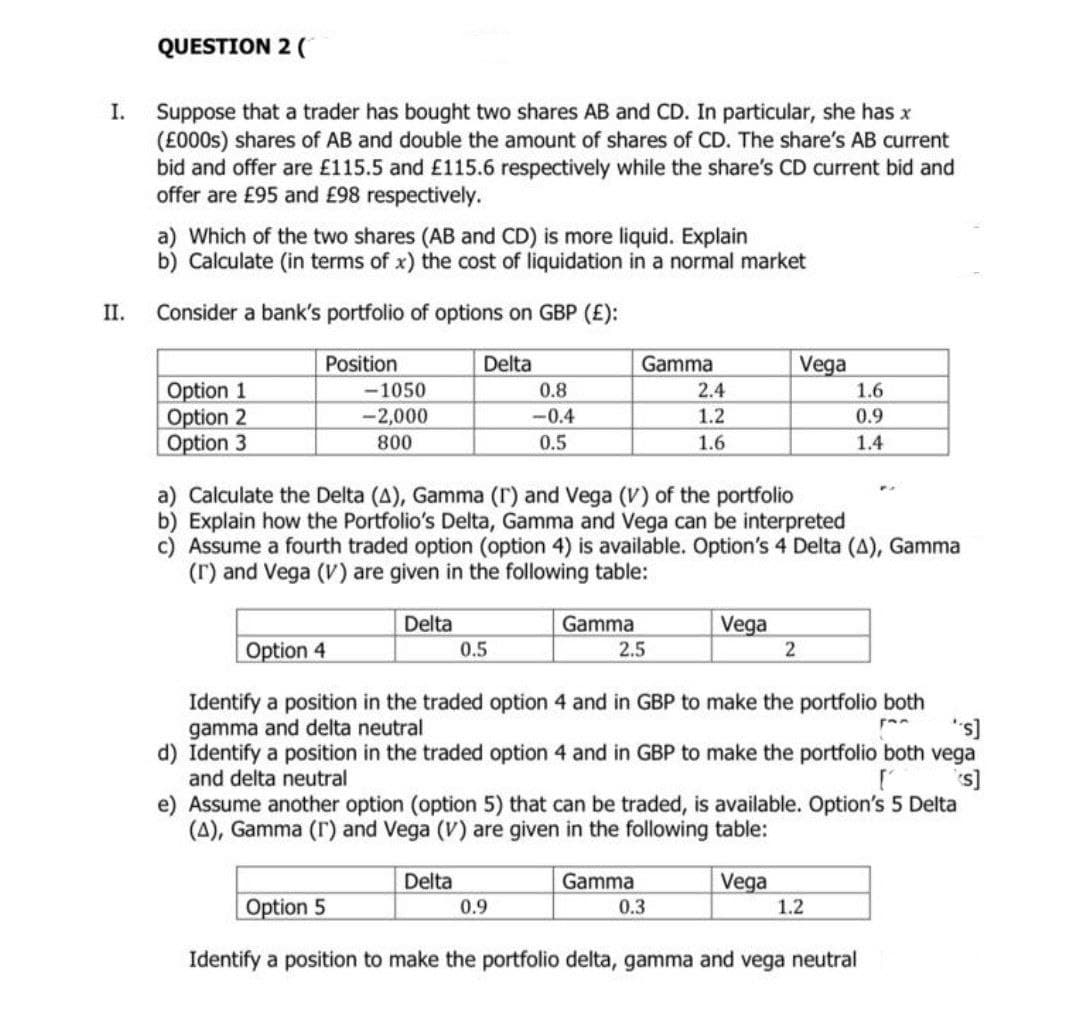

Suppose that a trader has bought two shares AB and CD. In particular, she has x (£000s) shares of AB and double the amount of shares of CD. The share's AB current bid and offer are £115.5 and £115.6 respectively while the share's CD current bid and offer are £95 and £98 respectively. I. a) Which of the two shares (AB and CD) is more liquid. Explain b) Calculate (in terms of x) the cost of liquidation in a normal market

Suppose that a trader has bought two shares AB and CD. In particular, she has x (£000s) shares of AB and double the amount of shares of CD. The share's AB current bid and offer are £115.5 and £115.6 respectively while the share's CD current bid and offer are £95 and £98 respectively. I. a) Which of the two shares (AB and CD) is more liquid. Explain b) Calculate (in terms of x) the cost of liquidation in a normal market

Chapter14: Security Structures And Determining Enterprise Values

Section: Chapter Questions

Problem 1EP

Related questions

Question

i need the answer quickly

Transcribed Image Text:QUESTION 2 (

Suppose that a trader has bought two shares AB and CD. In particular, she has x

(£000s) shares of AB and double the amount of shares of CD. The share's AB current

bid and offer are £115.5 and £115.6 respectively while the share's CD current bid and

offer are £95 and £98 respectively.

I.

a) Which of the two shares (AB and CD) is more liquid. Explain

b) Calculate (in terms of x) the cost of liquidation in a normal market

II.

Consider a bank's portfolio of options on GBP (£):

Position

Delta

Gamma

Vega

Option 1

Option 2

Option 3

-1050

-2,000

0.8

2.4

1.6

-0.4

1.2

0.9

800

0.5

1.6

1.4

a) Calculate the Delta (A), Gamma (r) and Vega (V) of the portfolio

b) Explain how the Portfolio's Delta, Gamma and Vega can be interpreted

Assume a fourth traded option (option 4) is available. Option's 4 Delta (A), Gamma

(r) and Vega (V) are given in the following table:

Delta

Gamma

Vega

Option 4

2.5

0.5

Identify a position in the traded option 4 and in GBP to make the portfolio both

gamma and delta neutral

d) Identify a position in the traded option 4 and in GBP to make the portfolio both vega

and delta neutral

[s.,

e) Assume another option (option 5) that can be traded, is available. Option's 5 Delta

(A), Gamma (r) and Vega (V) are given in the following table:

Delta

Gamma

Vega

Option 5

0.9

0.3

1.2

Identify a position to make the portfolio delta, gamma and vega neutral

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you