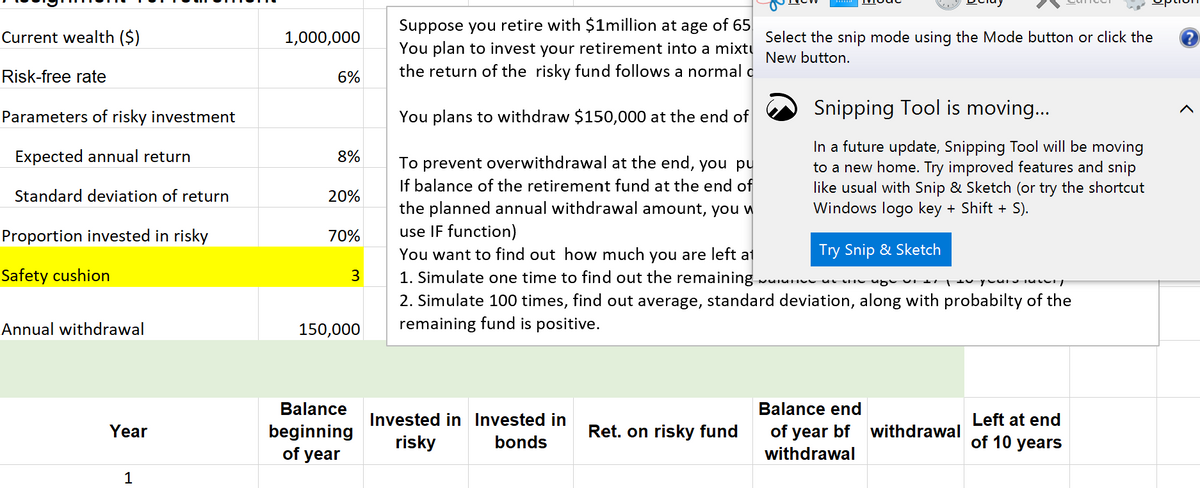

Suppose you retire with $1million at age of 65. You plan to invest your retirement into a mixture of a riky fund and a fixed income fund, where the return of the risky fund follows a normal distribution. You plans to withdraw $150,000 at the end of every year from this accout. To prevent overwithdrawal at the end, you put a safety cushion of 3 If balance of the retirement fund at the end of year, before annual withdrawal is less than 3 times the planned annual withdrawal amount, you withdraw one-third of the remaining balance. (Hint: use IF function) You want to find out how much you are left at the age of 75. Simulate one time to find out the remaining balance at the age of 17 ( 10 years later) Simulate 100 times, find out average, standard deviation, along with probabilty of the remaining fund is positive.

Suppose you retire with $1million at age of 65. You plan to invest your retirement into a mixture of a riky fund and a fixed income fund, where the return of the risky fund follows a normal distribution. You plans to withdraw $150,000 at the end of every year from this accout. To prevent overwithdrawal at the end, you put a safety cushion of 3 If balance of the retirement fund at the end of year, before annual withdrawal is less than 3 times the planned annual withdrawal amount, you withdraw one-third of the remaining balance. (Hint: use IF function) You want to find out how much you are left at the age of 75. Simulate one time to find out the remaining balance at the age of 17 ( 10 years later) Simulate 100 times, find out average, standard deviation, along with probabilty of the remaining fund is positive.

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 7FPE

Related questions

Question

Suppose you retire with $1million at age of 65.

You plan to invest your retirement into a mixture of a riky fund and a fixed income fund, where the return of the risky fund follows a

You plans to withdraw $150,000 at the end of every year from this accout.

To prevent overwithdrawal at the end, you put a safety cushion of 3

If balance of the retirement fund at the end of year, before annual withdrawal is less than 3 times the planned annual withdrawal amount, you withdraw one-third of the remaining balance. (Hint: use IF function)

You want to find out how much you are left at the age of 75.

- Simulate one time to find out the remaining balance at the age of 17 ( 10 years later)

- Simulate 100 times, find out average, standard deviation, along with probabilty of the remaining fund is positive.

Transcribed Image Text:Current wealth ($)

Risk-free rate

Parameters of risky investment

Expected annual return

Standard deviation of return

Proportion invested in risky

Safety cushion

Annual withdrawal

Year

1

1,000,000

Suppose you retire with $1million at age of 65

You plan to invest your retirement into a mixtu

the return of the risky fund follows a normal c

Select the snip mode using the Mode button or click the ?

New button.

6%

Snipping Tool is moving...

You plans to withdraw $150,000 at the end of

8%

In a future update, Snipping Tool will be moving

to a new home. Try improved features and snip

like usual with Snip & Sketch (or try the shortcut

Windows logo key + Shift + S).

To prevent overwithdrawal at the end, you pu

If balance of the retirement fund at the end of

the planned annual withdrawal amount, you w

use IF function)

20%

70%

Try Snip & Sketch

3

PICTI

you you

You want to find out how much you are left at

1. Simulate one time to find out the remaining

2. Simulate 100 times, find out average, standard deviation, along with probabilty of the

remaining fund is positive.

150,000

Balance end

Balance

beginning

Invested in Invested in

risky bonds

Ret. on risky fund

of year bf withdrawal

withdrawal

Left at end

of 10 years

of year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning