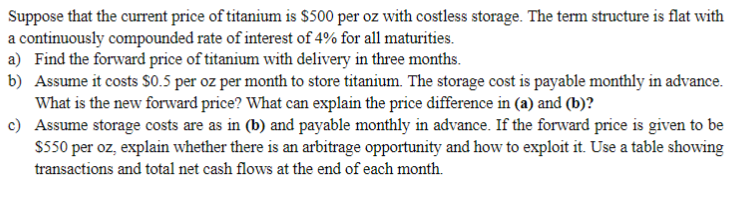

Suppose that the current price of titanium is $500 per oz with costless storage. The term structure is flat with a continuously compounded rate of interest of 4% for all maturities. a) Find the forward price of titanium with delivery in three months. b) Assume it costs $0.5 per oz per month to store titanium. The storage cost is payable monthly in advance. What is the new forward price? What can explain the price difference in (a) and (b)? c) Assume storage costs are as in (b) and payable monthly in advance. If the forward price is given to be $550 per oz, explain whether there is an arbitrage opportunity and how to exploit it. Use a table showing transactions and total net cash flows at the end of each month.

Suppose that the current price of titanium is $500 per oz with costless storage. The term structure is flat with a continuously compounded rate of interest of 4% for all maturities. a) Find the forward price of titanium with delivery in three months. b) Assume it costs $0.5 per oz per month to store titanium. The storage cost is payable monthly in advance. What is the new forward price? What can explain the price difference in (a) and (b)? c) Assume storage costs are as in (b) and payable monthly in advance. If the forward price is given to be $550 per oz, explain whether there is an arbitrage opportunity and how to exploit it. Use a table showing transactions and total net cash flows at the end of each month.

Chapter13: Other Financing Alternatives

Section: Chapter Questions

Problem 1bM

Related questions

Question

Transcribed Image Text:Suppose that the curent price of titanium is $500 per oz with costless storage. The term structure is flat with

a continuously compounded rate of interest of 4% for all maturities.

a) Find the forward price of titanium with delivery in three months.

b) Assume it costs S0.5 per oz per month to store titanium. The storage cost is payable monthly in advance.

What is the new forward price? What can explain the price difference in (a) and (b)?

c) Assume storage costs are as in (b) and payable monthly in advance. If the forward price is given to be

S550 per oz, explain whether there is an arbitrage opportunity and how to exploit it. Use a table showing

transactions and total net cash flows at the end of each month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College