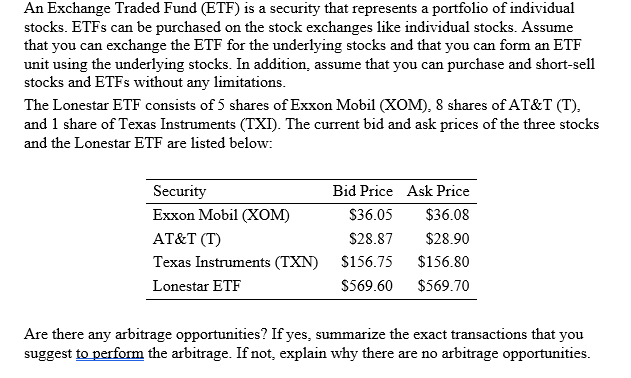

stocks. ETFS can be purchased on the stock exchanges like individual stocks. Assume that you can exchange the ETF for the underlying stocks and that you can form an ETF unit using the underlying stocks. In addition, assume that you can purchase and short-sell stocks and ETFS without any limitations. The Lonestar ETF consists of 5 shares of Exxon Mobil (XOM), 8 shares of AT&T (T), and 1 share of Texas Instruments (TXI). The current bid and ask prices of the three stocks and the Lonestar ETF are listed below: Security Bid Price Ask Price Еxxon Mobil (Xом) $36.05 $36.08 AT&T (T) $28.87 $28.90 Texas Instruments (TXN) $156.75 $156.80 Lonestar ETF $569.60 $569.70 Are there any arbitrage opportunities? If yes, summarize the exact transactions that you suggest to perform the arbitrage. If not, explain why there are no arbitrage opportunities.

stocks. ETFS can be purchased on the stock exchanges like individual stocks. Assume that you can exchange the ETF for the underlying stocks and that you can form an ETF unit using the underlying stocks. In addition, assume that you can purchase and short-sell stocks and ETFS without any limitations. The Lonestar ETF consists of 5 shares of Exxon Mobil (XOM), 8 shares of AT&T (T), and 1 share of Texas Instruments (TXI). The current bid and ask prices of the three stocks and the Lonestar ETF are listed below: Security Bid Price Ask Price Еxxon Mobil (Xом) $36.05 $36.08 AT&T (T) $28.87 $28.90 Texas Instruments (TXN) $156.75 $156.80 Lonestar ETF $569.60 $569.70 Are there any arbitrage opportunities? If yes, summarize the exact transactions that you suggest to perform the arbitrage. If not, explain why there are no arbitrage opportunities.

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 5FPE

Related questions

Question

100%

Transcribed Image Text:An Exchange Traded Fund (ETF) is a security that represents a portfolio of individual

stocks. ETFS can be purchased on the stock exchanges like individual stocks. Assume

that you can exchange the ETF for the underlying stocks and that you can form an ETF

unit using the underlying stocks. In addition, assume that you can purchase and short-sell

stocks and ETFS without any limitations.

The Lonestar ETF consists of 5 shares of Exxon Mobil (XOM), 8 shares of AT&T (T),

and 1 share of Texas Instruments (TXI). The current bid and ask prices of the three stocks

and the Lonestar ETF are listed below:

Security

Bid Price Ask Price

Еxxon Mobil (Xом)

S36.05

$36.08

AT&T (T)

$28.87

$28.90

Texas Instruments (TXN)

$156.75

$156.80

Lonestar ETF

$569.60

$569.70

Are there any arbitrage opportunities? If yes, summarize the exact transactions that you

suggest to perform the arbitrage. If not, explain why there are no arbitrage opportunities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning