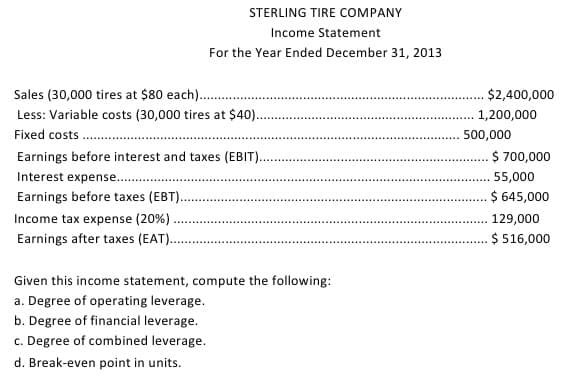

STERLING TIRE COMPANY Income Statement For the Year Ended December 31, 2013 Sales (30,000 tires at $80 each).. $2,400,000 Less: Variable costs (30,000 tires at $40).. 1,200,000 Fixed costs 500,000 Earnings before interest and taxes (EBIT). $ 700,000 Interest expense.. 55,000 Earnings before taxes (EBT). $ 645,000 Income tax expense (20%). 129,000 Earnings after taxes (EAT). $ 516,000 Given this income statement, compute the following: a. Degree of operating leverage. b. Degree of financial leverage. c. Degree of combined leverage. d. Break-even point in units.

STERLING TIRE COMPANY Income Statement For the Year Ended December 31, 2013 Sales (30,000 tires at $80 each).. $2,400,000 Less: Variable costs (30,000 tires at $40).. 1,200,000 Fixed costs 500,000 Earnings before interest and taxes (EBIT). $ 700,000 Interest expense.. 55,000 Earnings before taxes (EBT). $ 645,000 Income tax expense (20%). 129,000 Earnings after taxes (EAT). $ 516,000 Given this income statement, compute the following: a. Degree of operating leverage. b. Degree of financial leverage. c. Degree of combined leverage. d. Break-even point in units.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 11RE: Johnson Corporation had beginning inventory of 20,000 at cost and 35,000 at retail. During the year,...

Related questions

Question

100%

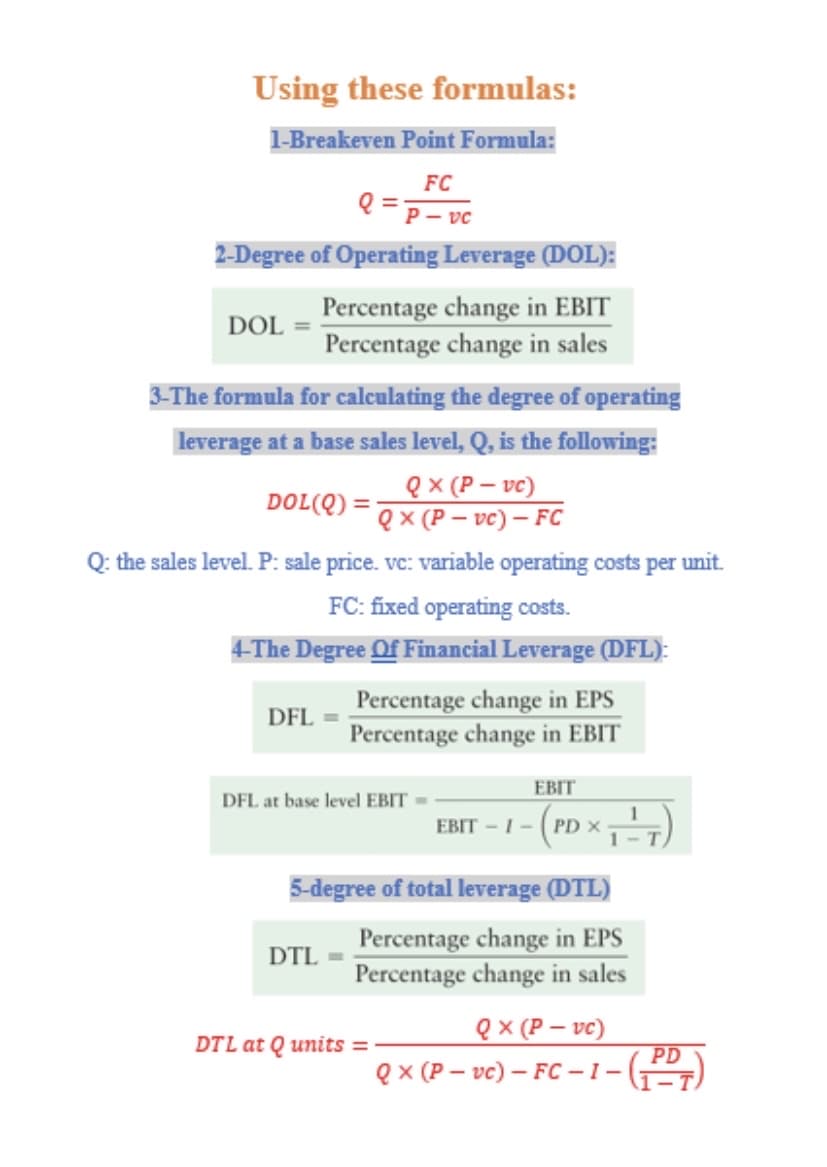

Please, use these formulas that are in the image only.

Transcribed Image Text:STERLING TIRE COMPANY

Income Statement

For the Year Ended December 31, 2013

Sales (30,000 tires at $80 each)..

$2,400,000

Less: Variable costs (30,000 tires at $40).

1,200,000

Fixed costs .

500,000

Earnings before interest and taxes (EBIT)..

$ 700,000

Interest expense..

55,000

Earnings before taxes (EBT)..

$ 645,000

Income tax expense (20%)

129,000

Earnings after taxes (EAT)..

$ 516,000

Given this income statement, compute the following:

a. Degree of operating leverage.

b. Degree of financial leverage.

c. Degree of combined leverage.

d. Break-even point in units.

Transcribed Image Text:Using these formulas:

1-Breakeven Point Formula:

FC

Q =p- vc

2-Degree of Operating Leverage (DOL):

Percentage change in EBIT

Percentage change in sales

DOL

3-The formula for calculating the degree of operating

leverage at a base sales level, Q, is the following:

eX (P – vc)

DOL(Q) = Qx (P –- vc) – FC

Q: the sales level. P: sale price. vc: variable operating costs per unit.

FC: fixed operating costs.

4-The Degree Of Financial Leverage (DFL):

Percentage change in EPS

Percentage change in EBIT

DFL

EBIT

DFL at base level EBIT =

EBIT - I - (PD x

5-degree of total leverage (DTL)

Percentage change in EPS

Percentage change in sales

DTL

ex (P – vc)

PD

DTL at Q units =

ex (P – vc) – FC – 1 –(2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning