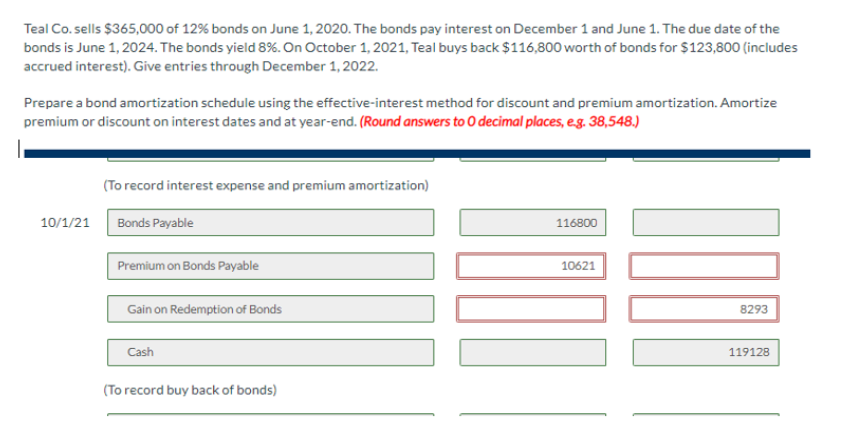

Teal Co.sells $365,000 of 12% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The due date of the bonds is June 1, 2024. The bonds yield 8%. On October 1, 2021, Teal buys back $116,800 worth of bonds for $123,800 (includes accrued interest). Give entries through December 1, 2022. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to O decimal places, e.g. 38,548.) (To record interest expense and premium amortization) 10/1/21 Bonds Payable Premium on Bonds Payable Gain on Redemption of Bonds Cash (To record buy back of bonds) 116800 10621 8293 119128

Teal Co.sells $365,000 of 12% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The due date of the bonds is June 1, 2024. The bonds yield 8%. On October 1, 2021, Teal buys back $116,800 worth of bonds for $123,800 (includes accrued interest). Give entries through December 1, 2022. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to O decimal places, e.g. 38,548.) (To record interest expense and premium amortization) 10/1/21 Bonds Payable Premium on Bonds Payable Gain on Redemption of Bonds Cash (To record buy back of bonds) 116800 10621 8293 119128

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 5P: Bats Corporation issued 800,000 of 12% face value bonds for 851,705.70. The bonds were dated and...

Related questions

Question

Ee 148.

Transcribed Image Text:Teal Co.sells $365,000 of 12% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The due date of the

bonds is June 1, 2024. The bonds yield 8%. On October 1, 2021, Teal buys back $116,800 worth of bonds for $123,800 (includes

accrued interest). Give entries through December 1, 2022.

Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize

premium or discount on interest dates and at year-end. (Round answers to O decimal places, e.g. 38,548.)

(To record interest expense and premium amortization)

10/1/21 Bonds Payable

Premium on Bonds Payable

Gain on Redemption of Bonds

Cash

(To record buy back of bonds)

116800

10621

8293

119128

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College