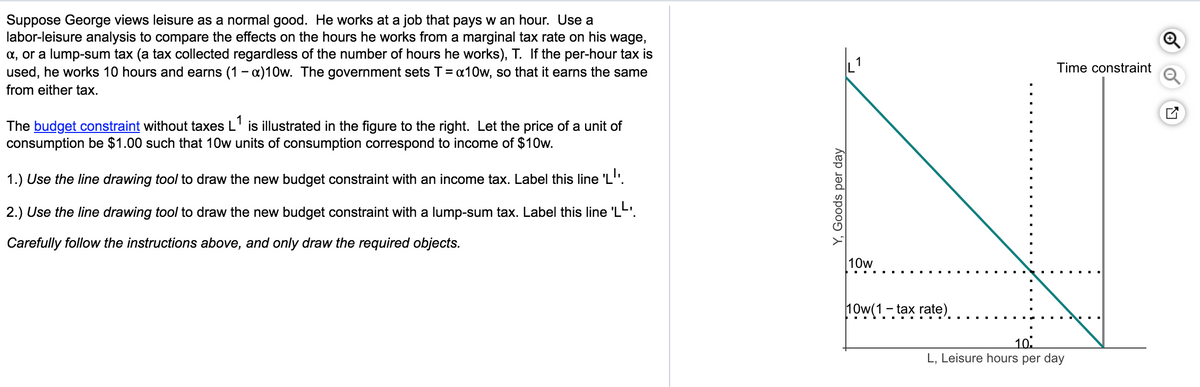

Suppose George views leisure as a normal good. He works at a job that pays w an hour. Use a labor-leisure analysis to compare the effects on the hours he works from a marginal tax rate on his wage, x, or a lump-sum tax (a tax collected regardless of the number of hours he works), T. If the per-hour tax is used, he works 10 hours and earns (1-x)10w. The government sets T = a10w, so that it earns the same from either tax. The budget constraint without taxes L¹ is illustrated in the figure to the right. Let the price of a unit of consumption be $1.00 such that 10w units of consumption correspond to income of $10w. 1.) Use the line drawing tool to draw the new budget constraint with an income tax. Label this line 'L''. 2.) Use the line drawing tool to draw the new budget constraint with a lump-sum tax. Label this line 'LL. Carefully follow the instructions above, and only draw the required objects. Y, Goods per day 10w 10w(1-tax rate) Time constraint 10: L, Leisure hours per day

Suppose George views leisure as a normal good. He works at a job that pays w an hour. Use a labor-leisure analysis to compare the effects on the hours he works from a marginal tax rate on his wage, x, or a lump-sum tax (a tax collected regardless of the number of hours he works), T. If the per-hour tax is used, he works 10 hours and earns (1-x)10w. The government sets T = a10w, so that it earns the same from either tax. The budget constraint without taxes L¹ is illustrated in the figure to the right. Let the price of a unit of consumption be $1.00 such that 10w units of consumption correspond to income of $10w. 1.) Use the line drawing tool to draw the new budget constraint with an income tax. Label this line 'L''. 2.) Use the line drawing tool to draw the new budget constraint with a lump-sum tax. Label this line 'LL. Carefully follow the instructions above, and only draw the required objects. Y, Goods per day 10w 10w(1-tax rate) Time constraint 10: L, Leisure hours per day

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter28: Income Inequality And Poverty

Section: Chapter Questions

Problem 9CQ

Related questions

Question

Transcribed Image Text:Suppose George views leisure as a normal good. He works at a job that pays w an hour. Use a

labor-leisure analysis to compare the effects on the hours he works from a marginal tax rate on his wage,

α, or a lump-sum tax (a tax collected regardless of the number of hours he works), T. If the per-hour tax is

used, he works 10 hours and earns (1-x)10w. The government sets T = α10w, so that it earns the same

from either tax.

The budget constraint without taxes L¹ is illustrated in the figure to the right. Let the price of a unit of

consumption be $1.00 such that 10w units of consumption correspond to income of $10w.

1.) Use the line drawing tool to draw the new budget constraint with an income tax. Label this line 'L''.

2.) Use the line drawing tool to draw the new budget constraint with a lump-sum tax. Label this line 'LL'.

Carefully follow the instructions above, and only draw the required objects.

Y, Goods per day

10w

10w(1-tax rate)

Time constraint

10:

L, Leisure hours per day

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning