Suppose that in year 1, Acme Corporation can make a real (inflation-adjusted) return on an investment of 3 percent. Assume the nominal interest rate is 8 percent and the inflation rate is 4 percent. Instructions: Enter your answer as a whole number. a. Using this information, we can conclude that the investment would not be profitable b. Suppose that in year 2, the real interest rate changes to 7 percent while inflation remains constant at 4 percent. In year 2, the nominal interest rate must be * percent.

Suppose that in year 1, Acme Corporation can make a real (inflation-adjusted) return on an investment of 3 percent. Assume the nominal interest rate is 8 percent and the inflation rate is 4 percent. Instructions: Enter your answer as a whole number. a. Using this information, we can conclude that the investment would not be profitable b. Suppose that in year 2, the real interest rate changes to 7 percent while inflation remains constant at 4 percent. In year 2, the nominal interest rate must be * percent.

Chapter18: Introduction To Macroeconomics: Unemployment, Inflation, And Economic Fluctuations

Section: Chapter Questions

Problem 13P

Related questions

Question

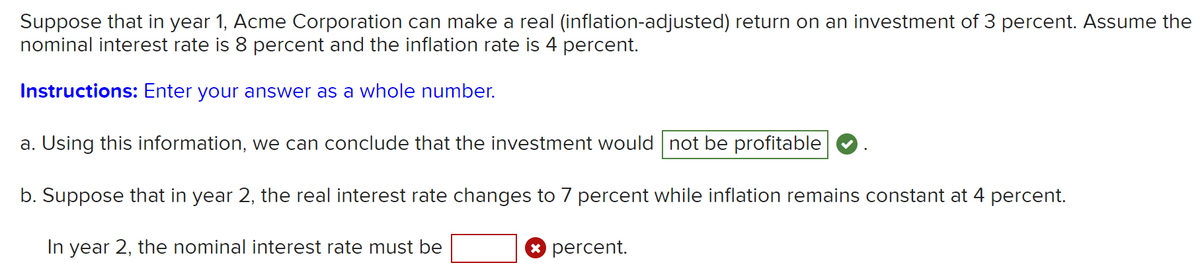

Transcribed Image Text:Suppose that in year 1, Acme Corporation can make a real (inflation-adjusted) return on an investment of 3 percent. Assume the

nominal interest rate is 8 percent and the inflation rate is 4 percent.

Instructions: Enter your answer as a whole number.

a. Using this information, we can conclude that the investment would not be profitable

b. Suppose that in year 2, the real interest rate changes to 7 percent while inflation remains constant at 4 percent.

In year 2, the nominal interest rate must be

percent.

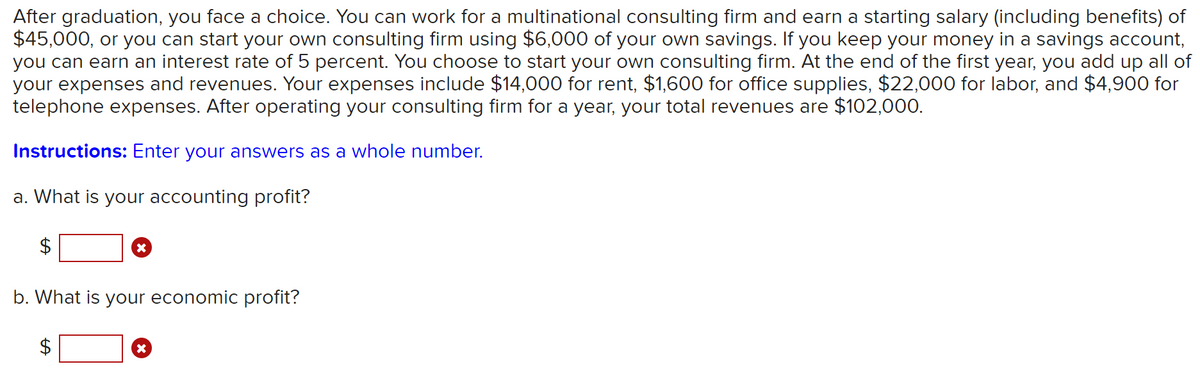

Transcribed Image Text:After graduation, you face a choice. You can work for a multinational consulting firm and earn a starting salary (including benefits) of

$45,000, or you can start your own consulting firm using $6,000 of your own savings. If you keep your money in a savings account,

you can earn an interest rate of 5 percent. You choose to start your own consulting firm. At the end of the first year, you add up all of

your expenses and revenues. Your expenses include $14,000 for rent, $1,600 for office supplies, $22,000 for labor, and $4,900 for

telephone expenses. After operating your consulting firm for a year, your total revenues are $102,000.

Instructions: Enter your answers as a whole number.

a. What is your accounting profit?

2$

b. What is your economic profit?

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning