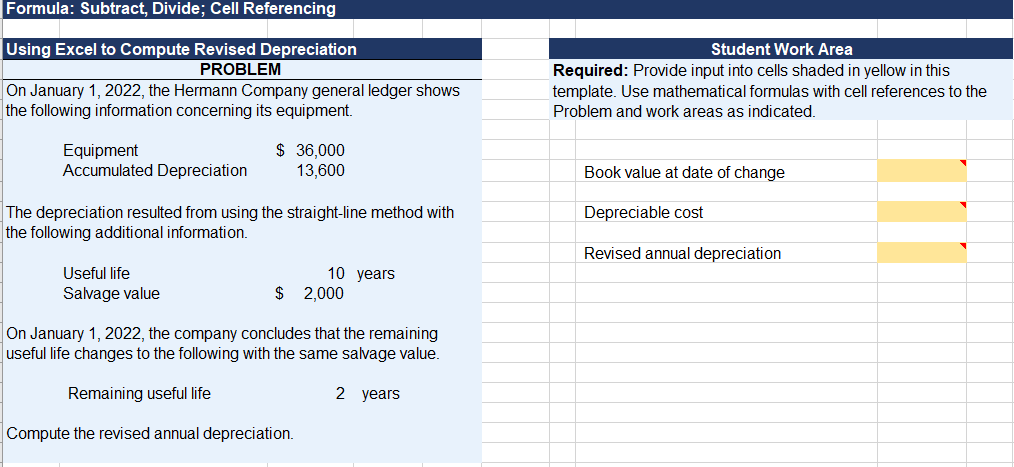

Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to the Problem and work areas as indicated. Book value at date of change Depreciable cost Revised annual depreciation

Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to the Problem and work areas as indicated. Book value at date of change Depreciable cost Revised annual depreciation

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section19.5: Declining-balance Method Of Depreciation

Problem 1WT

Related questions

Question

I cant seem to figure out the formulas for these answers.

Transcribed Image Text:Formula: Subtract, Divide; Cell Referencing

Using Excel to Compute Revised Depreciation

Student Work Area

PROBLEM

Required: Provide input into cells shaded in yellow in this

template. Use mathematical formulas with cell references to the

On January 1, 2022, the Hermann Company general ledger shows

the following information concerning its equipment.

Problem and work areas as indicated.

Equipment

Accumulated Depreciation

$ 36,000

13,600

Book value at date of change

The depreciation resulted from using the straight-line method with

the following additional information.

Depreciable cost

Revised annual depreciation

10 years

$ 2,000

Useful life

Salvage value

On January 1, 2022, the company concludes that the remaining

useful life changes to the following with the same salvage value.

Remaining useful life

2 years

Compute the revised annual depreciation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning