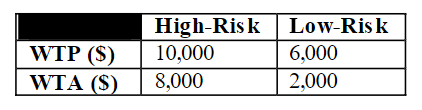

Suppose the market for auto insurance is made of up two types of buyers: high-risk and low-risk. Buyers’ willingness to pay (WTP) for auto insurance plans, and sellers’ willingness to accept (WTA) when selling plans to each type of buyer, are outlined in a photo Assume now that there is asymmetric information and that insurance companies do not know how risky an individual buyer is. In the face of this uncertainty, they determine that the probability that a “walk-in” is high-risk is 0.75. What is the minimum price sellers are willing to accept when selling an insurance plan? At this price, will low- and high-risk buyers both be willing to purchase this insurance plan? Explain. Be sure the mention adverse selection in your answer. Returning to the conditions outlined in Q1, suppose that buyers of auto insurance (high- and low- risk) were offered a $1,000 subsidy to purchase coverage. This would raise their WTP by $1,000. Would the market for both insurance plans clear after the subsidy? Explain.

Suppose the market for auto insurance is made of up two types of buyers: high-risk and low-risk.

Buyers’

when selling plans to each type of buyer, are outlined in a photo

Assume now that there is asymmetric information and that insurance companies do not know

how risky an individual buyer is. In the face of this uncertainty, they determine that the probability that a “walk-in” is high-risk is 0.75.

What is the minimum price sellers are willing to accept when selling an

insurance plan? At this price, will low- and high-risk buyers both be willing to purchase this insurance plan? Explain. Be sure the mention adverse selection in your answer.

Returning to the conditions outlined in Q1, suppose that buyers of auto insurance (high- and low-

risk) were offered a $1,000 subsidy to purchase coverage. This would raise their WTP by $1,000.

Would the market for both insurance plans clear after the subsidy? Explain.

Step by step

Solved in 2 steps