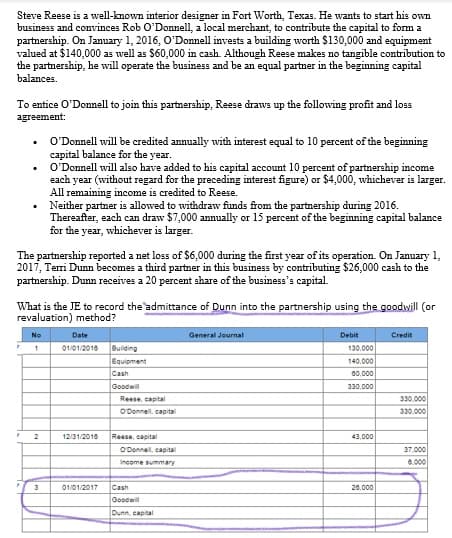

Steve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O'Donnell, a local merchant, to contribute the capital to form a partnership. On January 1, 2016, O'Donnell invests a building worth $130,000 and equipment valued at $140,000 as well as $60,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances. To entice O'Donnell to join this partnership, Reese draws up the following profit and loss agreement: • O'Donnell will be credited annually with interest equal to 10 percent of the beginning capital balance for the year. • O'Donnell will also have added to his capital account 10 percent of partnership income each year (without regard for the preceding interest figure) or $4,000, whichever is larger. All remaining income is credited to Reese. • Neither partner is allowed to withdraw funds from the partnership during 2016. Thereafter, each can draw $7,000 annually or 15 percent of the beginning capital balance for the year, whichever is larger. The partnership reported a net loss of $6,000 during the first year of its operation. On January 1, 2017, Terri Dunn becomes a third partner in this business by contributing $26,000 cash to the partnership. Dunn receives a 20 percent share of the business's capital. What is the JE to record the admittance of Dunn into the partnership using the goodwill (or revaluation) method? No Date General Journal Debit Credit 1 01/01/2016 Building 2 12/31/2016 3 01/01/2017 Equipment Cash Goodwill Reese capital O'Donnell, capital O'Donnell, capital Income summary Reese, capital Cash Goodwill Dunn, capital 130.000 140.000 00.000 330,000 43,000 20,000 330.000 330.000 37.000 6.000

Steve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O'Donnell, a local merchant, to contribute the capital to form a partnership. On January 1, 2016, O'Donnell invests a building worth $130,000 and equipment valued at $140,000 as well as $60,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances. To entice O'Donnell to join this partnership, Reese draws up the following profit and loss agreement: • O'Donnell will be credited annually with interest equal to 10 percent of the beginning capital balance for the year. • O'Donnell will also have added to his capital account 10 percent of partnership income each year (without regard for the preceding interest figure) or $4,000, whichever is larger. All remaining income is credited to Reese. • Neither partner is allowed to withdraw funds from the partnership during 2016. Thereafter, each can draw $7,000 annually or 15 percent of the beginning capital balance for the year, whichever is larger. The partnership reported a net loss of $6,000 during the first year of its operation. On January 1, 2017, Terri Dunn becomes a third partner in this business by contributing $26,000 cash to the partnership. Dunn receives a 20 percent share of the business's capital. What is the JE to record the admittance of Dunn into the partnership using the goodwill (or revaluation) method? No Date General Journal Debit Credit 1 01/01/2016 Building 2 12/31/2016 3 01/01/2017 Equipment Cash Goodwill Reese capital O'Donnell, capital O'Donnell, capital Income summary Reese, capital Cash Goodwill Dunn, capital 130.000 140.000 00.000 330,000 43,000 20,000 330.000 330.000 37.000 6.000

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 72TA

Related questions

Question

100%

What is the JE on 12/31/2017 to admit Dunn to the

Transcribed Image Text:Steve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own

business and convinces Rob O'Donnell, a local merchant, to contribute the capital to form a

partnership. On January 1, 2016, O'Donnell invests a building worth $130,000 and equipment

valued at $140,000 as well as $60,000 in cash. Although Reese makes no tangible contribution to

the partnership, he will operate the business and be an equal partner in the beginning capital

balances.

To entice O'Donnell to join this partnership, Reese draws up the following profit and loss

agreement:

O'Donnell will be credited annually with interest equal to 10 percent of the beginning

capital balance for the year.

.

O'Donnell will also have added to his capital account 10 percent of partnership income

each year (without regard for the preceding interest figure) or $4,000, whichever is larger.

All remaining income is credited to Reese.

Neither partner is allowed to withdraw funds from the partnership during 2016.

Thereafter, each can draw $7,000 annually or 15 percent of the beginning capital balance

for the year, whichever is larger.

The partnership reported a net loss of $6,000 during the first year of its operation. On January 1,

2017, Terri Dunn becomes a third partner in this business by contributing $26,000 cash to the

partnership. Dunn receives a 20 percent share of the business's capital.

What is the JE to record the admittance of Dunn into the partnership using the goodwill (or

revaluation) method?

No

Date

General Journal

Debit

Credit

1

01/01/2016 Building

2

12/31/2016

01/01/2017

3

Equipment

Cash

Goodwill

Reese capital

O'Donnell, capital

O'Donnell, capital

Income summary

Reese, capital

Cash

Goodwill

Dunn, capital

130.000

140.000

00,000

330,000

43,000

20,000

330.000

330.000

37,000

6.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT