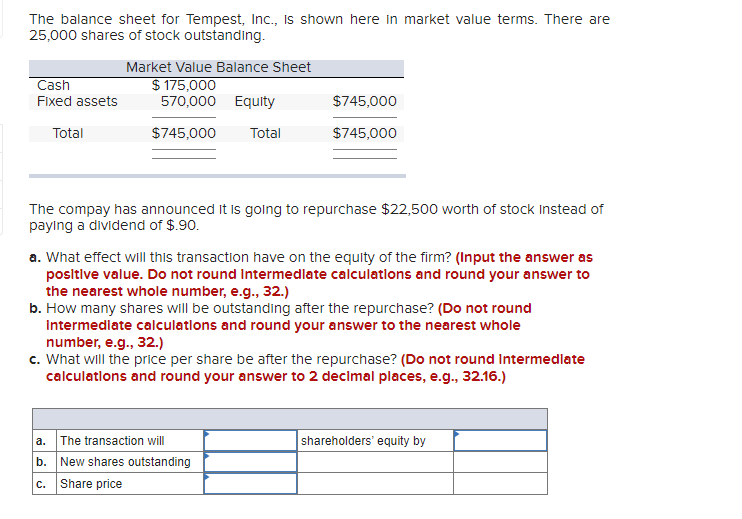

The balance sheet for Tempest, Inc., Is shown here in market value terms. There are 25,000 shares of stock outstanding. Market Value Balance Sheet Cash $ 175,000 570,000 Equity Fixed assets $745,000 Total $745,000 Total $745,000 The compay has announced It is golng to repurchase $22,500 worth of stock Instead of paying a dividend of $.90. a. What effect will this transaction have on the equity of the firm? (Input the answer as positive value. Do not round Intermedlate calculatlons and round your answer to the nearest whole number, e.g., 32.) b. How many shares wll be outstanding after the repurchase? (Do not round Intermedlate calculatlons and round your answer to the nearest whole number, e.g., 32.) c. What will the price per share be after the repurchase? (Do not round Intermedlate calculatlons and round your answer to 2 decimal places, e.g., 32.16.) a. The transaction will b. New shares outstanding c. Share price |shareholders' equity by

The balance sheet for Tempest, Inc., Is shown here in market value terms. There are 25,000 shares of stock outstanding. Market Value Balance Sheet Cash $ 175,000 570,000 Equity Fixed assets $745,000 Total $745,000 Total $745,000 The compay has announced It is golng to repurchase $22,500 worth of stock Instead of paying a dividend of $.90. a. What effect will this transaction have on the equity of the firm? (Input the answer as positive value. Do not round Intermedlate calculatlons and round your answer to the nearest whole number, e.g., 32.) b. How many shares wll be outstanding after the repurchase? (Do not round Intermedlate calculatlons and round your answer to the nearest whole number, e.g., 32.) c. What will the price per share be after the repurchase? (Do not round Intermedlate calculatlons and round your answer to 2 decimal places, e.g., 32.16.) a. The transaction will b. New shares outstanding c. Share price |shareholders' equity by

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 55E: Rebert Inc. showed the following balances for last year: Reberts net income for last year was...

Related questions

Question

Transcribed Image Text:The balance sheet for Tempest, Ic., Is shown here in market value terms. There are

25,000 shares of stock outstanding.

Market Value Balance Sheet

$ 175,000

570,000

Cash

Fixed assets

Equity

$745,000

Total

$745,000

Total

$745,000

The compay has announced It is going to repurchase $22,500 worth of stock Instead of

paying a dividend of $.90.

a. What effect will this transaction have on the equity of the firm? (Input the answer as

positive value. Do not round Intermedlate calculations and round your answer to

the nearest whole number, e.g., 32.)

b. How many shares will be outstanding after the repurchase? (Do not round

Intermedlate calculatlons and round your answer to the nearest whole

number, e.g., 32.)

c. What will the price per share be after the repurchase? (Do not round Intermedlate

calculatlons and round your answer to 2 decimal places, e.g., 32.16.)

a. The transaction will

shareholders' equity by

b. New shares outstanding

C.

Share price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning