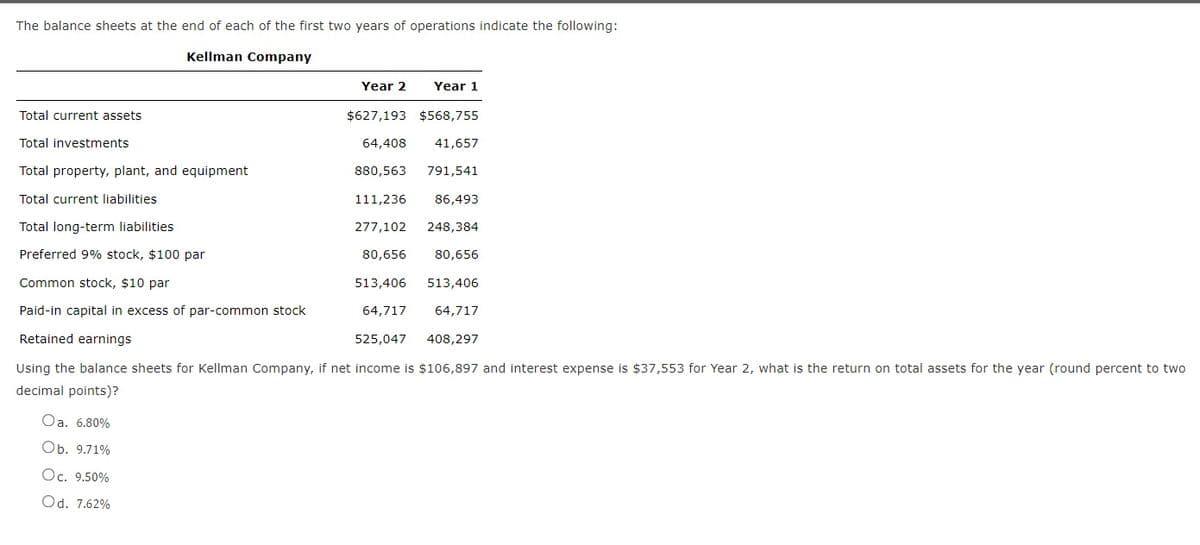

The balance sheets at the end of each of the first two years of operations indicate the following: Kellman Company Year 2 Year 1 Total current assets $627,193 $568,755 Total investments 64,408 41,657 Total property, plant, and equipment 880,563 791,541 Total current liabilities 111,236 86,493 Total long-term liabilities 277,102 248,384 Preferred 9% stock, $100 par 80,656 80,656 Common stock, $10 par 513,406 513,406 Paid-in capital in excess of par-common stock 64,717 64,717 Retained earnings 525,047 408,297 Using the balance sheets for Kellman Company, if net income is $106,897 and interest expense is $37,553 for Year 2, what is the return on total assets for the year (round percent to two decimal points)? Oa. 6.80% Оb. 9.71% Oc. 9.50% Od. 7.62%

The balance sheets at the end of each of the first two years of operations indicate the following: Kellman Company Year 2 Year 1 Total current assets $627,193 $568,755 Total investments 64,408 41,657 Total property, plant, and equipment 880,563 791,541 Total current liabilities 111,236 86,493 Total long-term liabilities 277,102 248,384 Preferred 9% stock, $100 par 80,656 80,656 Common stock, $10 par 513,406 513,406 Paid-in capital in excess of par-common stock 64,717 64,717 Retained earnings 525,047 408,297 Using the balance sheets for Kellman Company, if net income is $106,897 and interest expense is $37,553 for Year 2, what is the return on total assets for the year (round percent to two decimal points)? Oa. 6.80% Оb. 9.71% Oc. 9.50% Od. 7.62%

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 19P

Related questions

Question

100%

Practice Pack

Transcribed Image Text:The balance sheets at the end of each of the first two years of operations indicate the following:

Kellman Company

Year 2

Year 1

Total current assets

$627,193 $568,755

Total investments

64,408

41,657

Total property, plant, and equipment

880,563

791,541

Total current liabilities

111,236

86,493

Total long-term liabilities

277,102

248,384

Preferred 9% stock, $100 par

80,656

80,656

Common stock, $10 par

513,406

513,406

Paid-in capital in excess of par-common stock

64,717

64,717

Retained earnings

525,047

408,297

Using the balance sheets for Kellman Company, if net income is $106,897 and interest expense is $37,553 for Year 2, what is the return on total assets for the year (round percent to two

decimal points)?

Oa. 6.80%

Оb. 9.71%

Oc. 9.50%

Od. 7.62%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College