Stocks may be categorized by sectors. The accompanying data represent the one-year rate of return (in percent) for a sample of consumer cyclical stocks and industrial stocks for a 12-month period. Note: Consumer cyclical stocks include restaurants and retailers. Industrial stocks include manufacturers and shipping companies. Complete parts (a) through (c) below. E Click the icon to view the data. (b) Determine the mean and median rate of return for each sector. Which sector has the higher mean rate of return? Which sector has the higher median rate of return? Xconsumer cyclical = Mconsumer cyclical = (Round to three decimal places as needed.)

Stocks may be categorized by sectors. The accompanying data represent the one-year rate of return (in percent) for a sample of consumer cyclical stocks and industrial stocks for a 12-month period. Note: Consumer cyclical stocks include restaurants and retailers. Industrial stocks include manufacturers and shipping companies. Complete parts (a) through (c) below. E Click the icon to view the data. (b) Determine the mean and median rate of return for each sector. Which sector has the higher mean rate of return? Which sector has the higher median rate of return? Xconsumer cyclical = Mconsumer cyclical = (Round to three decimal places as needed.)

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 4BGP

Related questions

Question

Transcribed Image Text:Stocks may be categorized by sectors. The accompanying data represent the one-year rate of return (in percent) for a sample of consumer cyclical stocks and industrial stocks for a

12-month period. Note: Consumer cyclical stocks include restaurants and retailers. Industrial stocks include manufacturers and shipping companies. Complete parts (a) through (c) below.

E Click the icon to view the data.

(b) Determine the mean and median rate of return for each sector. Which sector has the higher mean rate of return? Which sector has the higher median rate of return?

Xconsumer cyclical =

Mconsumer cyclical =

(Round to three decimal places as needed.)

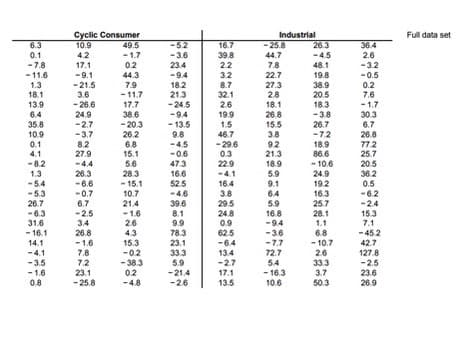

Transcribed Image Text:Cyclic Consumer

49.5

10.9

Industrial

Full data set

6.3

-5.2

16.7

-25.8

26.3

36.4

0.1

4.2

-1.7

-3.6

39.8

22

44.7

-4.5

2.6

-7.8

17.1

02

23.4

7.8

22.7

48.1

-3.2

- 11.6

1.3

-9.1

44.3

7.9

- 11.7

17.7

38.6

-9.4

3.2

19.8

-0.5

-21.5

3.6

- 26.6

24.9

-2.7

-3.7

8.2

27.9

18.2

21.3

-24.5

-94

18.1

13.9

6.4

35.8

10.9

0.1

8.7

32.1

2.6

19.9

1.5

46.7

- 29.6

0.3

229

27.3

2.8

18.1

26.8

15.5

3.8

38.9

20.5

18.3

-3.8

26.7

-72

18.9

86.6

- 10.6

0.2

7.6

-1.7

30.3

6.7

26.8

772

25.7

- 20.3

26.2

6.8

15.1

5.6

28.3

- 15.1

10.7

21.4

-1.6

2.6

4.3

15.3

- 13.5

9.8

-4.5

-0.6

47.3

16.6

52.5

-4.6

39.6

8.1

9.9

78.3

23.1

33.3

5.9

-21.4

-26

9.2

21.3

18.9

5.9

9.1

64

5.9

4.1

-8.2

-4.4

20.5

36.2

0.5

-6.2

-2.4

15.3

26.3

-6.6

1.3

-54

- 5.3

26.7

-6.3

31.6

24.9

19.2

16.3

25.7

28.1

-4.1

-0.7

6.7

-2.5

16.4

3.8

29.5

24.8

0.9

62.5

-6.4

13.4

-2.7

17.1

13.5

16.8

-94

3.4

1.1

26.8

- 1.6

7.8

7.1

- 45.2

42.7

- 16.1

-36

6.8

-7.7

72.7

54

- 16.3

10.6

14.1

- 10.7

26

33.3

3.7

-0.2

- 38.3

127.8

-2.5

23.6

26.9

-4.1

-3.5

- 1.6

0.8

7.2

23.1

-25.8

02

-4.8

50.3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 10 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt