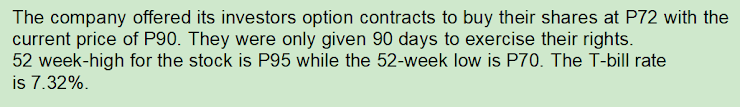

The company offered its investors option contracts to buy their shares at P72 with the current price of P90. They were only given 90 days to exercise their rights. 52 week-high for the stock is P95 while the 52-week low is P70. The T-bill rate is 7.32%.

Q: On July 14, an investor goes short on a put option for 100 shares of ABC Corporation common stock…

A: The profit and loss on the put option is the difference between the strike price and the current…

Q: Investor considers entering a 1Y forward contract for a delivery of 5 shares of company ABC which he…

A:

Q: The company offered its investors option contracts to buy their shares at P72 with the current price…

A: Put option: It is the right given to the owner to sell the share at a specific price and date. When…

Q: On July 14, an investor goes short on a put option for 100 shares of ABC Corporation common stock…

A: A put option is a derivative contract that provides the right, but not the obligation to the put…

Q: The price of Stock Y, which is currently $80, can go to $120, $90, or $60 in 6 months’ time.…

A: Assume that P1, P2, and P3 are the probabilities that the price of the stock increases upto $120,…

Q: ou decide to sell short 100 shares of Charlotte Horse Farms when it is selling at its yearly high of…

A: Rate of return on investment is the return expressed in percentage terms that is expected on the…

Q: You bought 3 contracts of 6-month call options on stock XYZ @ $3.86 per call, with strike price of…

A: A call option is the right to buy the underlying asset at a given date in future and also at a…

Q: Rob Thomas Traders opened an account to short-sell 1,000 shares of WeWork at $60. The initial margin…

A: When the money borrowed from the broker for making an investment is made then it is called margin…

Q: Purple Corporation just purchased a call option for 10,000 Red Corp. ordinary shares at a strike…

A: Market value per share us P534 Volatility is 10% Risk free rate is 3% Strikr price is P489 Time…

Q: The company offered its investors option contracts to buy their shares at P72 with the current price…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Nanno Company offers its investors option contracts to buy their shares at a price of P50.…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: On March 2021, a 6-month long forward contract on a dividend-paying stock is agreed between two…

A: The question is to find the forward price of a stock with help of the cost and carry model. The…

Q: On March 1st, Frank opens a brokerage account and sell shorts 300 shares of Doggie Treats Inc. at…

A: Stock: Stock is the number of shares being owned by the company. It is being segregated into two…

Q: BCD Company offer its investors option contracts to buy their shares at a price of P50. Currently,…

A: The binomial model for option pricing is an important model that determines the option price. It…

Q: On January 1, you sold short 100 shares of XYZ stock at $20 using a 50% initial margin. The interest…

A: Given, Stock XYZ sold at = $20 Initial margin = 50% Interest rate = 10% annually Bought stock at =…

Q: ambergeeny Inc. has decided to go public by selling $5,000,000 of new common stock. Its investment…

A: The question is based on the concept of Business finance.

Q: dentify the strategy employed by Dumo above. Profit to the strategy at expiration for the following…

A: The strategy employed by Dumo is protective put investment strategy. A protective put position is…

Q: ABC Co. bought 1,000 CALL options of XYZ Corporation with a strike price of ₱52 at ₱2.75 per option.…

A: Exercise of option - Call option is a right to buy the stock at the strike price on expiry date, if…

Q: ABC Corporation plans to purchase a call option for 1,000 Red Corp. ordinary shares at a strike…

A: Black Scholes Model is used to calculate the value of a call option and requires 5 variables to…

Q: Dumo is a trader at ZNF Equity traders and has just identified a stock, UFSI Limited, which is…

A: For long position (purchase) in Put option, Pay off from long position in stock:

Q: You decide to sell short 100 shares of Github Industries when it is selling at its yearly high $56.…

A: The conceptual formula used:

Q: 1. If you bought a September '17 contract, one contract is for 5,000 bushels, and the price closes…

A: Hi, as per our policy we will answer the first question alone. Since there are multiple questions…

Q: The company offered its investors option contracts to buy their shares at P72 with the current price…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Hooks Athletics, Inc., has outstanding a preferred stock with a par value of $30 that pays a…

A: given information cumulative preferred stock = 1.00 required rate of return = 12%

Q: Mazzi Corp. shares are currently trading at RM14.00 each. A three-month put option on this share is…

A: Note: As per our guidelines we can only answer one question at once. Since, you haven't asked a…

Q: Assume the commission per trade is $20 plus $1.75 per contract. Stock Price (May 1) Price…

A: Number of contracts of a put option is $1000/100 = 10 contracts Commission per trade cost = $20 +…

Q: On July 14, an investor goes long on a put option for 100 shares of Z Corporation common stock with…

A: Options are a way of trading in the stock markets. They are opted by the investors to gain a profit…

Q: Tom Hank buys 150 shares of J.W stock for $85 per share and a three-month J.W call option with an…

A: Total Shares $ 150.00 Stock Price $ 85.00 exercise price $ 105.00 Premium $…

Q: Pellegrino Capital owns a call option which gives it the right to purchase shares in Apple at a…

A: Generally, there are 2 type of option derivative traded in market in respected of exercise on or…

Q: What would be the value of one right? (Do not round intermediate calculations and round your…

A: Information Provided: Subscription Price = $74 Stock price = $96

Q: is believed that Blue Co.’s stock price is going to decline from its current level of P88.50 anytime…

A:

Q: You bought 9 contracts of 2-month call options on stock XYZ @ $4.65 per call, with strike price of…

A: Profit on call will be the difference between the strike price and spot price.

Q: The company offered its investors option contracts to buy their shares at P72 with the current price…

A: Call option: It is an option given to the buyer of the contract to buy the contract at a pre-decided…

Q: Mr. Wa Is believes that ABC Co.’s stock price is going to decline from its current level of P82.50…

A: Put Options gives the right but not the obligation to the seller of the option to sell a bond,…

Q: an investor bought a one-year forward contract with price F0(T) = 110. Six months later, at Time t =…

A: Forward contracts are used for the hedging purposes and prevents the loss due to volatile price.

Q: ABC Corporation plans to purchase a call option for 1,000 Red Corp. ordinary shares at a strike…

A: Stock Price P…

Q: Assume you sell short 100 shares of GE at P69 in July. You buy a September P70 call for P3.50 to…

A: The gain or loss is call is calculated as sum of loss on short position and the gain in call option…

Q: There's a call option contract of GM stock for $85.00 a contract, prior to the third Friday of…

A: A call option is a form of financial contract that gives the buyer a right to purchase or sell the…

Q: The Bulldogs Inc.’s stock price is believe to decline from its current level of P125 anytime during…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Dumo is a trader at ZNF Equity traders and has just identified a stock, UFSI Limited, which is…

A:

Q: As the same investor, you put in a limit order to purchase the above company at $12.00 per share at…

A: Limit order means an instruction given to the broker to purchase the stock at the given price or…

Q: Dumo is a trader at ZNF Equity traders and has just identified a stock, UFSI Limited, which is…

A: The calculation is:

Q: ABC Co. believes that XYZ Corporation’s stock price is going to decline from its current level of…

A: The put option is the option that gives the buyer the choice but not the obligation to sell the…

Q: Dumo is a trader at ZNF Equity traders and has just identified a stock, UFSI Limited, which is…

A: The question is based on the concept of investment strategy in combination of stock and Put at same…

Q: ABC Corporation bought 5 short futures. The contract size is 10,000 shares of Mining Inc. The strike…

A: ABC Corporation bought 5 short futures. It means ABC is a Put Buyer. The put Buyer will exercise…

Q: On July 14, an investor goes long on call option for 100 shares of ABC Corporation common stock with…

A: Options are one of the ways of trading in the stock market. These are chosen by the investors to…

Q: Dumo is a trader at ZNF Equity and has just identified a stock. UFSI Limited which is currently…

A: The strategy used by Dumo is Protective Put strategy because this strategy to hedge against the…

Q: Assume that on Friday August 1, you sell one Chicago Board of Trade September Treasury bond futures…

A: Given that, opening price = $97000 initial margin requirement is $2500 maintenance margin…

What is the value of Nd1?

Step by step

Solved in 4 steps

- The company offered its investors option contracts to buy their shares at P72 with the current price of P90. They were only given 90 days to exercise their rights. 52 week-high for the stock is P95 while the 52-week low is P70. The T-bill rate is 7.32%. REQUIRED: Value of Nd1. (Use 4 decimal places) Value of Nd2. (Use 4 decimal places) Volatility rate. (Use percentage and at least, two decimal places) Value of the call option. (Use two decimal places) Value of the put options. (Use two decimal places)The company offered its investors option contracts to buy their shares at P72 with the current price of P90. They were only given 90 days to exercise their rights. 52 week-high for the stock is P95 while the 52-week low is P70. The T-bill rate is 7.32%. REQUIRED: Value of Nd1. (Use 4 decimal places) ANS: 0.9991 Value of Nd2. (Use 4 decimal places) ANS: 0.9990 Volatility rate. (Use percentage and at least, two decimal places) ANS: 15.78% Value of the call option. (Use two decimal places) Value of the put options. (Use two decimal places)The company offered its investors option contracts to buy their shares at P72 with the current price of P90. They were only given 90 days to exercise their rights. 52 week-high for the stock is P95 while the 52-week low is P70. The T-bill rate is 7.32%. 1. What is the value of Nd1 and Nd2? (Use 4 decimal places) 2. What is the volatility rate? (Use percentage and at least, two decimal places) 3. What is the value of the call option and put options? (Use two decimal places)

- Aylmer Inc paid $520 for a call to purchase 850 shares of Belmont Inc on April 1, Y3.The strike price was $26.50 per share and could be exercised anytime in the next 6 months.On April 1, Y3, the market price for one share of Belmont Inc. was $29.30. Belmont's stock price rose. On June 30, Y3, the price for Belmont stock was $31.55 per share.The fair value of the option on June 30, Y3 was $7,365. REQUIRED Prepare the appropriate entries under two different scenarios: 1) Aylmer exercised the option 2) Aylmer did not exercise the option (just the June 30th entry)Aylmer Inc paid $520 for a call to purchase 850 shares of Belmont Inc on April 1, Y3.The strike price was $26.50 per share and could be exercised anytime in the next 6 months.On April 1, Y3, the market price for one share of Belmont Inc. was $29.30.Belmont's stock price rose. On June 30, Y3, the price for Belmont stock was $31.55 per share.The fair value of the option on June 30, Y3 was $7,365. REQUIRED Prepare the appropriate entries under two different scenarios:1) Aylmer exercised the option2) Aylmer did not exercise the option (just the June 30th entry)Eight months ago, the Zeus Fund entered into a short position in a one - year forward contract on 1,250 shares of Cerner Corporation stock at a forward contract price of $94 per share. Today, the price of Cerner stock is $92.50 per share and the interest rate for continuous compounding is 1 % . Cerner stock does not pay dividends. If the Zeus Fund wanted to exit the contract today, how much should it be willing to pay, or how much should it expect to receive, from its counterparty?

- Holder Ltd. purchases an options contract from Issuer Ltd. that gives Holder Ltd. the right to acquire 100,000 options in Torquay Ltd. for a price (exercise price) of $ 10.00 per share. When the contract was exchanged the price of Torquay Ltd. shares was $ 9.00 each. The option entitles Holder Ltd. to exercise the options and buy the shares any time within the next six months. If the options are not exercised within the six month period, then the options will expire. Need the answers to the followings; Determine whether a financial liability or financial asset exists from the perspectives of Holder Ltd. and Issuer Ltd. Further, if the price of shares in Torquay Ltd. falls to $ 5.00, with the result that it is improbable that Holder Ltd. will ever exercise the options, will this change the classification of the options as either financial assets or financial liabilities?On January 2, 2020, Ayayai Company purchases a call option for $310 on Merchant common stock. The call option gives Ayayai the option to buy 1,090 shares of Merchant at a strike price of $49 per share. The market price of a Merchant share is $49 on January 2, 2020 (the intrinsic value is therefore $0). On March 31, 2020, the market price for Merchant stock is $53 per share, and the time value of the option is $200. Prepare the journal entry to record the purchase of the call option on January 2, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 2, 2020 enter an account title to record the transaction on January 2, 2020 enter a debit amount enter a credit amount enter an account title to record the transaction on January 2, 2020 enter a debit…Hua Xin Services offered an incentive stock option plan to its employees. On January 1, 2024, options were granted for 90,000 $1 par common shares. The exercise price equals the $5 market price of the common stock on the grant date. The options cannot be exercised before January 1, 2027, and expire December 31, 2028. Each option has a fair value of $1 based on an option pricing model. What is the total compensation cost for this plan?

- On July 14, an investor goes short on a put option for 100 shares of ABC Corporation common stock with a strike price of ₱9 with an expiration date of August 16, at an option premium of ₱1.50 per share. The market price of ABC on July 14 is ₱8. On August 16, the market price of ABC is ₱6. How much has the investor gained or lost on the option transaction? Disregard any brokerage commissions involved.Eight months ago, the Zeus Fund entered into a short position in a one-year forward contract on 1,250 shares of Cerner Corporation stock at a forward contract price of $94 per share. Today, the price of Cerner stock is $92.50 per share and the interest rate for continuous compounding is 1%. Cerner stock does not pay dividends. What is today’s market value of the forward contract? If the Zeus Fund wanted to exit the contract today, how much should it be willing to pay, or how much should it expect to receive, from its counterparty?BCD Company offer its investors option contracts to buy their shares at a price of P50. Currently, the value of their stocks in the market stands at P60. The 52-week high of the share price is P83 and its 52-week low is P47. The treasury bill issued by the government yields 8.25% currently. What’s the probability for the up move?