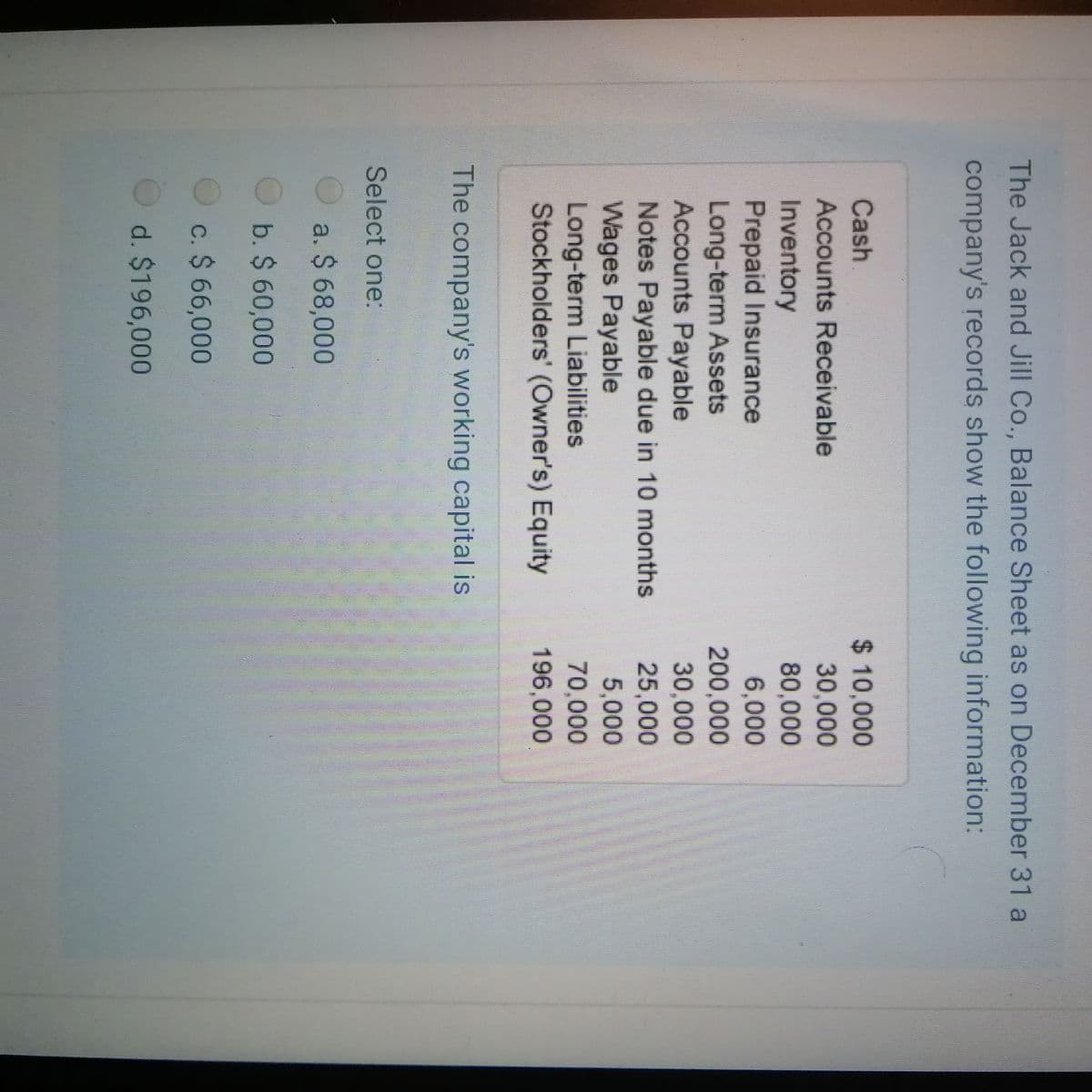

The company's working capital is Select one: O a. $ 68,000 b. $ 60,000 c. $ 66,000 d. $196,000

Q: Malaysia Inc. purchased a capital expenditure amounting to Php1.500 is 30% a. Php75,000 b. Php57,650…

A: Cash flow means inflow and outflow of cash into the business during a specified period of time

Q: "What was the return on net worth for the year?' Investment Assets at Year End $170,000 Investment…

A: Net worth refers to the total assets owned by the business after reducing total liabilities from it.…

Q: Current assets and current liabilities for Konex Properties Company follow: 20Υ9 20Υ8 Current assets…

A: Given:

Q: Sales $1,561,836 Operating Income $87,385 Total Assets (investment) $517,201 Target Rate of Return…

A: Please see the next step for the solution

Q: 10. If a company has current assets of $230,000 and current liabilities of $100,000 the amount of…

A: Working capital = Current assets - current liabilities

Q: Use the information below for questions 21-22 net income of $300,000. total assets of $1,500,000.…

A: Return on Total Assets: The return on total assets ratio reveals how successfully a company's…

Q: Assume XYZ total assets $1,000,000 and net fixed $600,000. But current liabilities $200,000.…

A: The amount invested by the firm to have future benefits is known as asset. The asset can be a…

Q: 11. Cô. has net income of $20,000 and total assets of $100,000. ROA ratio for the company is: O a)…

A: ROA = Net income / total assets

Q: Save A Cash flows from operating activities are $3,600,000; cash flows from financing activities are…

A: Definition:

Q: 40,000.00 40,000.00 Accounts Receivable-net 200,000.00 200,000.00 Inventories 100,000.00 400,000.00…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: The Working Capital for Insu Company from the information provided above is: * $37,000 $63,500…

A: Working capital means the amount which is invested in day to day business of the company. Working…

Q: overnmental activities for the fiscal year ended June 30, 2 ginning capital assets balance ? rchases…

A: Journal : It is the first book of accounts where all the business transactions are recorded at…

Q: A firm has net working capital = $1000. Total liability= $3000. Total assets = $5000 and fixed…

A: Working capital means net of current asset which also means how much current assets exceeds over…

Q: Capital Balance P10,000 20,000 30,000 P/I

A: Given: To prepare the entries of the admission incidental for all the given as,

Q: One item is omitted in each of the following summaries of balance sheet and income statement data…

A: As per the accounting equation of the business, total amount of assets should always be equal to…

Q: 16 A firm has net income of $21,350, depreciation of $2,780, interest of $640, and taxes of $10,990.…

A: Earnings before interest, taxes, depreciation, and amortization (EBITDA) will be net income plus…

Q: $1,449,185 Sales $130,380 Operating Income Total Assets (investment) $544,102 Target Rate of Return…

A: Return on investment:Return on investment is a measure of profitability. It evaluates the efficiency…

Q: Bruin, Incorporated, has identified the following two mutually exclusive projects: Year 0 1 2 1234 3…

A: To Find: IRR NPV NPV profile for both projects

Q: Find the capital beginning when, Additional Income = 150,000.00 Net Income = 120,000.00 Withdrawal =…

A: Capital Beginning = Capital Ending + Withdrawal - Additional income - Net income

Q: The ending net book value of Property, Plant & Equipment (PP&E) in year 1 and year 2 are $500,000…

A: Calculation of the amount of Company A net Capital Expenditure:: Opening book.value of the…

Q: The following information is available for company X. 20X7 $ 20X8 Profit Sales Capital employed…

A: We have the following information: Profit for 20X7: $7,500 Profit for 20X8: $9,000 Sales for 20X7:…

Q: Share in profit of associate a. 660,000 b. 660,000 Investment in associate 1,620,000 1,840,000 C.…

A: Business combination: Business combination is defined as the process where one company acquires…

Q: C. P50,000 increase d. P90,000 increase 11. Parducho had a P500,000 capital bal for four months.…

A: "We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: ACCOUNTS PAYABLE P60,000 ACCOUNTS RECEIVABLE P10,000…

A: As per accounting equation of the business, total assets must be equal to total liabilities and…

Q: How much are the revenue and cost of construction recognized in 20x2? Revenue Cost of construction…

A: Solution Given Contract price =4000000 Total estimated cost =3000000 20X1 20X2…

Q: 10. If a company has current assets of $230,000 and current liabilities of $100,000 the amount of…

A: Formula: Working capital = Current Assets - Current liabilities

Q: Working Capital Working Capital Working Capital = Current Ratio = Current Ratio = Current Assets -…

A: Ratio Analysis There are different ratio which are available for which is used to calculate the…

Q: Equipment(net), $80,000. The equipment originally cost $140,000. How would I classify this on a…

A: Total Assets comprise of Current Assets and Non-Current Assets. The current assets are those assets…

Q: Asset 500,000 Liabilities ? Beginning Capital 100,000 Revenue 600,000 Expense 700,000 Net…

A: Total assets = Total capital + Liabilities Liabilities = Total assets - Total capital

Q: ntity began the self-construct. 20 and the building was cor ollowing expenditures were ry 1 1 ber 1…

A: 1) Weighted Average Accumulated Expenses = 1,000,000*12/12 + 2,000,000*6/12 + 3000,000*2/12 =…

Q: Expenditures—Operating—Salaries..........................................…

A: Salaries payable is the amount which is due to the employees but not yet paid.

Q: Current Ratio is 2.5, Working Capital is $150,000. Calculate the amount of current assets and…

A: Ratio analysis is a method of measuring the financial position of the organization with different…

Q: If the fixed assets 9 250 ID ,-3 Current assets 11 600 ID , short term liabilities 2 040 ID , Long…

A: The accounting equation is written as: Assets = liabilities + Shareholder's equity

Q: Cash Flow E $44,000 $9,778 $9,778 Cost $90,000 Cash flow year 1 $36,000 Cash flow year 2 Cash flow…

A:

Q: Assets (RM) Liabilities (RM) Capital (RM) i. 45,600 34,500 ii. 600,900 405,300 ii. 11,800 2,800 iv.…

A: Capital = Assets - Liabilities Assets = Liabilities + Capital Liabilities = Assets - Capital

Q: $1,563,741 Sales $135,601 Operating Income Total Assets (investment) $565,923 Target Rate of Return…

A: Return on investment is a measure of profitability. It evaluates the efficiency of the investment.

Q: Capital Beginning Additional Investment Profit Capital Ending Drawings 85,000.00 (20,000.00)…

A: A STATEMENT OF CHANGES IN OWNER'S EQUITY SHOWS THE OWNER'S OPENING CAPITAL , THE CHANGES THAT AFFECT…

Q: The current ratio of Company X is 3.0. Company X has working capital of $20,000. Total current…

A: We have the following information: Current ratio = 3 Working Capital = $20,000

Q: balances and profit ratio on this date, follow Capital Bal. P 50,000 60,000 20,000 RR TT

A: The sharing of profit and loss in accordance with the profit and loss sharing ratio.it completely…

Q: 345,000.00 10,800.00 10,000.00 3,000.00 13,000.00 15,000.00 8,000.00 1,000.00 15,000.00 20,000.00…

A: The Different accounts in accounting are classified with debit and credit balances.

Q: Sales $1,519,621 Operating Income $108,450 Total Assets (investment) $583,662…

A: Return on investment measures the percentage of profit or loss earned on the total investment made…

Q: Given: • Asset - P3,500,000 Liabilities - P500,000 Income - P1,250,000 Expenses - P750,000 Compute…

A: Owners equity means amount attributable for the owners of the business. It will be calculated by…

Q: ASSETS LIABILITII OWNER'S EQUITY $30,000 $22,000 a. b. $ 7,000 $98,000 C. $25,000 $11,000

A: Asset equation satisfies the double entry system of accounting. It is given by the formula, "Assets…

Q: Total assets of JBA Engineering and Design Firm is $1,000,000. 20% represents the claim of the…

A: Accounting Equations: An analysis of transactions is conducted by expanding the basic accounting…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Payroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December: Dec. 2. Issued Check No. 410 for 3,400 to Jay Bank to invest in a retirement savings account for employees. 2. Issued Check No. 411 to Jay Bank for 27,046, in payment of 9,273 of social security tax, 2,318 of Medicare tax, and 15,455 of employees federal income tax due. 13. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Dec. 13. Issued Check No. 420 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 13. Journalized the entry to record payroll taxes on employees earnings of December13: social security tax, 4,632; Medicare tax, 1,158; state unemployment tax, 350; federal unemployment tax, 125. 16. Issued Check No. 424 to Jay Bank for 27,020, in payment of 9,264 of social security tax, 2,316 of Medicare tax, and 15,440 of employees federal income tax due. 19. Issued Check No. 429 to Sims-Walker Insurance Company for 31,500, in payment of the semiannual premium on the group medical insurance policy. 27. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 27. Issued Check No. 541 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 27. Journalized the entry to record payroll taxes on employees earnings of December27: social security tax, 4,668; Medicare tax, 1,167; state unemployment tax, 225; federal unemployment tax, 75. 27. Issued Check No. 543 for 20,884 to State Department of Revenue in payment of employees state income tax due on December 31. 31. Issued Check No. 545 to Jay Bank for 3,400 to invest in a retirement savings account for employees. 31. Paid 45,000 to the employee pension plan. The annual pension cost is 60,000. (Record both the payment and unfunded pension liability.) Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: operations salaries, 8,560; officers salaries, 5,600; office salaries,1,400. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 15,000.A company collects an honored note with a maturity date of 24 months from establishment, a 10% interest rate, and an initial loan amount of $30,000. Which accounts are used to record collection of the honored note at maturity date? A. Interest Revenue, Interest Expense, Cash B. Interest Receivable, Cash, Notes Receivable C. Interest Revenue, Interest Receivable, Cash, Notes Receivable D. Notes Receivable, Interest Revenue, Cash, Interest ExpenseThe following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain how multiple-step and single-step income statements differ.

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.Whirlie Inc. issued $300,000 face value, 10% paid annually, 10-year bonds for $319,251 when the market of interest was 9%. The company uses the effective-interest method of amortization. At the end of the year, the company will record ________. A. a credit to cash for $28,733 B. a debit to interest expense for $31,267 C. a debit to Discount on Bonds Payable for $1,267 D. a debit to Premium on Bonds Payable for $1.267Provide journal entries to record each of the following transactions. For each, identify whether the transaction represents a source of cash (S), a use of cash (U), or neither (N). A. Paid $22,000 cash on bonds payable. B. Collected $12,600 cash for a note receivable. C. Declared a dividend to shareholders for $16,000, to be paid in the future. D. Paid $26,500 to suppliers for purchases on account. E. Purchased treasury stock for $18,000 cash.

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan.Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000On January 1, 2018, King Inc. borrowed $150,000 and signed a 5-year, note payable with a 10% interest rate. Each annual payment is in the amount of $39,569 and payment is due each Dec. 31. What is the journal entry on Jan. 1 to record the cash received and on Dec. 31 to record the annual payment? (You will need to prepare the first row in the amortization table to determine the amounts.)