The following additional information relates to the company’s 2020 financial affairs and was provided in the first week of 2021 and are to be record same as adjusting entries:( Key each transaction by its letter and narrations are not required): O. Accrued salary expense, $19,500. P. Depreciation expense, $6,500. Q. Prepaid insurance expired, $24,000. R. Supplies on hand, $2,500. S. Unearned service revenue earned during 2020, $7,000. 5. Use the transactions in requirement 4 to update the affected T accounts. hello I did this question and in the adjusted journal entries for part R i use the total 16,500 instead of 2500 showing the transaction as dr cr supplies expense 16,500 supplies 16,500 would this be correct and if so why?

The following additional information relates to the company’s 2020 financial affairs and was provided in the first week of 2021 and are to be record same as adjusting entries:( Key each transaction by its letter and narrations are not required): O. Accrued salary expense, $19,500. P. Depreciation expense, $6,500. Q. Prepaid insurance expired, $24,000. R. Supplies on hand, $2,500. S. Unearned service revenue earned during 2020, $7,000. 5. Use the transactions in requirement 4 to update the affected T accounts. hello I did this question and in the adjusted journal entries for part R i use the total 16,500 instead of 2500 showing the transaction as dr cr supplies expense 16,500 supplies 16,500 would this be correct and if so why?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 61E

Related questions

Question

- The following additional information relates to the company’s 2020 financial affairs and was provided in the first week of 2021 and are to be record same as

adjusting entries :( Key each transaction by its letter and narrations are not required):

O. Accrued salary expense, $19,500.

P.

Q. Prepaid insurance expired, $24,000.

R. Supplies on hand, $2,500.

S. Unearned service revenue earned during 2020, $7,000.

5. Use the transactions in requirement 4 to update the affected T accounts.

hello I did this question and in the adjusted

dr cr

supplies expense 16,500

supplies 16,500

would this be correct and if so why?

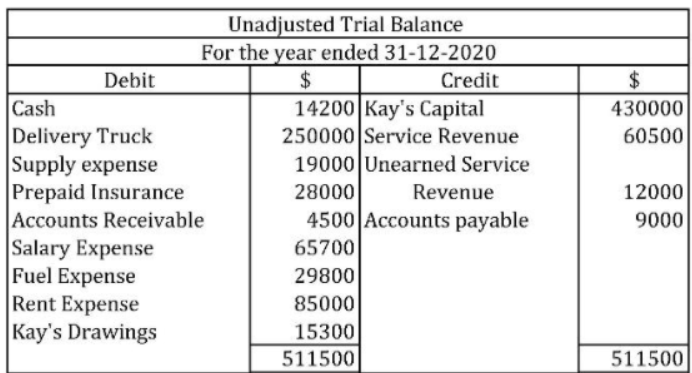

Transcribed Image Text:Unadjusted Trial Balance

For the year ended 31-12-2020

$

Debit

Credit

24

14200 Kay's Capital

Cash

Delivery Truck

Supply expense

Prepaid Insurance

Accounts Receivable

Salary Expense

Fuel Expense

Rent Expense

Kay's Drawings

430000

250000 Service Revenue

60500

19000 Unearned Service

28000

Revenue

12000

4500 Accounts payable

9000

65700

29800

85000

15300

511500

511500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning