Suppose we are interested in bidding on a piece of land and we know one other bidder is interested. The seller announced that the highest bid in excess of $25,000 will be accepted. Assume that the competitor's bid x is a random variable that is uniformly distributed between $25,000 and $30,000. (a) Suppose you bid $27,000. What is the probability that your bid will be accepted? (b) Suppose you bid $28,000. What is the probability that your bid will be accepted? (c) What amount should you bid in dollars to maximize the probability that you get the property?

Suppose we are interested in bidding on a piece of land and we know one other bidder is interested. The seller announced that the highest bid in excess of $25,000 will be accepted. Assume that the competitor's bid x is a random variable that is uniformly distributed between $25,000 and $30,000. (a) Suppose you bid $27,000. What is the probability that your bid will be accepted? (b) Suppose you bid $28,000. What is the probability that your bid will be accepted? (c) What amount should you bid in dollars to maximize the probability that you get the property?

Chapter8: Sequences, Series,and Probability

Section8.7: Probability

Problem 11ECP: A manufacturer has determined that a machine averages one faulty unit for every 500 it produces....

Related questions

Concept explainers

Contingency Table

A contingency table can be defined as the visual representation of the relationship between two or more categorical variables that can be evaluated and registered. It is a categorical version of the scatterplot, which is used to investigate the linear relationship between two variables. A contingency table is indeed a type of frequency distribution table that displays two variables at the same time.

Binomial Distribution

Binomial is an algebraic expression of the sum or the difference of two terms. Before knowing about binomial distribution, we must know about the binomial theorem.

Topic Video

Question

100%

Transcribed Image Text:11.

DETAILS

ASWSBE14 6.E.007.

MY NOTES

ASK YOUR TEACHER

PRACTICE ANOTHER

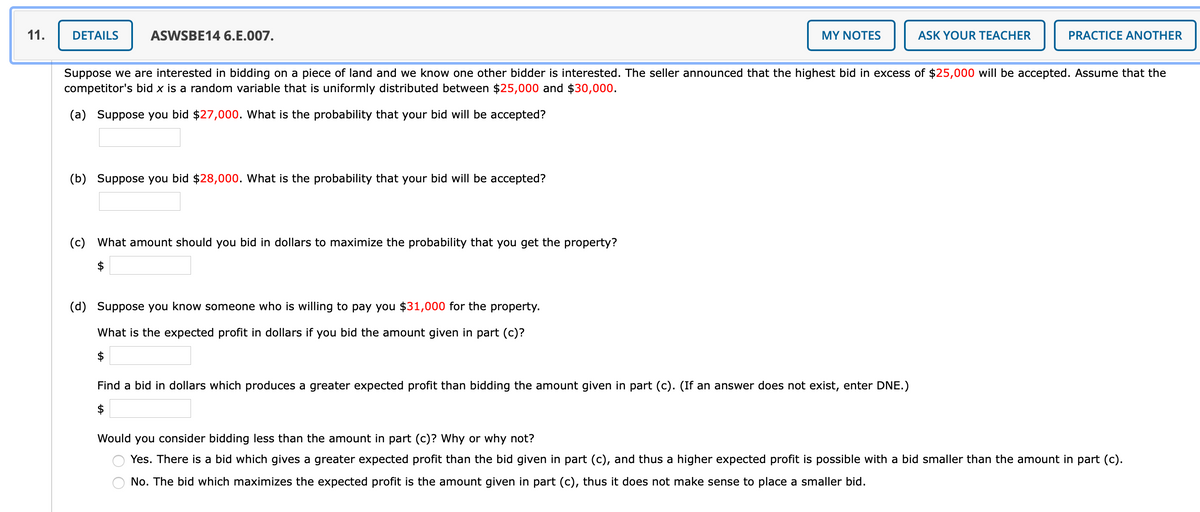

Suppose we are interested in bidding on a piece of land and we know one other bidder is interested. The seller announced that the highest bid in excess of $25,000 will be accepted. Assume that the

competitor's bid x is a random variable that is uniformly distributed between $25,000 and $30,000.

(a) Suppose you bid $27,000. What is the probability that your bid will be accepted?

(b) Suppose you bid $28,000. What is the probability that your bid will be accepted?

(c) What amount should you bid in dollars to maximize the probability that you get the property?

$

(d) Suppose you know someone who is willing to pay you $31,000 for the property.

What is the expected profit in dollars if you bid the amount given in part (c)?

$

Find a bid in dollars which produces a greater expected profit than bidding the amount given in part (c). (If an answer does not exist, enter DNE.)

$

Would you consider bidding less than the amount in part (c)? Why or why not?

Yes. There is a bid which gives a greater expected profit than the bid given in part (c), and thus a higher expected profit is possible with a bid smaller than the amount in part (c).

No. The bid which maximizes the expected profit is the amount given in part (c), thus it does not make sense to place a smaller bid.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you