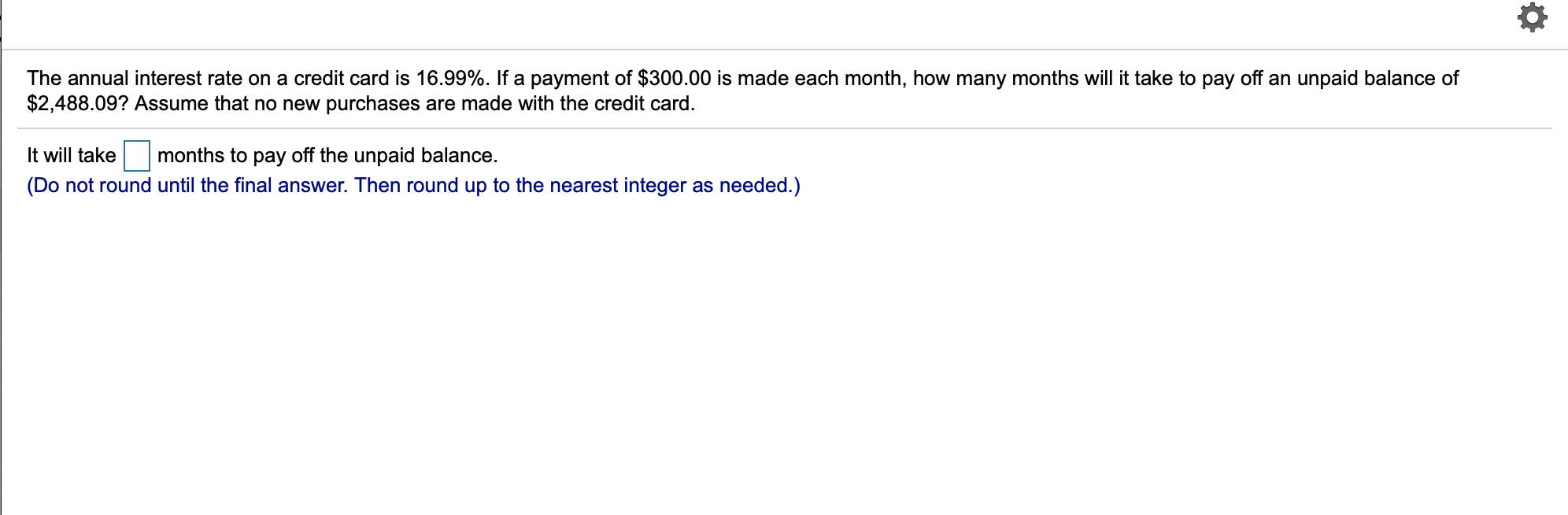

The annual interest rate on a credit card is 16.99%. If a payment of $300.00 is made each month, how many months will it take to pay off an unpaid balance of $2,488.09? Assume that no new purchases are made with the credit card months to pay off the unpaid balance It will take (Do not round until the final answer. Then round up to the nearest integer as needed.)

The annual interest rate on a credit card is 16.99%. If a payment of $300.00 is made each month, how many months will it take to pay off an unpaid balance of $2,488.09? Assume that no new purchases are made with the credit card months to pay off the unpaid balance It will take (Do not round until the final answer. Then round up to the nearest integer as needed.)

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 21MC: A customer takes out a loan of $130,000 on January 1, with a maturity date of 36 months, and an...

Related questions

Question

Transcribed Image Text:The annual interest rate on a credit card is 16.99%. If a payment of $300.00 is made each month, how many months will it take to pay off an unpaid balance of

$2,488.09? Assume that no new purchases are made with the credit card

months to pay off the unpaid balance

It will take

(Do not round until the final answer. Then round up to the nearest integer as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College