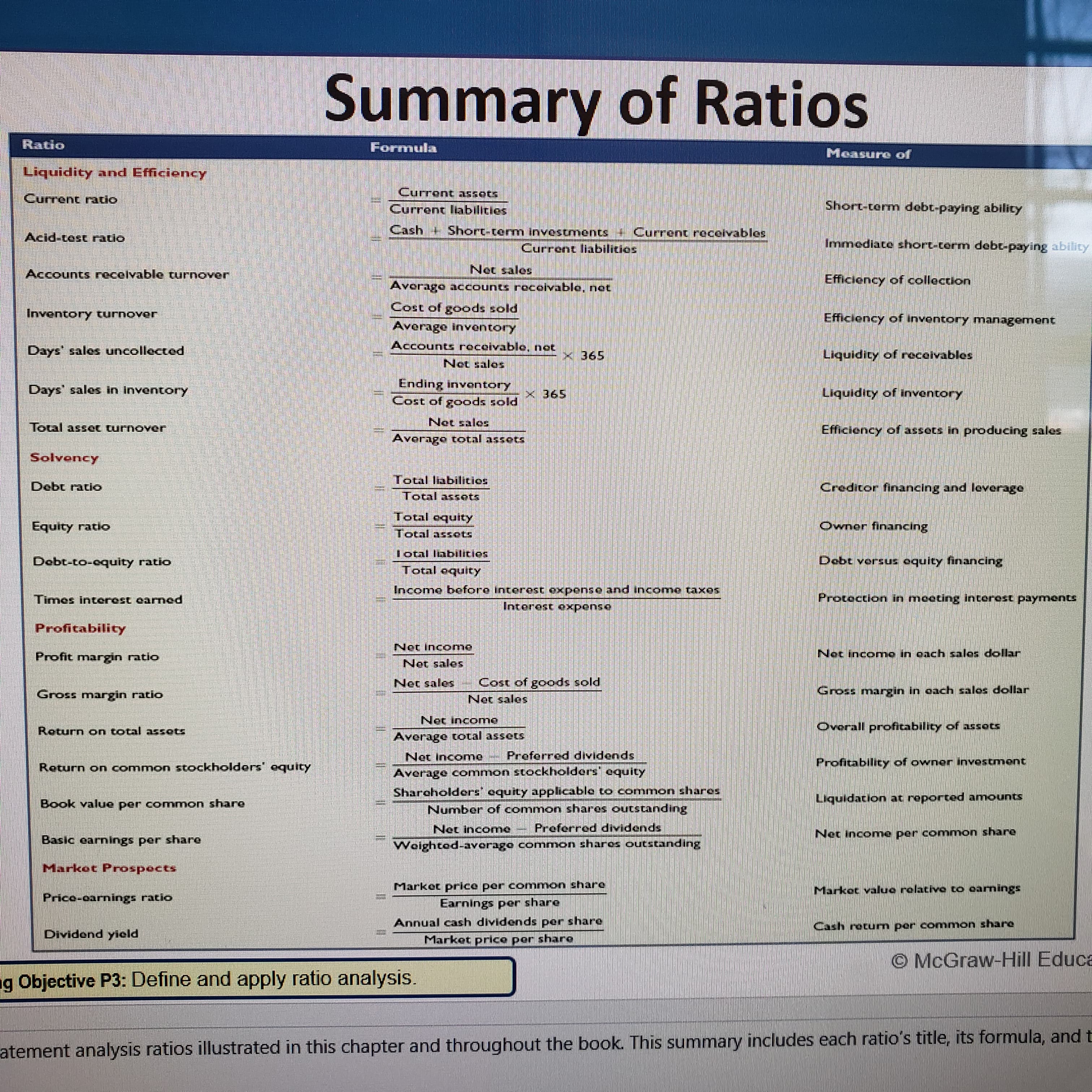

Summary of Ratios Ratio Formula Measure of Liquidity and Efficiency Current assets Current ratio Short-term debt-paying abilicy Current labilities Cash + Short-torm investments Current recerables Acid-test ratio Immediate short-cerm debt-paying ability Curront liabilitics Net sales Accounts recelvable turnover Efficiency of collection Avorage accounts rocolvable, net Cost of goods sold Inventory turnover Efficiency of invontory management Average inventory Accounts rocolvable, not Days' salos uncollected Liquidicy of receivables x 365 Net sales Ending invontory Cost of goods sold Days' sales In inventory Liquidity of inventory x 365 Net sales Total asset turnover Efficiency of assets in producing sales Avorago total assets Solvency Total liabilitios Total assots Croditor financing and leverage Debt ratio Total oquity Owner financing Equity ratio Total assots lotal labilitios Dobt vorsus oquity financing Debt-to-oquity ratio Total oquity Income before Interest oxpense and Income taxes Interest expense Procoction in moetins interest paymonts Times interost carned Profitability Net Income Not inconmo in oach salos dollar Profit margin ratio Not sales Cost of goods sold Net sales Net salos Gross margin in cach salos dollar Gross margin ratio Noc income Overall profitabilicy of assots Roturn on total assots Average total assets Proforred dividends Not Incomne Average common stockholders equity Profitabilicy of owner Invostmont Roturn on common stockholders" equity Sharoholders.oquity aPplicablo to common shares Number of common shares outstanding Preferred dividends Book value per common share Net income Net income per common share Basic earnings per share Market Prospects Market price per common share Earnings per share Markoc value rolative to oarnings Price-oarnings ratio Annual cash dividends per share Cash retum per common share Dividend yield Market price por share © McGraw-Hill Educa ng Objective P3: Define and apply ratio analysis. atement analysis ratios illustrated in this chapter and throughout the book. This summary includes each ratio's title, its formula, and t

Summary of Ratios Ratio Formula Measure of Liquidity and Efficiency Current assets Current ratio Short-term debt-paying abilicy Current labilities Cash + Short-torm investments Current recerables Acid-test ratio Immediate short-cerm debt-paying ability Curront liabilitics Net sales Accounts recelvable turnover Efficiency of collection Avorage accounts rocolvable, net Cost of goods sold Inventory turnover Efficiency of invontory management Average inventory Accounts rocolvable, not Days' salos uncollected Liquidicy of receivables x 365 Net sales Ending invontory Cost of goods sold Days' sales In inventory Liquidity of inventory x 365 Net sales Total asset turnover Efficiency of assets in producing sales Avorago total assets Solvency Total liabilitios Total assots Croditor financing and leverage Debt ratio Total oquity Owner financing Equity ratio Total assots lotal labilitios Dobt vorsus oquity financing Debt-to-oquity ratio Total oquity Income before Interest oxpense and Income taxes Interest expense Procoction in moetins interest paymonts Times interost carned Profitability Net Income Not inconmo in oach salos dollar Profit margin ratio Not sales Cost of goods sold Net sales Net salos Gross margin in cach salos dollar Gross margin ratio Noc income Overall profitabilicy of assots Roturn on total assots Average total assets Proforred dividends Not Incomne Average common stockholders equity Profitabilicy of owner Invostmont Roturn on common stockholders" equity Sharoholders.oquity aPplicablo to common shares Number of common shares outstanding Preferred dividends Book value per common share Net income Net income per common share Basic earnings per share Market Prospects Market price per common share Earnings per share Markoc value rolative to oarnings Price-oarnings ratio Annual cash dividends per share Cash retum per common share Dividend yield Market price por share © McGraw-Hill Educa ng Objective P3: Define and apply ratio analysis. atement analysis ratios illustrated in this chapter and throughout the book. This summary includes each ratio's title, its formula, and t

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter3: Analysis Of Financial Statements

Section: Chapter Questions

Problem 5MC: Calculate the projected debt ratio, debt-to-equity ratio, liabilities-to-assets ratio,...

Related questions

Question

How do you calculate all the ratios?

Transcribed Image Text:Summary of Ratios

Ratio

Formula

Measure of

Liquidity and Efficiency

Current assets

Current ratio

Short-term debt-paying abilicy

Current labilities

Cash + Short-torm investments Current recerables

Acid-test ratio

Immediate short-cerm debt-paying ability

Curront liabilitics

Net sales

Accounts recelvable turnover

Efficiency of collection

Avorage accounts rocolvable,

net

Cost of goods sold

Inventory turnover

Efficiency of invontory management

Average inventory

Accounts rocolvable, not

Days' salos uncollected

Liquidicy of receivables

x 365

Net sales

Ending invontory

Cost of goods sold

Days' sales In inventory

Liquidity of inventory

x 365

Net sales

Total asset turnover

Efficiency of assets in producing sales

Avorago total assets

Solvency

Total liabilitios

Total assots

Croditor financing and leverage

Debt ratio

Total oquity

Owner financing

Equity ratio

Total assots

lotal labilitios

Dobt vorsus oquity financing

Debt-to-oquity ratio

Total oquity

Income before Interest oxpense and Income taxes

Interest expense

Procoction in moetins interest paymonts

Times interost carned

Profitability

Net Income

Not inconmo in oach salos dollar

Profit margin ratio

Not sales

Cost of goods sold

Net sales

Net salos

Gross margin in cach salos dollar

Gross margin ratio

Noc income

Overall profitabilicy of assots

Roturn on total assots

Average total assets

Proforred dividends

Not Incomne

Average common stockholders equity

Profitabilicy of owner Invostmont

Roturn on common stockholders" equity

Sharoholders.oquity aPplicablo to common shares

Number of common shares outstanding

Preferred dividends

Book value per common share

Net income

Net income per common share

Basic earnings per share

Market Prospects

Market price per common share

Earnings per share

Markoc value rolative to oarnings

Price-oarnings ratio

Annual cash dividends per share

Cash retum per common share

Dividend yield

Market price por share

© McGraw-Hill Educa

ng Objective P3: Define and apply ratio analysis.

atement analysis ratios illustrated in this chapter and throughout the book. This summary includes each ratio's title, its formula, and t

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning