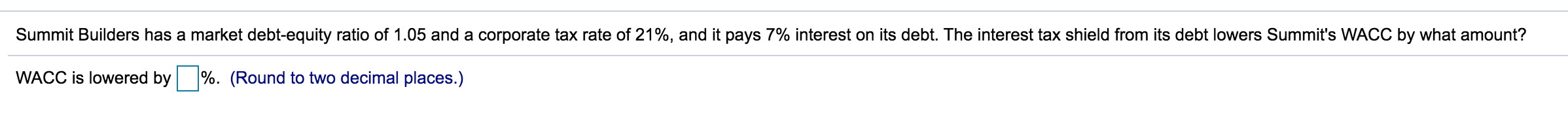

Summit Builders has a market debt-equity ratio of 1.05 and a corporate tax rate of 21%, and it pays 7% interest on its debt. The interest tax shield from its debt lowers Summit's WACC by what amount? WACC is lowered by %. (Round to two decimal places.)

Summit Builders has a market debt-equity ratio of 1.05 and a corporate tax rate of 21%, and it pays 7% interest on its debt. The interest tax shield from its debt lowers Summit's WACC by what amount? WACC is lowered by %. (Round to two decimal places.)

Chapter9: The Cost Of Capital

Section: Chapter Questions

Problem 7P

Related questions

Question

Transcribed Image Text:Summit Builders has a market debt-equity ratio of 1.05 and a corporate tax rate of 21%, and it pays 7% interest on its debt. The interest tax shield from its debt lowers Summit's WACC by what amount?

WACC is lowered by

%. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning