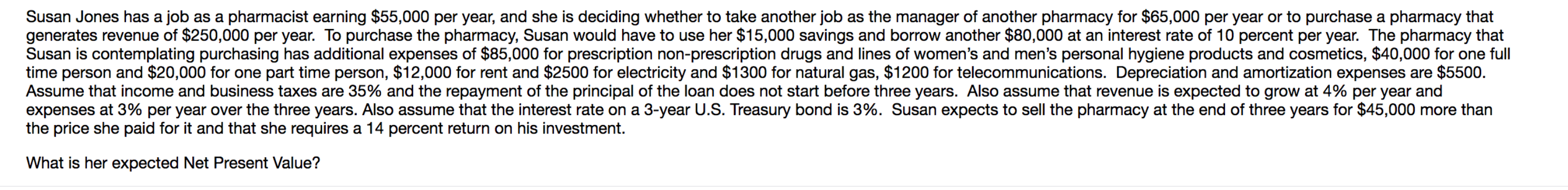

Susan Jones has a job as a pharmacist earning $55,000 per year, and she is deciding whether to take another job as the manager of another pharmacy for $65,000 per year or to purchase a pharmacy that generates revenue of $250,000 per year. To purchase the pharmacy, Susan would have to use her $15,000 savings and borrow another $80,000 at an interest rate of 10 percent per year. The pharmacy that Susan is contemplating purchasing has additional expenses of $85,000 for prescription non-prescription drugs and lines of women's and men's personal hygiene products and cosmetics, $40,000 for one full time person and $20,000 for one part time person, $12,000 for rent and $2500 for electricity and $1300 for natural gas, $1200 for telecommunications. Depreciation and amortization expenses are $5500 Assume that income and business taxes are 35% and the repayment of the principal of the loan does not start before three years. Also assume that revenue is expected to grow at 4% per year and expenses at 3% per year over the three years. Also assume that the interest rate on a 3-year U.S. Treasury bond is 3%. Susan expects to sell the pharmacy at the end of three years for $45,000 more than the price she paid for it and that she requires a 14 percent return on his investment. What is her expected Net Present Value?

Susan Jones has a job as a pharmacist earning $55,000 per year, and she is deciding whether to take another job as the manager of another pharmacy for $65,000 per year or to purchase a pharmacy that generates revenue of $250,000 per year. To purchase the pharmacy, Susan would have to use her $15,000 savings and borrow another $80,000 at an interest rate of 10 percent per year. The pharmacy that Susan is contemplating purchasing has additional expenses of $85,000 for prescription non-prescription drugs and lines of women's and men's personal hygiene products and cosmetics, $40,000 for one full time person and $20,000 for one part time person, $12,000 for rent and $2500 for electricity and $1300 for natural gas, $1200 for telecommunications. Depreciation and amortization expenses are $5500 Assume that income and business taxes are 35% and the repayment of the principal of the loan does not start before three years. Also assume that revenue is expected to grow at 4% per year and expenses at 3% per year over the three years. Also assume that the interest rate on a 3-year U.S. Treasury bond is 3%. Susan expects to sell the pharmacy at the end of three years for $45,000 more than the price she paid for it and that she requires a 14 percent return on his investment. What is her expected Net Present Value?

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 6DQ

Related questions

Question

Transcribed Image Text:Susan Jones has a job as a pharmacist earning $55,000 per year, and she is deciding whether to take another job as the manager of another pharmacy for $65,000 per year or to purchase a pharmacy that

generates revenue of $250,000 per year. To purchase the pharmacy, Susan would have to use her $15,000 savings and borrow another $80,000 at an interest rate of 10 percent per year. The pharmacy that

Susan is contemplating purchasing has additional expenses of $85,000 for prescription non-prescription drugs and lines of women's and men's personal hygiene products and cosmetics, $40,000 for one full

time person and $20,000 for one part time person, $12,000 for rent and $2500 for electricity and $1300 for natural gas, $1200 for telecommunications. Depreciation and amortization expenses are $5500

Assume that income and business taxes are 35% and the repayment of the principal of the loan does not start before three years. Also assume that revenue is expected to grow at 4% per year and

expenses at 3% per year over the three years. Also assume that the interest rate on a 3-year U.S. Treasury bond is 3%. Susan expects to sell the pharmacy at the end of three years for $45,000 more than

the price she paid for it and that she requires a 14 percent return on his investment.

What is her expected Net Present Value?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning