculate the manufacturing overhead cost per unit for shafts and gears using activity-based costing

assuming each of the five cost pools represents a separate activity pool. Use the most appropriate

activity driver for assigning activity costs to the two products.

d. Comment on Sterling 's current cost system and the reason the company is facing fierce competition

for shafts but little competition for gears

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning