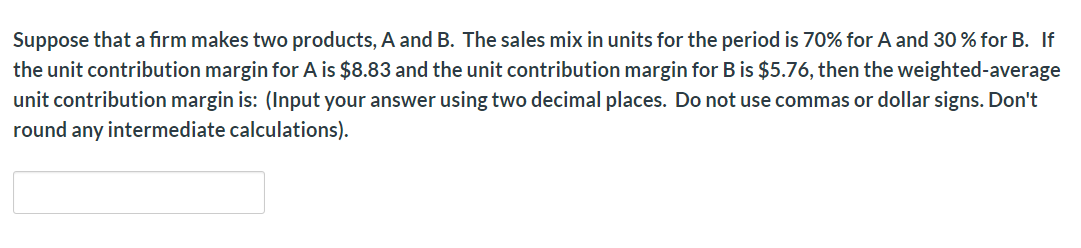

Suppose that a firm makes two products, A and B. The sales mix in units for the period is 70% for A and 30% for B. If the unit contribution margin for A is $8.83 and the unit contribution margin for B is $5.76, then the weighted-average unit contribution margin is: (Input your answer using two decimal places. Do not use commas or dollar signs. Don't round any intermediate calculations)

Suppose that a firm makes two products, A and B. The sales mix in units for the period is 70% for A and 30% for B. If the unit contribution margin for A is $8.83 and the unit contribution margin for B is $5.76, then the weighted-average unit contribution margin is: (Input your answer using two decimal places. Do not use commas or dollar signs. Don't round any intermediate calculations)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 47E: Klamath Company produces a single product. The projected income statement for the coming year is as...

Related questions

Question

Transcribed Image Text:Suppose that a firm makes two products, A and B. The sales mix in units for the period is 70% for A and 30% for B. If

the unit contribution margin for A is $8.83 and the unit contribution margin for B is $5.76, then the weighted-average

unit contribution margin is: (Input your answer using two decimal places. Do not use commas or dollar signs. Don't

round any intermediate calculations)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College