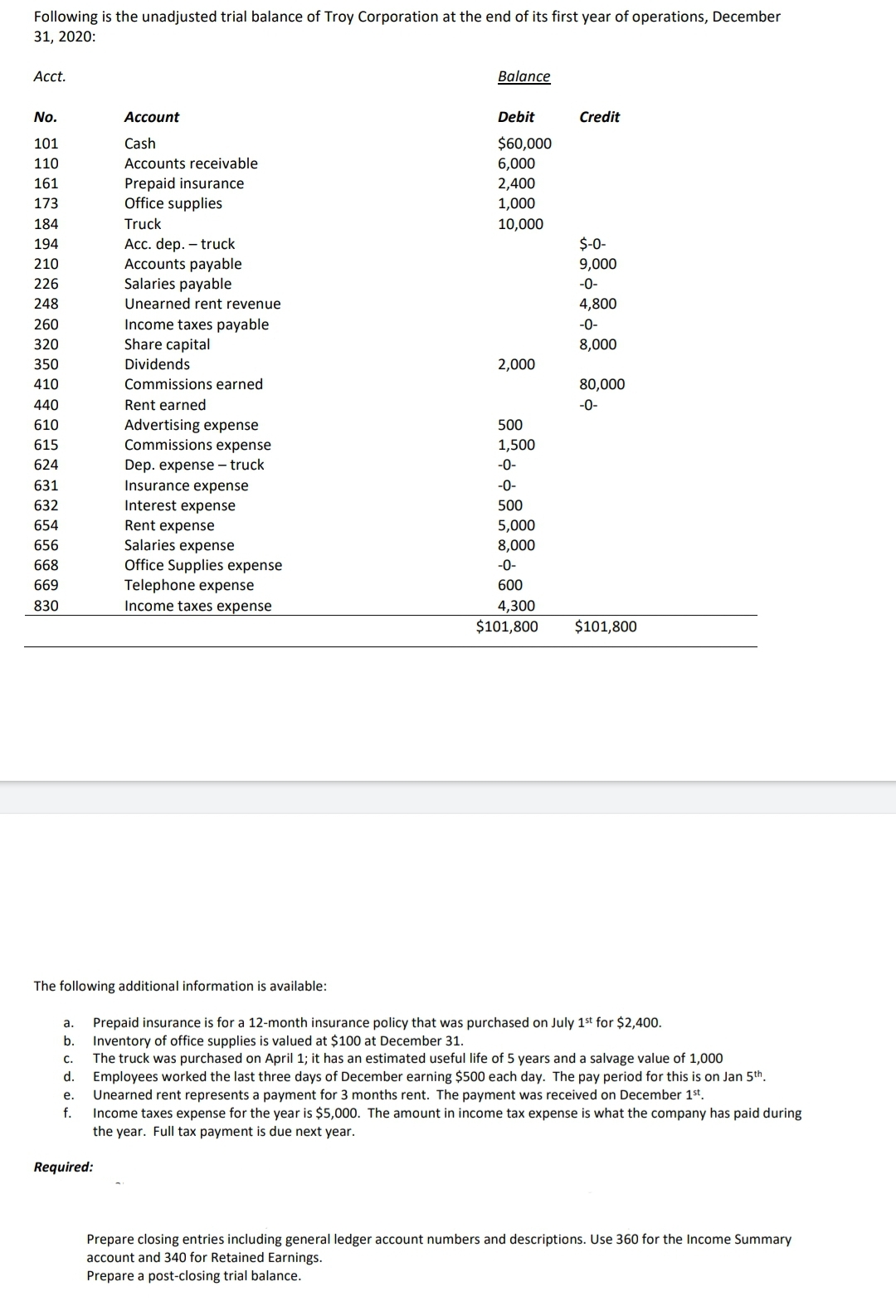

The following additional information is available: Prepaid insurance is for a 12-month insurance policy that was purchased on July 1st for $2,400. Inventory of office supplies is valued at $100 at December 31. The truck was purchased on April 1; it has an estimated useful life of 5 years and a salvage value of 1,000 a. b. С. Employees worked the last three days of December earning $500 each day. The pay period for this is on Jan 5th. Unearned rent represents a payment for 3 months rent. The payment was received on December 1st. Income taxes expense for the year is $5,000. The amount in income tax expense is what the company has paid during the year. Full tax payment is due next year. d. e. f. Required: Prepare closing entries including general ledger account numbers and descriptions. Use 360 for the Income Summary account and 340 for Retained Earnings. Prepare a post-closing trial balance.

The following additional information is available: Prepaid insurance is for a 12-month insurance policy that was purchased on July 1st for $2,400. Inventory of office supplies is valued at $100 at December 31. The truck was purchased on April 1; it has an estimated useful life of 5 years and a salvage value of 1,000 a. b. С. Employees worked the last three days of December earning $500 each day. The pay period for this is on Jan 5th. Unearned rent represents a payment for 3 months rent. The payment was received on December 1st. Income taxes expense for the year is $5,000. The amount in income tax expense is what the company has paid during the year. Full tax payment is due next year. d. e. f. Required: Prepare closing entries including general ledger account numbers and descriptions. Use 360 for the Income Summary account and 340 for Retained Earnings. Prepare a post-closing trial balance.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 5PB: Review the following transactions and prepare any necessary journal entries. A. On January 5, Bunnet...

Related questions

Question

Transcribed Image Text:The following additional information is available:

Prepaid insurance is for a 12-month insurance policy that was purchased on July 1st for $2,400.

Inventory of office supplies is valued at $100 at December 31.

The truck was purchased on April 1; it has an estimated useful life of 5 years and a salvage value of 1,000

a.

b.

С.

Employees worked the last three days of December earning $500 each day. The pay period for this is on Jan 5th.

Unearned rent represents a payment for 3 months rent. The payment was received on December 1st.

Income taxes expense for the year is $5,000. The amount in income tax expense is what the company has paid during

the year. Full tax payment is due next year.

d.

e.

f.

Required:

Prepare closing entries including general ledger account numbers and descriptions. Use 360 for the Income Summary

account and 340 for Retained Earnings.

Prepare a post-closing trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning