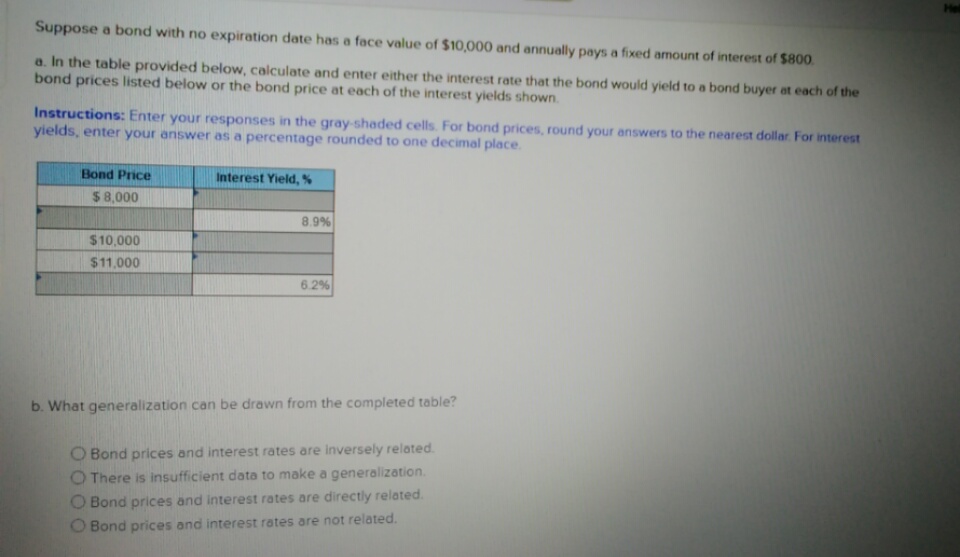

Suppose a bond with no expiration date has a face value of $10,000 and annually pays a fixed amount of interest of $800 a. In the table provided below, calculate and enter either the interest rate that the bond would yield to a bond buyer at each of the bond prices listed below or the bond price at each of the interest yields shown Instructions: Enter your responses in the gray-shaded cells. For bond prices, round your answers to the nearest dollar For interest yields, enter your answer as a percentage rounded to one decimal place. Bond Price Interest Yield, % $8,000 8.9% $10,000 $11,000 62% b. What generalization can be drawn from the completed table? O Bond prices and interest rates are inversely related O There is insufficient data to make a generalization. O Bond prices and interest rates are directly related. O Bond prices and interest rates are not related.

Suppose a bond with no expiration date has a face value of $10,000 and annually pays a fixed amount of interest of $800 a. In the table provided below, calculate and enter either the interest rate that the bond would yield to a bond buyer at each of the bond prices listed below or the bond price at each of the interest yields shown Instructions: Enter your responses in the gray-shaded cells. For bond prices, round your answers to the nearest dollar For interest yields, enter your answer as a percentage rounded to one decimal place. Bond Price Interest Yield, % $8,000 8.9% $10,000 $11,000 62% b. What generalization can be drawn from the completed table? O Bond prices and interest rates are inversely related O There is insufficient data to make a generalization. O Bond prices and interest rates are directly related. O Bond prices and interest rates are not related.

Chapter13: Monetary Policy: Conventional And Unconventional

Section: Chapter Questions

Problem 4TY

Related questions

Question

Transcribed Image Text:Suppose a bond with no expiration date has a face value of $10,000 and annually pays a fixed amount of interest of $800

a. In the table provided below, calculate and enter either the interest rate that the bond would yield to a bond buyer at each of the

bond prices listed below or the bond price at each of the interest yields shown

Instructions: Enter your responses in the gray-shaded cells. For bond prices, round your answers to the nearest dollar For interest

yields, enter your answer as a percentage rounded to one decimal place.

Bond Price

Interest Yield, %

$8,000

8.9%

$10,000

$11,000

62%

b. What generalization can be drawn from the completed table?

O Bond prices and interest rates are inversely related

O There is insufficient data to make a generalization.

O Bond prices and interest rates are directly related.

O Bond prices and interest rates are not related.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 5 images

Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning