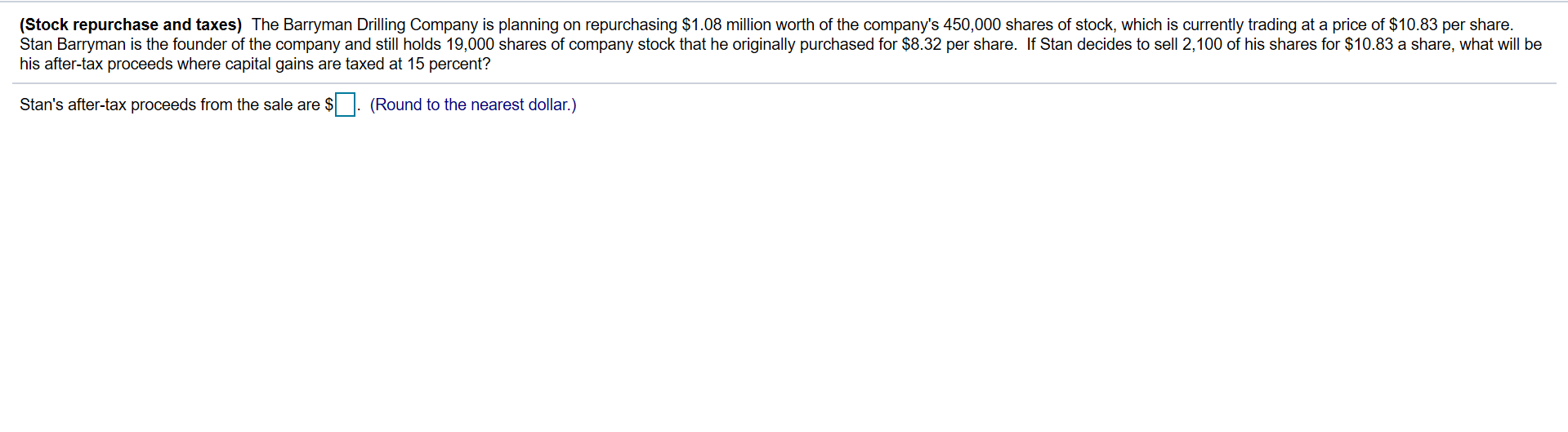

(Stock repurchase and taxes) The Barryman Drilling Company is planning on repurchasing $1.08 million worth of the company's 450,000 shares of stock, which is currently trading at a price of $10.83 per share. Stan Barryman is the founder of the company and still holds 19,000 shares of company stock that he originally purchased for $8.32 per share. If Stan decides to sell 2,100 of his shares for $10.83 a share, what will be his after-tax proceeds where capital gains are taxed at 15 percent? Stan's after-tax proceeds from the sale are $. (Round to the nearest dollar.)

(Stock repurchase and taxes) The Barryman Drilling Company is planning on repurchasing $1.08 million worth of the company's 450,000 shares of stock, which is currently trading at a price of $10.83 per share. Stan Barryman is the founder of the company and still holds 19,000 shares of company stock that he originally purchased for $8.32 per share. If Stan decides to sell 2,100 of his shares for $10.83 a share, what will be his after-tax proceeds where capital gains are taxed at 15 percent? Stan's after-tax proceeds from the sale are $. (Round to the nearest dollar.)

Chapter7: Corporations: Reorganizations

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:(Stock repurchase and taxes) The Barryman Drilling Company is planning on repurchasing $1.08 million worth of the company's 450,000 shares of stock, which is currently trading at a price of $10.83 per share.

Stan Barryman is the founder of the company and still holds 19,000 shares of company stock that he originally purchased for $8.32 per share. If Stan decides to sell 2,100 of his shares for $10.83 a share, what will be

his after-tax proceeds where capital gains are taxed at 15 percent?

Stan's after-tax proceeds from the sale are $. (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning