Sydney International Business College ABN No: 40 602 418 815 SIBC SIBC ETreRNATIONAL RTO No: 41182 CRICOS Provider No.: 03504G Address: Level 5, 307 Pitt Street, Sydney NSW 2000 Phone: 02 9264 4438 Email: info@sibc.nsw.edu.au Task 5 The general ledger of Daedalus Ltd, a manufacturing firm operating a job cost system, included the following balances at May 31: $ 35,000 3,375 (Cr.) 420 (Cr.) 16,150 17,075 Raw Materials Control Labour Control Factory Overhead Applied Work In Process Finished Goods Particulars of jobs in process and the job completed were Material Job No. Labour Overhead Total $ 3,000 500 $6,750 1,700 6,350 $ 3,600 $13,350 2,800 17,075 323 In process 324 600 Completed 322 5,850 4,875 During the month of June the following transactions occurred: $ $ 24,700 Materials purchased on credit Factory wages paid 29,000 - Gross - PAYG Tax 6,700 22,300 2,500 2,000 Factory rent paid Invoices for sundry factory overhead items Depreciation at 15% per annum is to be charged on factory plant valued at $160,000 Material issued to the factory and labour charged for the month were: Material Job No. Labour $ nil 5,600 $1,175 323 4,400 9,250 1,000 9,800 324 325 12,000 4,500 3,000 326 Indirect 25,100 25,625 Factory overhead is applied using a rate of 120% of direct labour cost. Any over/under-applied overhead is transferred to cost of goods sold at June 30. At 30 June, Job No. 326 was incomplete. Job Nos 322, 323 and 324 had been completed and sold on credit, wh ile Job No. 325 was still in the finished goods warehouse. The jobs sold had a total sales value of $81,744 REQUIRED: Prepare a Job Card Cost Summary for June Prepare and balance the following accounts (a single ledger is used) (i) ( ii (v (а) (b) (ii) Raw Materials Control Labour Control Factory Overhead Control Work in Process (iv) (v) Factory Overhead Applied Finished Goods Version Date: September 2019 Page 19 of 24 Sydney International Institute Pty Ltd T/A Sydney International Business College ABN No: 40 602 418 815 RTO No: 41182 CRICOS Provider: 03504G Address: Level 5, 307 Pitt Street, Sydney NSW 2000 Phone: 02 8971 0170 Email: sydibc@gmail.com SYDNEY SENL GE Sydney International Business College ABN No: 40 602 418 815 SIBC SIBC ETreRNATIONAL RTO No: 41182 CRICOS Provider No.: 03504G Address: Level 5, 307 Pitt Street, Sydney NSW 2000 Phone: 02 9264 4438 Email: info@sibc.nsw.edu.au Task 6: The following information has been prepared from the accounting records of Doubting Ltd for the six-months to 30 June 2010. The business uses a periodic inventory system $ 178,300 1,846,500 Accounts receivable: Balance 01/01/2010 Sales Inventories 01/01/2010: 95,940 8,440 174,690 28,650 Raw Materials Factory Supplies Finished Goods Work in Process Factory insurances: Prepaid 01/01/2010 Annual Premium paid 01/04/2010 Factory Plant & Equipment: At cost 01/01/2010 2,920 12,360 343,800 154,710 Accumulated Depreciation 01/01/2010 Depreciation Straight-line 10% p.a Accounts payable: Balance 01/01/2010 45,180 442,230 18,620 38,730 317,840 Purchases - Raw materials - Factory supplies - Finished goods Payments Freight Inwards: Raw materials 15,450 1,790 50,060 Factory supplies Freight outwards Wages and salaries: Direct Labour 154,680 78,030 11,430 Indirect Labour Factory Maintenance Factory Lighting and Power: Accrued 01/01/2010 4,110 16,750 $ 102,660 9,070 171,890 37,220 16,320 Payments Other adjustments as at 30 June 2010: - Raw Materials Inventories - Factory Supplies - Finished Goods - Work In Process Annual Leave accrued - Factory REQUIRED: Prepare the following statements (appropriately classified) for the six-months ended 30 June 2010: (a) Manufacturing statement and A Trading statement (b) Version Date: September 2019 Page 20 of 24 Sydney International Institute Pty Ltd T/A Sydney International Business College ABN No: 40 602 418 815 RTO No: 41182 CRICOS Provider: 03504G Address: Level 5, 307 Pitt Street, Sydney NSW 2000 Phone: 02 8971 0170 Email: sydibc@gmail.com SYDNEY SENL GE

Sydney International Business College ABN No: 40 602 418 815 SIBC SIBC ETreRNATIONAL RTO No: 41182 CRICOS Provider No.: 03504G Address: Level 5, 307 Pitt Street, Sydney NSW 2000 Phone: 02 9264 4438 Email: info@sibc.nsw.edu.au Task 5 The general ledger of Daedalus Ltd, a manufacturing firm operating a job cost system, included the following balances at May 31: $ 35,000 3,375 (Cr.) 420 (Cr.) 16,150 17,075 Raw Materials Control Labour Control Factory Overhead Applied Work In Process Finished Goods Particulars of jobs in process and the job completed were Material Job No. Labour Overhead Total $ 3,000 500 $6,750 1,700 6,350 $ 3,600 $13,350 2,800 17,075 323 In process 324 600 Completed 322 5,850 4,875 During the month of June the following transactions occurred: $ $ 24,700 Materials purchased on credit Factory wages paid 29,000 - Gross - PAYG Tax 6,700 22,300 2,500 2,000 Factory rent paid Invoices for sundry factory overhead items Depreciation at 15% per annum is to be charged on factory plant valued at $160,000 Material issued to the factory and labour charged for the month were: Material Job No. Labour $ nil 5,600 $1,175 323 4,400 9,250 1,000 9,800 324 325 12,000 4,500 3,000 326 Indirect 25,100 25,625 Factory overhead is applied using a rate of 120% of direct labour cost. Any over/under-applied overhead is transferred to cost of goods sold at June 30. At 30 June, Job No. 326 was incomplete. Job Nos 322, 323 and 324 had been completed and sold on credit, wh ile Job No. 325 was still in the finished goods warehouse. The jobs sold had a total sales value of $81,744 REQUIRED: Prepare a Job Card Cost Summary for June Prepare and balance the following accounts (a single ledger is used) (i) ( ii (v (а) (b) (ii) Raw Materials Control Labour Control Factory Overhead Control Work in Process (iv) (v) Factory Overhead Applied Finished Goods Version Date: September 2019 Page 19 of 24 Sydney International Institute Pty Ltd T/A Sydney International Business College ABN No: 40 602 418 815 RTO No: 41182 CRICOS Provider: 03504G Address: Level 5, 307 Pitt Street, Sydney NSW 2000 Phone: 02 8971 0170 Email: sydibc@gmail.com SYDNEY SENL GE Sydney International Business College ABN No: 40 602 418 815 SIBC SIBC ETreRNATIONAL RTO No: 41182 CRICOS Provider No.: 03504G Address: Level 5, 307 Pitt Street, Sydney NSW 2000 Phone: 02 9264 4438 Email: info@sibc.nsw.edu.au Task 6: The following information has been prepared from the accounting records of Doubting Ltd for the six-months to 30 June 2010. The business uses a periodic inventory system $ 178,300 1,846,500 Accounts receivable: Balance 01/01/2010 Sales Inventories 01/01/2010: 95,940 8,440 174,690 28,650 Raw Materials Factory Supplies Finished Goods Work in Process Factory insurances: Prepaid 01/01/2010 Annual Premium paid 01/04/2010 Factory Plant & Equipment: At cost 01/01/2010 2,920 12,360 343,800 154,710 Accumulated Depreciation 01/01/2010 Depreciation Straight-line 10% p.a Accounts payable: Balance 01/01/2010 45,180 442,230 18,620 38,730 317,840 Purchases - Raw materials - Factory supplies - Finished goods Payments Freight Inwards: Raw materials 15,450 1,790 50,060 Factory supplies Freight outwards Wages and salaries: Direct Labour 154,680 78,030 11,430 Indirect Labour Factory Maintenance Factory Lighting and Power: Accrued 01/01/2010 4,110 16,750 $ 102,660 9,070 171,890 37,220 16,320 Payments Other adjustments as at 30 June 2010: - Raw Materials Inventories - Factory Supplies - Finished Goods - Work In Process Annual Leave accrued - Factory REQUIRED: Prepare the following statements (appropriately classified) for the six-months ended 30 June 2010: (a) Manufacturing statement and A Trading statement (b) Version Date: September 2019 Page 20 of 24 Sydney International Institute Pty Ltd T/A Sydney International Business College ABN No: 40 602 418 815 RTO No: 41182 CRICOS Provider: 03504G Address: Level 5, 307 Pitt Street, Sydney NSW 2000 Phone: 02 8971 0170 Email: sydibc@gmail.com SYDNEY SENL GE

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Job Order Costing

Section: Chapter Questions

Problem 17.1CP: Managerial analysis The controller of the plant of Minsky Company prepared a graph of the unit costs...

Related questions

Question

Transcribed Image Text:Sydney International Business College

ABN No: 40 602 418 815

SIBC

SIBC

ETreRNATIONAL

RTO No: 41182 CRICOS Provider No.: 03504G

Address: Level 5, 307 Pitt Street, Sydney NSW 2000

Phone: 02 9264 4438 Email: info@sibc.nsw.edu.au

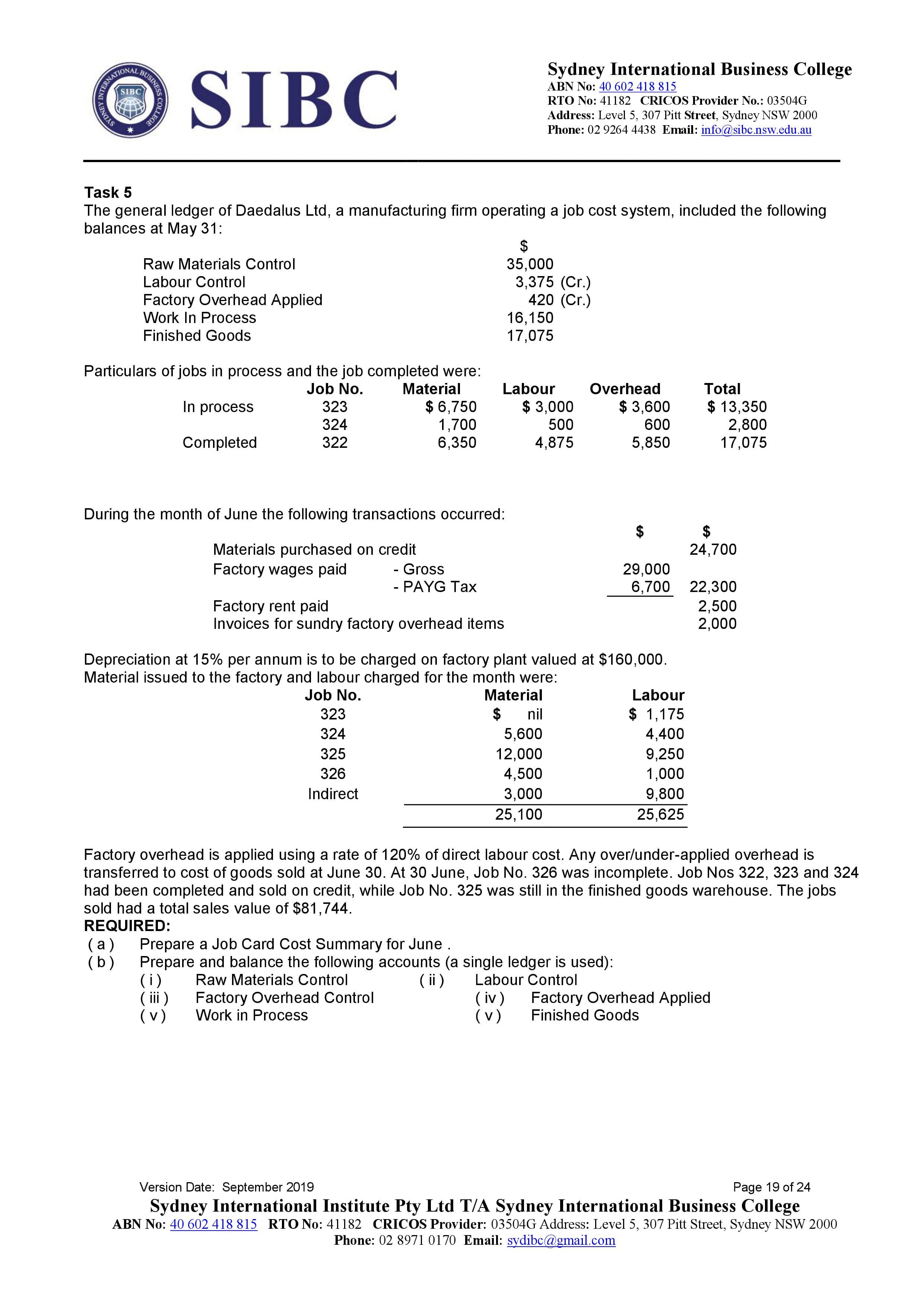

Task 5

The general ledger of Daedalus Ltd, a manufacturing firm operating a job cost system, included the following

balances at May 31:

$

35,000

3,375 (Cr.)

420 (Cr.)

16,150

17,075

Raw Materials Control

Labour Control

Factory Overhead Applied

Work In Process

Finished Goods

Particulars of jobs in process and the job completed were

Material

Job No.

Labour

Overhead

Total

$ 3,000

500

$6,750

1,700

6,350

$ 3,600

$13,350

2,800

17,075

323

In process

324

600

Completed

322

5,850

4,875

During the month of June the following transactions occurred:

$

$

24,700

Materials purchased on credit

Factory wages paid

29,000

- Gross

- PAYG Tax

6,700 22,300

2,500

2,000

Factory rent paid

Invoices for sundry factory overhead items

Depreciation at 15% per annum is to be charged on factory plant valued at $160,000

Material issued to the factory and labour charged for the month were:

Material

Job No.

Labour

$ nil

5,600

$1,175

323

4,400

9,250

1,000

9,800

324

325

12,000

4,500

3,000

326

Indirect

25,100

25,625

Factory overhead is applied using a rate of 120% of direct labour cost. Any over/under-applied overhead is

transferred to cost of goods sold at June 30. At 30 June, Job No. 326 was incomplete. Job Nos 322, 323 and 324

had been completed and sold on credit, wh ile Job No. 325 was still in the finished goods warehouse. The jobs

sold had a total sales value of $81,744

REQUIRED:

Prepare a Job Card Cost Summary for June

Prepare and balance the following accounts (a single ledger is used)

(i)

( ii

(v

(а)

(b)

(ii)

Raw Materials Control

Labour Control

Factory Overhead Control

Work in Process

(iv)

(v)

Factory Overhead Applied

Finished Goods

Version Date: September 2019

Page 19 of 24

Sydney International Institute Pty Ltd T/A Sydney International Business College

ABN No: 40 602 418 815 RTO No: 41182 CRICOS Provider: 03504G Address: Level 5, 307 Pitt Street, Sydney NSW 2000

Phone: 02 8971 0170 Email: sydibc@gmail.com

SYDNEY

SENL GE

Transcribed Image Text:Sydney International Business College

ABN No: 40 602 418 815

SIBC

SIBC

ETreRNATIONAL

RTO No: 41182 CRICOS Provider No.: 03504G

Address: Level 5, 307 Pitt Street, Sydney NSW 2000

Phone: 02 9264 4438 Email: info@sibc.nsw.edu.au

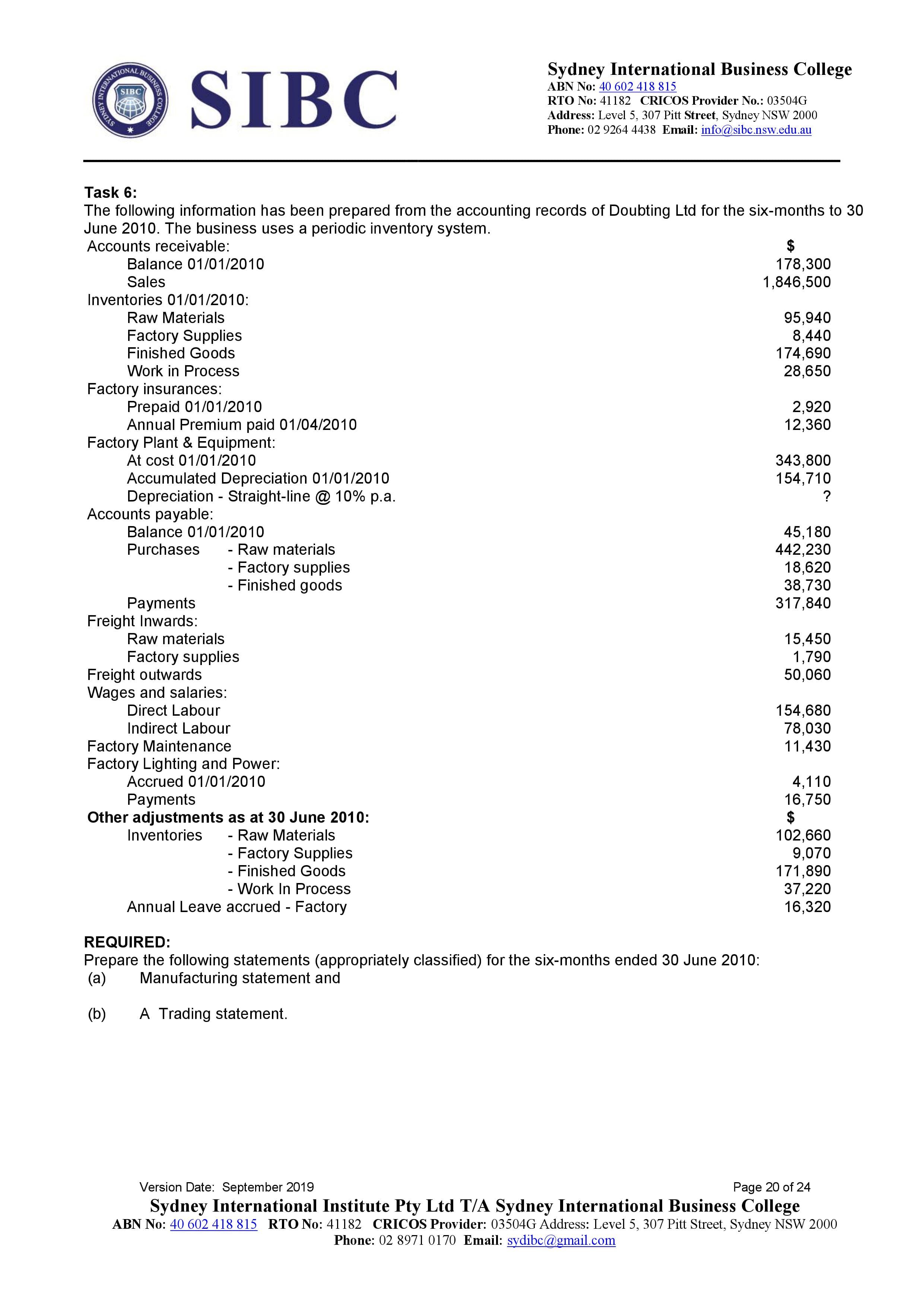

Task 6:

The following information has been prepared from the accounting records of Doubting Ltd for the six-months to 30

June 2010. The business uses a periodic inventory system

$

178,300

1,846,500

Accounts receivable:

Balance 01/01/2010

Sales

Inventories 01/01/2010:

95,940

8,440

174,690

28,650

Raw Materials

Factory Supplies

Finished Goods

Work in Process

Factory insurances:

Prepaid 01/01/2010

Annual Premium paid 01/04/2010

Factory Plant & Equipment:

At cost 01/01/2010

2,920

12,360

343,800

154,710

Accumulated Depreciation 01/01/2010

Depreciation Straight-line 10% p.a

Accounts payable:

Balance 01/01/2010

45,180

442,230

18,620

38,730

317,840

Purchases

- Raw materials

- Factory supplies

- Finished goods

Payments

Freight Inwards:

Raw materials

15,450

1,790

50,060

Factory supplies

Freight outwards

Wages and salaries:

Direct Labour

154,680

78,030

11,430

Indirect Labour

Factory Maintenance

Factory Lighting and Power:

Accrued 01/01/2010

4,110

16,750

$

102,660

9,070

171,890

37,220

16,320

Payments

Other adjustments as at 30 June 2010:

- Raw Materials

Inventories

- Factory Supplies

- Finished Goods

- Work In Process

Annual Leave accrued - Factory

REQUIRED:

Prepare the following statements (appropriately classified) for the six-months ended 30 June 2010:

(a)

Manufacturing statement and

A Trading statement

(b)

Version Date: September 2019

Page 20 of 24

Sydney International Institute Pty Ltd T/A Sydney International Business College

ABN No: 40 602 418 815 RTO No: 41182 CRICOS Provider: 03504G Address: Level 5, 307 Pitt Street, Sydney NSW 2000

Phone: 02 8971 0170 Email: sydibc@gmail.com

SYDNEY

SENL GE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning