4. (a) Suppose you decide to short sell some GameStop shares. Their cur- rent price is $5, and you have $5000 available to you. Your broker tells you that you have an initial margin requirement of 50%, with maintenance margin 35%. i. How many shares can you shortsell? How much cash will there be in the margin account? ii. Suppose GameStop rises in value to $6 per share. What percent- age margin do you have now? iii. How high will GameStop have to rise before you will get a margin call?

4. (a) Suppose you decide to short sell some GameStop shares. Their cur- rent price is $5, and you have $5000 available to you. Your broker tells you that you have an initial margin requirement of 50%, with maintenance margin 35%. i. How many shares can you shortsell? How much cash will there be in the margin account? ii. Suppose GameStop rises in value to $6 per share. What percent- age margin do you have now? iii. How high will GameStop have to rise before you will get a margin call?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter18: Initial Public Offerings, Investment Banking, And Capital Formation

Section: Chapter Questions

Problem 5P

Related questions

Question

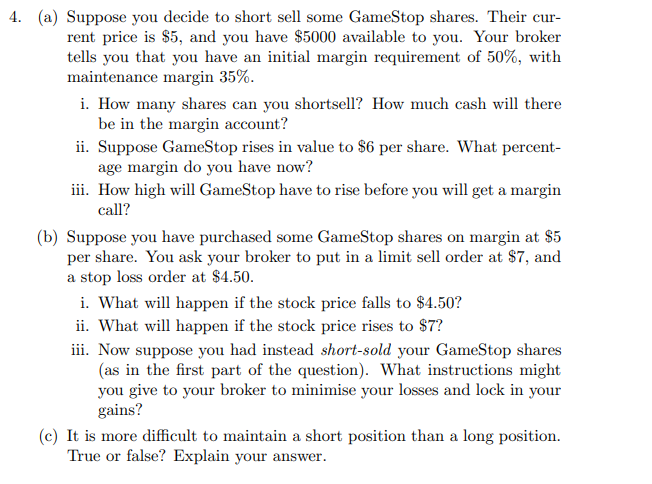

Transcribed Image Text:4. (a) Suppose you decide to short sell some GameStop shares. Their cur-

rent price is $5, and you have $5000 available to you. Your broker

tells you that you have an initial margin requirement of 50%, with

maintenance margin 35%.

i. How many shares can you shortsell? How much cash will there

be in the margin account?

ii. Suppose GameStop rises in value to $6 per share. What percent-

age margin do you have now?

iii. How high will GameStop have to rise before you will get a margin

call?

(b) Suppose you have purchased some GameStop shares on margin at $5

per share. You ask your broker to put in a limit sell order at $7, and

a stop loss order at $4.50.

i. What will happen if the stock price falls to $4.50?

ii. What will happen if the stock price rises to $7?

iii. Now suppose you had instead short-sold your GameStop shares

(as in the first part of the question). What instructions might

you give to your broker to minimise your losses and lock in your

gains?

(c) It is more difficult to maintain a short position than a long position.

True or false? Explain your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Is it more difficult to maintain a short position than a long position.

True or false? Explain your answer.

Solution

Follow-up Question

What about for these?

(b) Suppose you have purchased some GameStop shares on margin at $5

per share. You ask your broker to put in a limit sell order at $7, and

a stop loss order at $4.50.

i. What will happen if the stock price falls to $4.50?

ii. What will happen if the stock price rises to $7?

iii. Now suppose you had instead short-sold your GameStop shares

(as in the first part of the question). What instructions might

you give to your broker to minimise your losses and lock in your

gains?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning