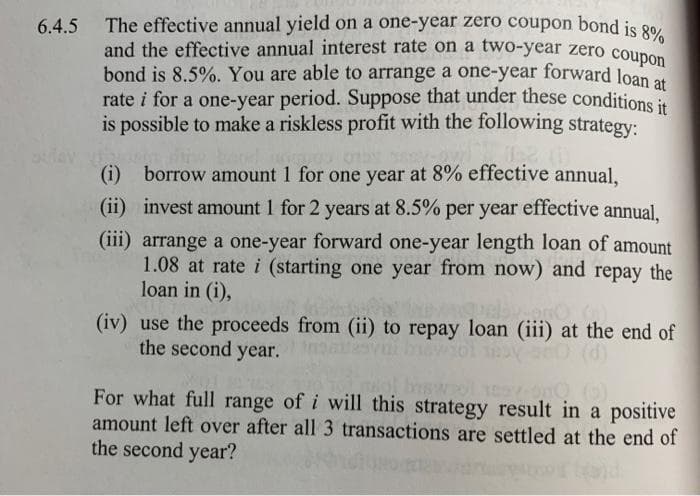

The effective annual yield on a one-year zero coupon bond is 8% and the effective annual interest rate on a two-year zero coupon bond is 8.5%. You are able to arrange a one-year forward loan at rate i for a one-year period. Suppose that under these conditions it is possible to make a riskless profit with the following strategy: (i) borrow amount 1 for one year at 8% effective annual, (ii) invest amount 1 for 2 years at 8.5% per year effective annual, (iii) arrange a one-year forward one-year length loan of amount 1.08 at rate i (starting one year from now) and repay the loan in (i),

The effective annual yield on a one-year zero coupon bond is 8% and the effective annual interest rate on a two-year zero coupon bond is 8.5%. You are able to arrange a one-year forward loan at rate i for a one-year period. Suppose that under these conditions it is possible to make a riskless profit with the following strategy: (i) borrow amount 1 for one year at 8% effective annual, (ii) invest amount 1 for 2 years at 8.5% per year effective annual, (iii) arrange a one-year forward one-year length loan of amount 1.08 at rate i (starting one year from now) and repay the loan in (i),

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 10P

Related questions

Question

Transcribed Image Text:and the effective annual interest rate on a two-year zero coupon

6.4.5 The effective annual yield on a one-year zero coupon bond is 80,

and the effective annual interest rate on a two-year zero coupon

bond is 8.5%. You are able to arrange a one-year forward loan

rate i for a one-year period. Suppose that under these conditions it

is possible to make a riskless profit with the following strategy:

(i) borrow amount 1 for one year at 8% effective annual,

(ii) invest amount 1 for 2 years at 8.5% per year effective annual,

(iii) arrange a one-year forward one-year length loan of amount

1.08 at rate i (starting one year from now) and repay the

loan in (i),

(iv) use the proceeds from (ii) to repay loan (iii) at the end of

the second year.

vai by

For what full range of i will this strategy result in a positive

amount left over after all 3 transactions are settled at the end of

the second year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning