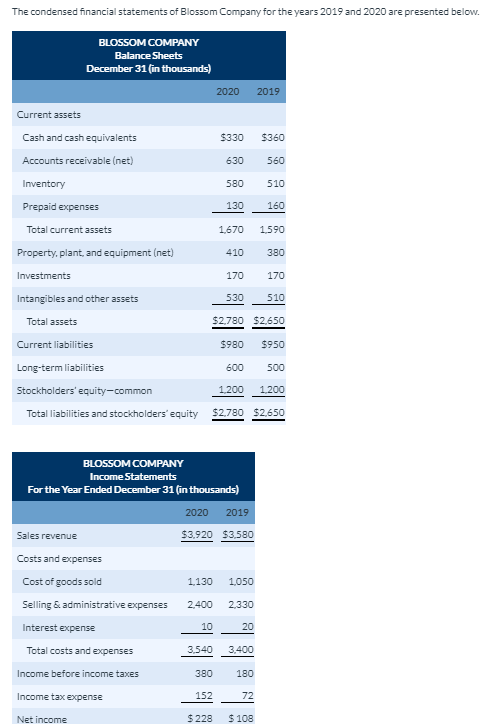

The condensed financial statements of Blossom Company for the years 2019 and 2020 are presented below. BLOSSOM COMPANY Balance Sheets December 31 (in thousands) 2020 2019 Current assets Cash and cash equivalents $330 $360 Accounts receivable (net) 630 560 Inventory 580 510 Prepaid expenses 130 160 Total current assets 1,670 1590 Property, plant, and equipment (net) 410 380 Investments 170 170 530 510 Intangibles and other assets $2,780 $2,650 Total assets $980 $950 Current liabilities Long-term liabilities 600 500 Stockholders' equity-common 1,200 1,200 Total liabilities and stockholders equity $2780 $2,650 BLOSSOM COMPANY Income Statements For the Year Ended December 31 (in thousands) 2019 2020 $3,920 $3,580 Sales revenue Costs and expenses Cost of goods sold 1,130 1050 Selling & administrative expenses 2400 2,330 Interest expense 10 20 Total costs and expenses 3,540 3400 Income before income taxes 380 180 Income tax expense 152 72 $228 $108 Net income Compute the following ratios for 2020 and 2019. (Round current ratio and inventory turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 12.6%.) (a) Current ratio. Inventory turnover. (Inventory on December 31, 2018, was $440.) (b) (c) Profit margin Return on assets. (Assets on December 31, 2018, were $2,180.) (d) Return on common stockholders' equity. (Equity on December 31, 2018, was $930.) (e) (f) Debt to assets ratio. Times interest earned (g) 2020 2019 (a) Current ratio 1 1 1.71 1.68 (b) Inventory turnover. (c) Profit margin. (d) Return on assets. (e) Return on common stockholders' equity (f) Debt to assets ratio. (g) Times interest earned times times

The condensed financial statements of Blossom Company for the years 2019 and 2020 are presented below. BLOSSOM COMPANY Balance Sheets December 31 (in thousands) 2020 2019 Current assets Cash and cash equivalents $330 $360 Accounts receivable (net) 630 560 Inventory 580 510 Prepaid expenses 130 160 Total current assets 1,670 1590 Property, plant, and equipment (net) 410 380 Investments 170 170 530 510 Intangibles and other assets $2,780 $2,650 Total assets $980 $950 Current liabilities Long-term liabilities 600 500 Stockholders' equity-common 1,200 1,200 Total liabilities and stockholders equity $2780 $2,650 BLOSSOM COMPANY Income Statements For the Year Ended December 31 (in thousands) 2019 2020 $3,920 $3,580 Sales revenue Costs and expenses Cost of goods sold 1,130 1050 Selling & administrative expenses 2400 2,330 Interest expense 10 20 Total costs and expenses 3,540 3400 Income before income taxes 380 180 Income tax expense 152 72 $228 $108 Net income Compute the following ratios for 2020 and 2019. (Round current ratio and inventory turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 12.6%.) (a) Current ratio. Inventory turnover. (Inventory on December 31, 2018, was $440.) (b) (c) Profit margin Return on assets. (Assets on December 31, 2018, were $2,180.) (d) Return on common stockholders' equity. (Equity on December 31, 2018, was $930.) (e) (f) Debt to assets ratio. Times interest earned (g) 2020 2019 (a) Current ratio 1 1 1.71 1.68 (b) Inventory turnover. (c) Profit margin. (d) Return on assets. (e) Return on common stockholders' equity (f) Debt to assets ratio. (g) Times interest earned times times

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.1C: Leverage Cook Corporation issued financial statements at December 31, 2019, that include the...

Related questions

Question

Transcribed Image Text:The condensed financial statements of Blossom Company for the years 2019 and 2020 are presented below.

BLOSSOM COMPANY

Balance Sheets

December 31 (in thousands)

2020

2019

Current assets

Cash and cash equivalents

$330

$360

Accounts receivable (net)

630

560

Inventory

580

510

Prepaid expenses

130

160

Total current assets

1,670

1590

Property, plant, and equipment (net)

410

380

Investments

170

170

530

510

Intangibles and other assets

$2,780 $2,650

Total assets

$980

$950

Current liabilities

Long-term liabilities

600

500

Stockholders' equity-common

1,200

1,200

Total liabilities and stockholders equity

$2780 $2,650

BLOSSOM COMPANY

Income Statements

For the Year Ended December 31 (in thousands)

2019

2020

$3,920 $3,580

Sales revenue

Costs and expenses

Cost of goods sold

1,130

1050

Selling & administrative expenses

2400

2,330

Interest expense

10

20

Total costs and expenses

3,540

3400

Income before income taxes

380

180

Income tax expense

152

72

$228

$108

Net income

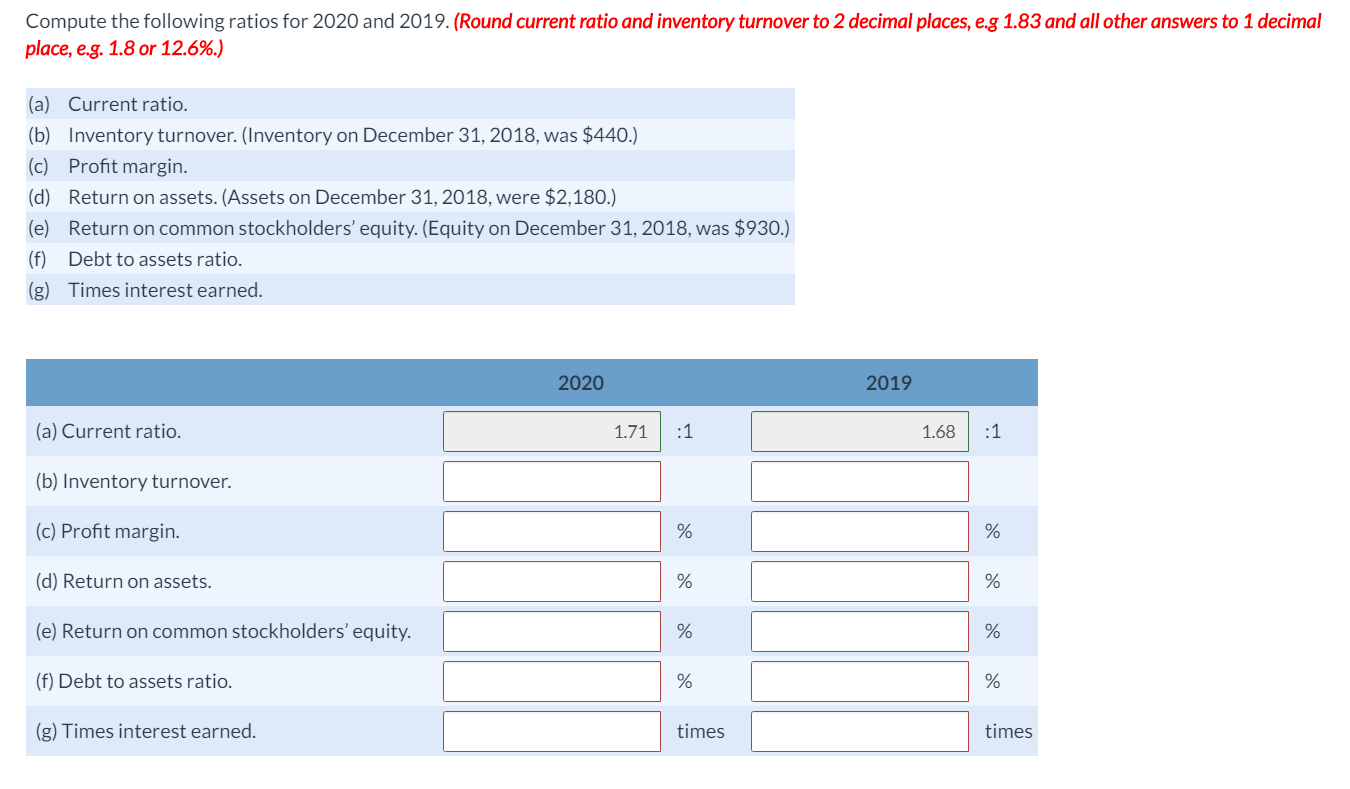

Transcribed Image Text:Compute the following ratios for 2020 and 2019. (Round current ratio and inventory turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal

place, e.g. 1.8 or 12.6%.)

(a) Current ratio.

Inventory turnover. (Inventory on December 31, 2018, was $440.)

(b)

(c) Profit margin

Return on assets. (Assets on December 31, 2018, were $2,180.)

(d)

Return on common stockholders' equity. (Equity on December 31, 2018, was $930.)

(e)

(f)

Debt to assets ratio.

Times interest earned

(g)

2020

2019

(a) Current ratio

1

1

1.71

1.68

(b) Inventory turnover.

(c) Profit margin.

(d) Return on assets.

(e) Return on common stockholders' equity

(f) Debt to assets ratio.

(g) Times interest earned

times

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning