Strategy #2: Firm 1 drives Firm 2 out of the market Consider an alternative strategy where Firm 1 produces a quantity that results in Firm 2 producing nothing. Calculate the minimum quantity that Firm 1 would have to produce to drive Firm 2 out of the market, the resulting market price, and Firm 1's profits. Firm 1's quantity: q₁ = 240.00 units. (Enter your response rounded to two decimal places.) Equilibrium price: P = 35.00. (Enter your response rounded to two decimal places.) Firm 1's profits: ₁ = $0.00. Firm 1 would need to continue producing at the higher level you found under Strategy #2 to keep Firm 2 out of the market. Comparing Firm 1's profits under the strategies, what is the optimal strategy for Firm 1, the Stackelberg leader, to use? A. Strategy 1 OB. Strategy 2

Strategy #2: Firm 1 drives Firm 2 out of the market Consider an alternative strategy where Firm 1 produces a quantity that results in Firm 2 producing nothing. Calculate the minimum quantity that Firm 1 would have to produce to drive Firm 2 out of the market, the resulting market price, and Firm 1's profits. Firm 1's quantity: q₁ = 240.00 units. (Enter your response rounded to two decimal places.) Equilibrium price: P = 35.00. (Enter your response rounded to two decimal places.) Firm 1's profits: ₁ = $0.00. Firm 1 would need to continue producing at the higher level you found under Strategy #2 to keep Firm 2 out of the market. Comparing Firm 1's profits under the strategies, what is the optimal strategy for Firm 1, the Stackelberg leader, to use? A. Strategy 1 OB. Strategy 2

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter12: Price And Output Determination: Oligopoly

Section: Chapter Questions

Problem 2E

Related questions

Question

Correct answers in the picture. Can someone please provide a solution.

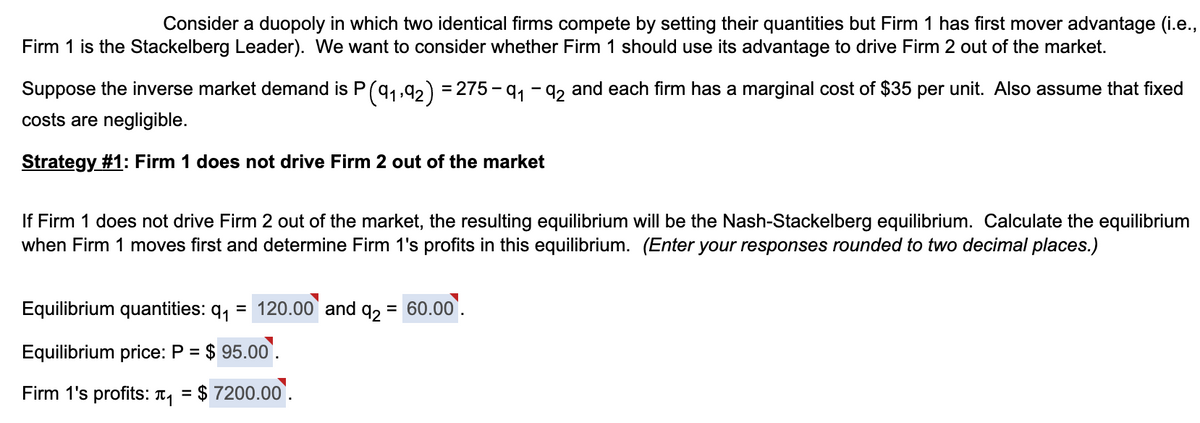

Transcribed Image Text:Consider a duopoly in which two identical firms compete by setting their quantities but Firm 1 has first mover advantage (i.e.,

Firm 1 is the Stackelberg Leader). We want to consider whether Firm 1 should use its advantage to drive Firm 2 out of the market.

Suppose the inverse market demand is P (9₁,92) = 275-9₁-92 and each firm has a marginal cost of $35 per unit. Also assume that fixed

costs are negligible.

Strategy #1: Firm 1 does not drive Firm 2 out of the market

If Firm 1 does not drive Firm 2 out of the market, the resulting equilibrium will be the Nash-Stackelberg equilibrium. Calculate the equilibrium

when Firm 1 moves first and determine Firm 1's profits in this equilibrium. (Enter your responses rounded to two decimal places.)

Equilibrium quantities: q₁ = 120.00 and q₂ = 60.00.

Equilibrium price: P = $95.00.

Firm 1's profits: ₁ = $7200.00.

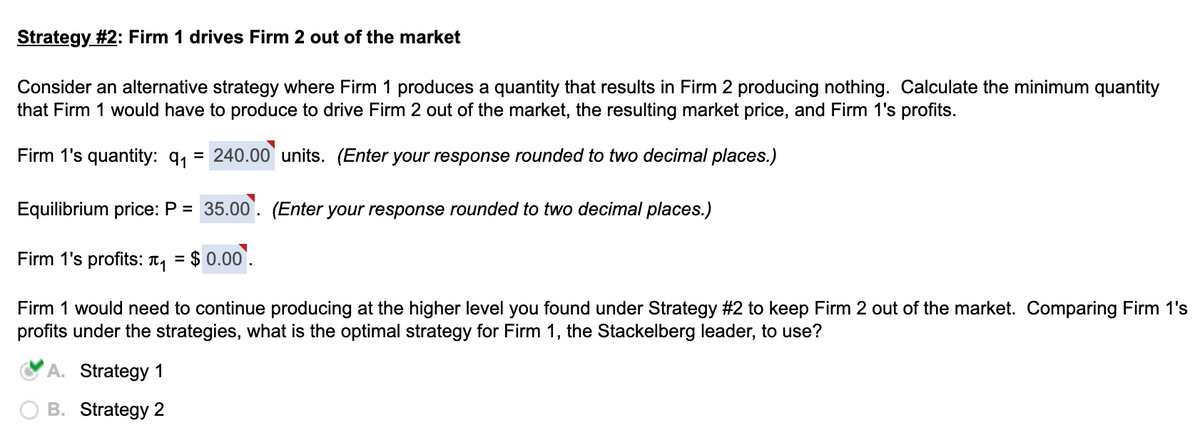

Transcribed Image Text:Strategy #2: Firm 1 drives Firm 2 out of the market

Consider an alternative strategy where Firm 1 produces a quantity that results in Firm 2 producing nothing. Calculate the minimum quantity

that Firm 1 would have to produce to drive Firm 2 out of the market, the resulting market price, and Firm 1's profits.

Firm 1's quantity: 9₁

= 240.00 units. (Enter your response rounded to two decimal places.)

Equilibrium price: P = 35.00. (Enter your response rounded to two decimal places.)

Firm 1's profits: ₁ = $0.00.

Firm 1 would need to continue producing at the higher level you found under Strategy #2 to keep Firm 2 out of the market. Comparing Firm 1's

profits under the strategies, what is the optimal strategy for Firm 1, the Stackelberg leader, to use?

A. Strategy 1

B. Strategy 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning