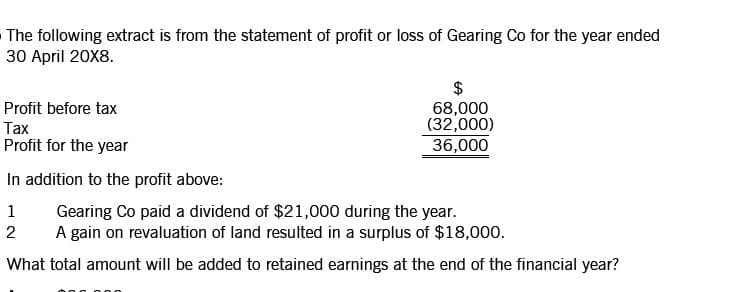

The following extract is from the statement of profit or loss of Gearing Co for the year ended 30 April 20X8. $ 68,000 (32,000) 36,000 Profit before tax Тах Profit for the year In addition to the profit above: Gearing Co paid a dividend of $21,000 during the year. A gain on revaluation of land resulted in a surplus of $18,000. 1 2 What total amount will be added to retained earnings at the end of the financial year?

The following extract is from the statement of profit or loss of Gearing Co for the year ended 30 April 20X8. $ 68,000 (32,000) 36,000 Profit before tax Тах Profit for the year In addition to the profit above: Gearing Co paid a dividend of $21,000 during the year. A gain on revaluation of land resulted in a surplus of $18,000. 1 2 What total amount will be added to retained earnings at the end of the financial year?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 5RE: Bloom Company had beginning unadjusted retained earnings of 400,000 in the current year. At the...

Related questions

Question

Transcribed Image Text:The following extract is from the statement of profit or loss of Gearing Co for the year ended

30 April 20X8.

$

68,000

(32,000)

36,000

Profit before tax

Тах

Profit for the year

In addition to the profit above:

Gearing Co paid a dividend of $21,000 during the year.

A gain on revaluation of land resulted in a surplus of $18,000.

1

2

What total amount will be added to retained earnings at the end of the financial year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT