the first quarter of the year assuming Pharoah follows ASPE. Ignore any cost of goods sold entry. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation (To record sale on account) (To record rebate) Debit Credit

the first quarter of the year assuming Pharoah follows ASPE. Ignore any cost of goods sold entry. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation (To record sale on account) (To record rebate) Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 15E: On January 1, 2019, Piper Company entered into an agreement with Save-Mart to sell its most popular...

Related questions

Question

Q.12 THANKS

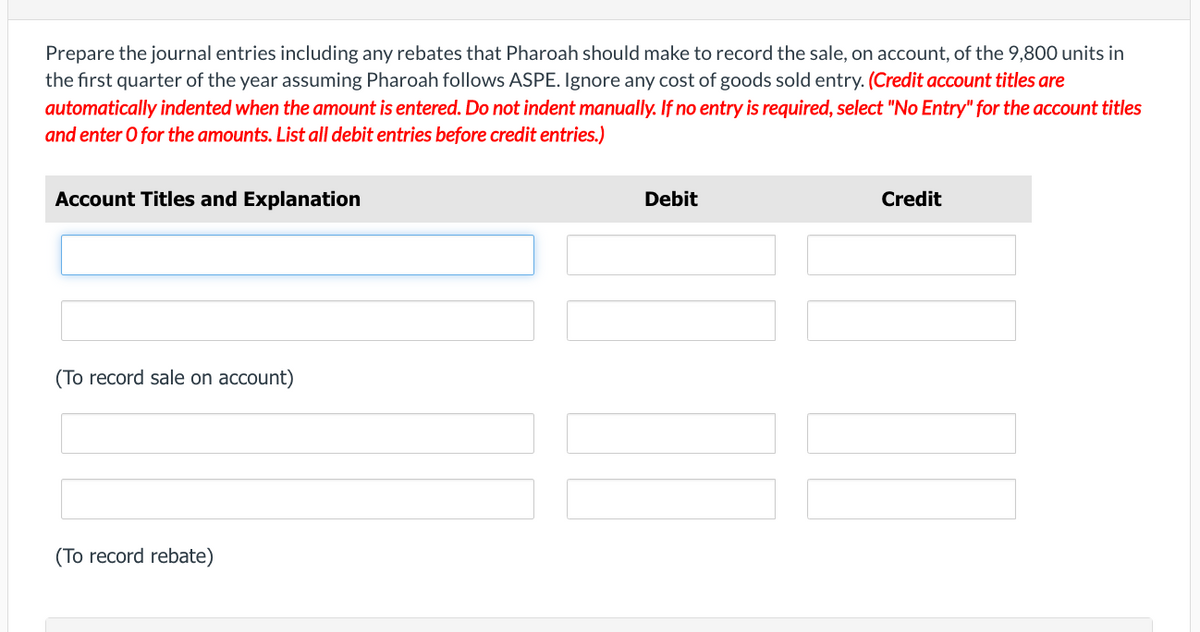

Transcribed Image Text:Prepare the journal entries including any rebates that Pharoah should make to record the sale, on account, of the 9,800 units in

the first quarter of the year assuming Pharoah follows ASPE. Ignore any cost of goods sold entry. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles

and enter O for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

(To record sale on account)

(To record rebate)

Debit

Credit

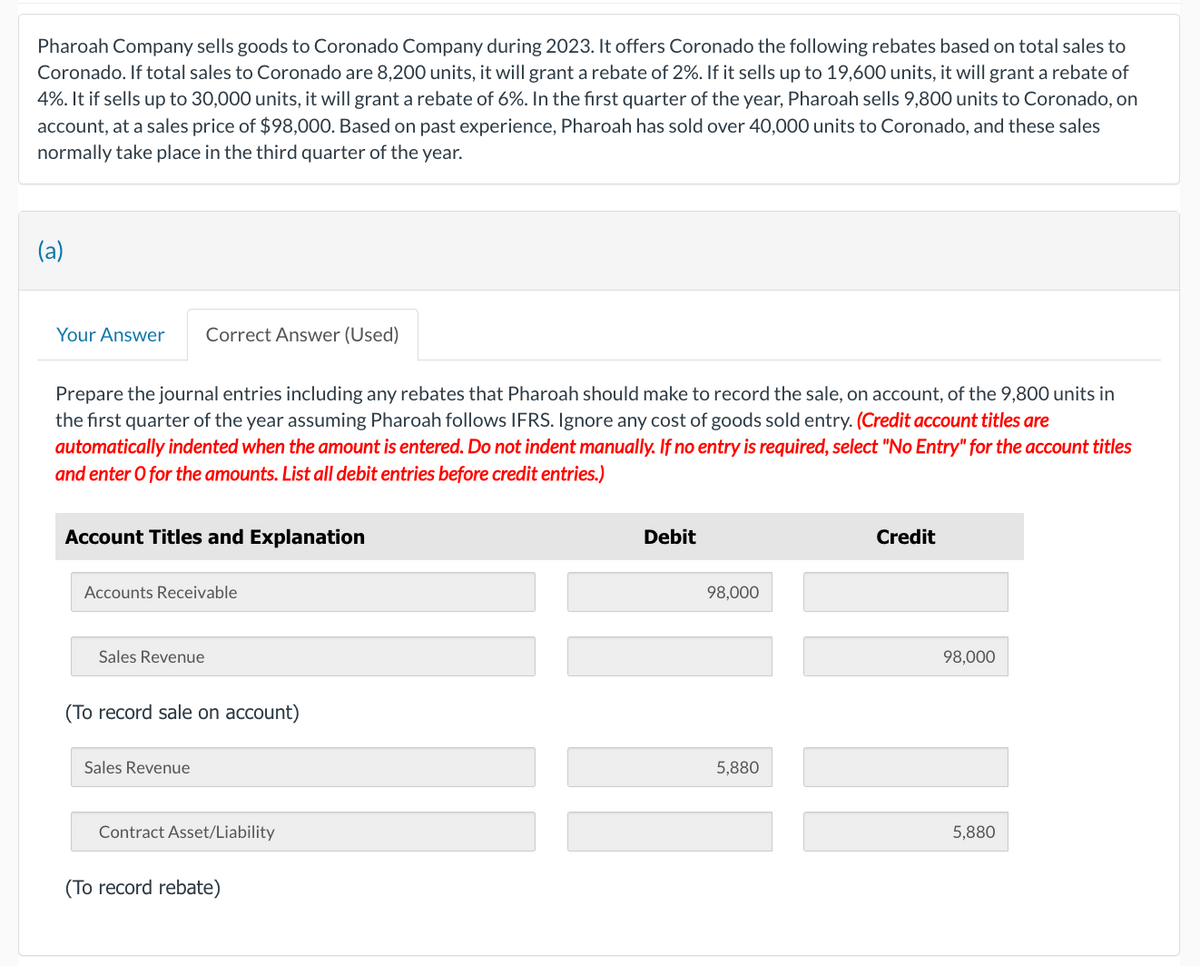

Transcribed Image Text:Pharoah Company sells goods to Coronado Company during 2023. It offers Coronado the following rebates based on total sales to

Coronado. If total sales to Coronado are 8,200 units, it will grant a rebate of 2%. If it sells up to 19,600 units, it will grant a rebate of

4%. It if sells up to 30,000 units, it will grant a rebate of 6%. In the first quarter of the year, Pharoah sells 9,800 units to Coronado, on

account, at a sales price of $98,000. Based on past experience, Pharoah has sold over 40,000 units to Coronado, and these sales

normally take place in the third quarter of the year.

(a)

Your Answer Correct Answer (Used)

Prepare the journal entries including any rebates that Pharoah should make to record the sale, on account, of the 9,800 units in

the first quarter of the year assuming Pharoah follows IFRS. Ignore any cost of goods sold entry. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles

and enter O for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

Accounts Receivable

Sales Revenue

(To record sale on account)

Sales Revenue

Contract Asset/Liability

(To record rebate)

Debit

98,000

Il

5,880

Credit

98,000

5,880

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College