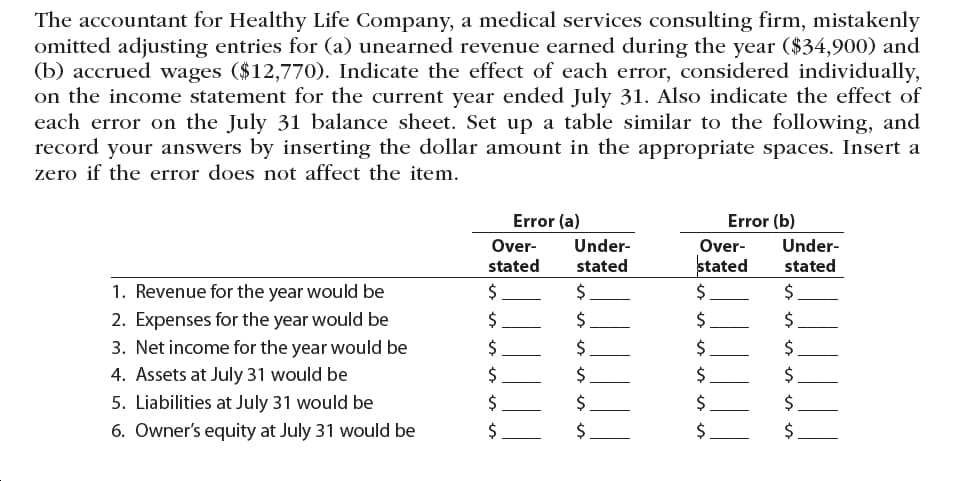

The accountant for Healthy Life Company, a medical services consulting firm, mistakenly omitted adjusting entries for (a) unearned revenue earned during the year ($34,900) and (b) accrued wages ($12,770). Indicate the effect of each error, considered individually, on the income statement for the current year ended July 31. Also indicate the effect of each error on the July 31 balance sheet. Set up a table similar to the following, and record your answers by inserting the dollar amount in the appropriate spaces. Insert a zero if the error does not affect the item. Error (b) Error (a) Under- stated Under- stated Over- Over- stated stated 1. Revenue for the year would be 2$ 24 2. Expenses for the year would be 2$ 2$ 24 24 3. Net income for the year would be 4. Assets at July 31 would be 2$ 2$ 2$ 2$ 24 24 5. Liabilities at July 31 would be 6. Owner's equity at July 31 would be 2$ 2$

The accountant for Healthy Life Company, a medical services consulting firm, mistakenly omitted adjusting entries for (a) unearned revenue earned during the year ($34,900) and (b) accrued wages ($12,770). Indicate the effect of each error, considered individually, on the income statement for the current year ended July 31. Also indicate the effect of each error on the July 31 balance sheet. Set up a table similar to the following, and record your answers by inserting the dollar amount in the appropriate spaces. Insert a zero if the error does not affect the item. Error (b) Error (a) Under- stated Under- stated Over- Over- stated stated 1. Revenue for the year would be 2$ 24 2. Expenses for the year would be 2$ 2$ 24 24 3. Net income for the year would be 4. Assets at July 31 would be 2$ 2$ 2$ 2$ 24 24 5. Liabilities at July 31 would be 6. Owner's equity at July 31 would be 2$ 2$

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter2: Service Company Worksheet (f1work)

Section: Chapter Questions

Problem 1R: The trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as...

Related questions

Question

Transcribed Image Text:The accountant for Healthy Life Company, a medical services consulting firm, mistakenly

omitted adjusting entries for (a) unearned revenue earned during the year ($34,900) and

(b) accrued wages ($12,770). Indicate the effect of each error, considered individually,

on the income statement for the current year ended July 31. Also indicate the effect of

each error on the July 31 balance sheet. Set up a table similar to the following, and

record your answers by inserting the dollar amount in the appropriate spaces. Insert a

zero if the error does not affect the item.

Error (b)

Error (a)

Under-

stated

Under-

stated

Over-

Over-

stated

stated

1. Revenue for the year would be

2$

24

2. Expenses for the year would be

2$

2$

24

24

3. Net income for the year would be

4. Assets at July 31 would be

2$

2$

2$

2$

24

24

5. Liabilities at July 31 would be

6. Owner's equity at July 31 would be

2$

2$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning