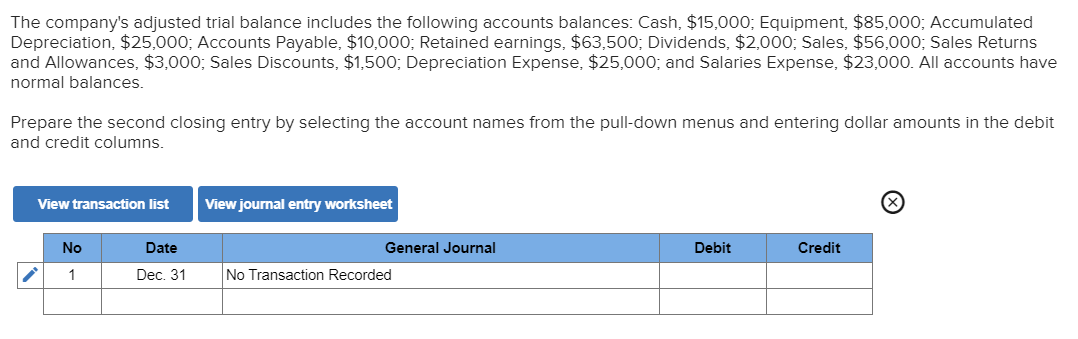

The company's adjusted trial balance includes the following accounts balances: Cash, $15,000; Equipment, $85,000; Accumulated Depreciation, $25,000; Accounts Payable, $10,000; Retained earnings, $63,500; Dividends, $2,000; Sales, $56,000; Sales Returns and Allowances, $3,000; Sales Discounts, $1,500; Depreciation Expense, $25,000; and Salaries Expense, $23,000. All accounts have normal balances. Prepare the second closing entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns. View transaction list View journal entry worksheet General Journal No Date Debit Credit No Transaction Recorded Dec. 31

The company's adjusted trial balance includes the following accounts balances: Cash, $15,000; Equipment, $85,000; Accumulated Depreciation, $25,000; Accounts Payable, $10,000; Retained earnings, $63,500; Dividends, $2,000; Sales, $56,000; Sales Returns and Allowances, $3,000; Sales Discounts, $1,500; Depreciation Expense, $25,000; and Salaries Expense, $23,000. All accounts have normal balances. Prepare the second closing entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns. View transaction list View journal entry worksheet General Journal No Date Debit Credit No Transaction Recorded Dec. 31

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.33E

Related questions

Question

100%

Transcribed Image Text:The company's adjusted trial balance includes the following accounts balances: Cash, $15,000; Equipment, $85,000; Accumulated

Depreciation, $25,000; Accounts Payable, $10,000; Retained earnings, $63,500; Dividends, $2,000; Sales, $56,000; Sales Returns

and Allowances, $3,000; Sales Discounts, $1,500; Depreciation Expense, $25,000; and Salaries Expense, $23,000. All accounts have

normal balances.

Prepare the second closing entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit

and credit columns.

View transaction list

View journal entry worksheet

General Journal

No

Date

Debit

Credit

No Transaction Recorded

Dec. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub