The first audit of the books of Bruce Gingrich Company was made for the year ended December 31, 2021. In examining the books, the auditor found that certain items had been overlooked or incorrectly handled in the last 3 years. These items are: 1. At the beginning of 2019, the company purchased a machine for $510,000 (salvage value of $51,000) that had a useful life of 6 years. The bookkeeper used straight-line depreciation but failed to deduct the salvage value in computing the depreciation base for the 3 years. 2. At the end of 2020, the company failed to accrue sales salaries of $45,000. 3. A tax lawsuit that involved the year 2019 was settled late in 2021. It was determined that the company owed an additional $85,000 in taxes related to 2019. The company did not record a liability in 2019 or 2020 because the possibility of loss was considered remote, and charged the $85,000 to a loss account in 2021. 4. Gingrich Company purchased a copyright from another company early in 2019 for $45,000. Gingrich had not amortized the copyright because its value had not diminished. The copyright has a useful life at purchase of 20 years. 5. In 2021, the company wrote off $87,000 of inventory considered to be obsolete; this loss was charged directly to Retained Earnings. Instructions Prepare the journal entries necessary in 2021 to correct the books, assuming that the books have not been closed. Disregard effects of corrections on income tax.

The first audit of the books of Bruce Gingrich Company was made for the year ended December 31, 2021. In examining the books, the auditor found that certain items had been overlooked or incorrectly handled in the last 3 years. These items are: 1. At the beginning of 2019, the company purchased a machine for $510,000 (salvage value of $51,000) that had a useful life of 6 years. The bookkeeper used straight-line depreciation but failed to deduct the salvage value in computing the depreciation base for the 3 years. 2. At the end of 2020, the company failed to accrue sales salaries of $45,000. 3. A tax lawsuit that involved the year 2019 was settled late in 2021. It was determined that the company owed an additional $85,000 in taxes related to 2019. The company did not record a liability in 2019 or 2020 because the possibility of loss was considered remote, and charged the $85,000 to a loss account in 2021. 4. Gingrich Company purchased a copyright from another company early in 2019 for $45,000. Gingrich had not amortized the copyright because its value had not diminished. The copyright has a useful life at purchase of 20 years. 5. In 2021, the company wrote off $87,000 of inventory considered to be obsolete; this loss was charged directly to Retained Earnings. Instructions Prepare the journal entries necessary in 2021 to correct the books, assuming that the books have not been closed. Disregard effects of corrections on income tax.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter12: Auditing Long-lived Assets And Merger And Acquisition Activity

Section: Chapter Questions

Problem 20RQSC

Related questions

Question

The first audit of the books of Bruce Gingrich Company was made for the year ended December 31, 2021. In examining the books, the auditor found that certain items had been overlooked or incorrectly handled in the last 3 years. These items are:

- 1. At the beginning of 2019, the company purchased a machine for $510,000 (salvage value of $51,000) that had a useful life of 6 years. The bookkeeper used straight-line

depreciation but failed to deduct the salvage value in computing the depreciation base for the 3 years. - 2. At the end of 2020, the company failed to accrue sales salaries of $45,000.

- 3. A tax lawsuit that involved the year 2019 was settled late in 2021. It was determined that the company owed an additional $85,000 in taxes related to 2019. The company did not record a liability in 2019 or 2020 because the possibility of loss was considered remote, and charged the $85,000 to a loss account in 2021.

- 4. Gingrich Company purchased a copyright from another company early in 2019 for $45,000. Gingrich had not amortized the copyright because its value had not diminished. The copyright has a useful life at purchase of 20 years.

- 5. In 2021, the company wrote off $87,000 of inventory considered to be obsolete; this loss was charged directly to

Retained Earnings .

Instructions

Prepare the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

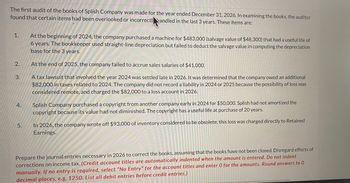

Transcribed Image Text:The first audit of the books of Splish Company was made for the year ended December 31, 2026. In examining the books, the auditor

found that certain items had been overlooked or incorrectl handled in the last 3 years. These items are:

1.

2.

3.

4.

5.

At the beginning of 2024, the company purchased a machine for $483,000 (salvage value of $48,300) that had a useful life of

6 years. The bookkeeper used straight-line depreciation but failed to deduct the salvage value in computing the depreciation

base for the 3 years.

At the end of 2025, the company failed to accrue sales salaries of $41,000.

A tax lawsuit that involved the year 2024 was settled late in 2026. It was determined that the company owed an additional

$82,000 in taxes related to 2024. The company did not record a liability in 2024 or 2025 because the possibility of loss was

considered remote, and charged the $82,000 to a loss account in 2026.

Splish Company purchased a copyright from another company early in 2024 for $50,000. Splish had not amortized the

copyright because its value had not diminished. The copyright has a useful life at purchase of 20 years.

In 2026, the company wrote off $93,000 of inventory considered to be obsolete; this loss was charged directly to Retained

Earnings.

Prepare the journal entries necessary in 2026 to correct the books, assuming that the books have not been closed. Disregard effects of

corrections on income tax. (Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to O

decimal places, e.g, 1250. List all debit entries before credit entries.)

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub