[The following Information applles to the quIestions alsplayed below Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and It reported two checks outstanding, No. 5888 for $1,028.05 and No. 5893 for $494.25. The following Information Is avallable for Its September 30 reconcilation. From the September 30 Bank Statement PREVIOUS BALANCE TOTAL CHECKS AND DEBITS TOTAL DEPOSITS AND CREDITS CURRENT BALANCE 16,800.45 9,628.85 11,272.85 18,453.25 CHECKS AND DEBITS DEPOSITS AND CREDITS Date No. Anount Date Aпount 09/03 09/04 09/07 09/17 09/28 09/22 09/22 09/28 69/29 5888 1,e28.es 69/05 09/12 1,183.75 5982 719.90 2.226.90 5981 1,824,25 09/21 4,093.ee 2,351.7e 09/25 09/30 09/30 6e0.25 NSF 5985 937.00 12.5e IN 1,485.ee CM 5983 399.10 2,e90.ee 5984 5987 213.85 5989 1,807.65 From Chavez Company's Accounting Records Cash Receipts Deposited Cash Date Debit 1,183.75 2,226.90 4,093.ee 2,351.7e 1,682.75 Sep. 5 12 21 25 30 11,458.18 Cash Disbursenents Check Cash Credit 1,824.25 No. 59e1 59e2 719.98 59e3 399.18 2,060.00 5904 59es 937.08 59e6 982.30 59e7 213.85 388.00 1,807.65 59e8 59e9 9,332.05 Cash Explanation Acct. No. 101 Date PR Debit Credit Balance Aug. 31 Balance 15,278.15 26,736.25 17,484.20 Sep. 30 Total receipts 30 Total disbursements R12 11,458.18 D23 9,332.05 Additional Information Check No. 5904 Is correctly drawn for $2,090 to pay for computer equipment, however, the recordkeeper misread the amount and entered It In the accounting records with a debit to Computer Equipment and a credit to Cash of $2060. The NSF check shown In the statement was originally recelved from a customer, S. Nilson, In payment of her account. Its return has not yet been recorded by the company. The credit memorandum (CM) Is from the collection of a $1,500 note for Chavez Company by the bank. The bank deducted a $15 collection expense. The collection and expense are not yet recorded. 2 Prepare Journal entrles to adjust the book balance of cash to the reconcled balance. (If no entry is required for a transactlon/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) View transaction liat Journal entry worksheet 1 2 3 4 5 6 Record the entry related to the September 30 deposit, if required Note: Enter debits before credits. Date General Journal Debit Credit Sept 30 Record entry Clear entry View general journal

[The following Information applles to the quIestions alsplayed below Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and It reported two checks outstanding, No. 5888 for $1,028.05 and No. 5893 for $494.25. The following Information Is avallable for Its September 30 reconcilation. From the September 30 Bank Statement PREVIOUS BALANCE TOTAL CHECKS AND DEBITS TOTAL DEPOSITS AND CREDITS CURRENT BALANCE 16,800.45 9,628.85 11,272.85 18,453.25 CHECKS AND DEBITS DEPOSITS AND CREDITS Date No. Anount Date Aпount 09/03 09/04 09/07 09/17 09/28 09/22 09/22 09/28 69/29 5888 1,e28.es 69/05 09/12 1,183.75 5982 719.90 2.226.90 5981 1,824,25 09/21 4,093.ee 2,351.7e 09/25 09/30 09/30 6e0.25 NSF 5985 937.00 12.5e IN 1,485.ee CM 5983 399.10 2,e90.ee 5984 5987 213.85 5989 1,807.65 From Chavez Company's Accounting Records Cash Receipts Deposited Cash Date Debit 1,183.75 2,226.90 4,093.ee 2,351.7e 1,682.75 Sep. 5 12 21 25 30 11,458.18 Cash Disbursenents Check Cash Credit 1,824.25 No. 59e1 59e2 719.98 59e3 399.18 2,060.00 5904 59es 937.08 59e6 982.30 59e7 213.85 388.00 1,807.65 59e8 59e9 9,332.05 Cash Explanation Acct. No. 101 Date PR Debit Credit Balance Aug. 31 Balance 15,278.15 26,736.25 17,484.20 Sep. 30 Total receipts 30 Total disbursements R12 11,458.18 D23 9,332.05 Additional Information Check No. 5904 Is correctly drawn for $2,090 to pay for computer equipment, however, the recordkeeper misread the amount and entered It In the accounting records with a debit to Computer Equipment and a credit to Cash of $2060. The NSF check shown In the statement was originally recelved from a customer, S. Nilson, In payment of her account. Its return has not yet been recorded by the company. The credit memorandum (CM) Is from the collection of a $1,500 note for Chavez Company by the bank. The bank deducted a $15 collection expense. The collection and expense are not yet recorded. 2 Prepare Journal entrles to adjust the book balance of cash to the reconcled balance. (If no entry is required for a transactlon/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) View transaction liat Journal entry worksheet 1 2 3 4 5 6 Record the entry related to the September 30 deposit, if required Note: Enter debits before credits. Date General Journal Debit Credit Sept 30 Record entry Clear entry View general journal

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter5: Internal Control And Cash

Section: Chapter Questions

Problem 5.5.2C

Related questions

Question

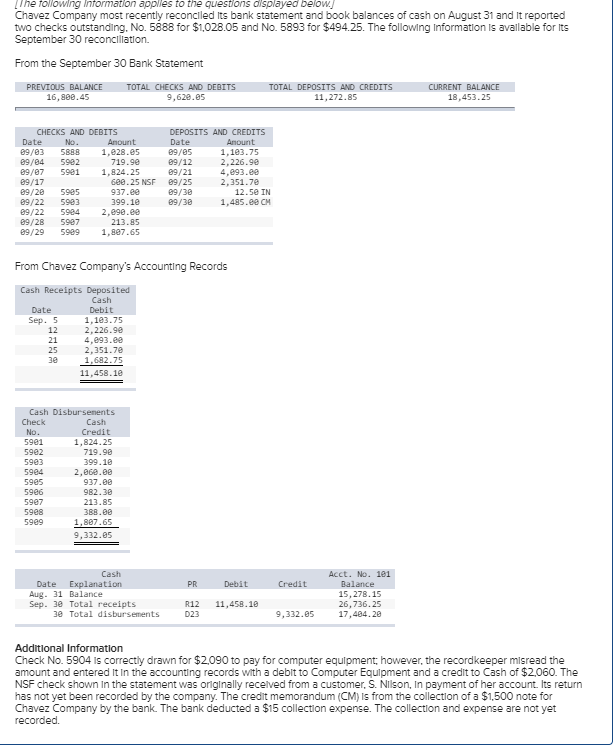

Transcribed Image Text:[The following Information applles to the quIestions alsplayed below

Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and It reported

two checks outstanding, No. 5888 for $1,028.05 and No. 5893 for $494.25. The following Information Is avallable for Its

September 30 reconcilation.

From the September 30 Bank Statement

PREVIOUS BALANCE

TOTAL CHECKS AND DEBITS

TOTAL DEPOSITS AND CREDITS

CURRENT BALANCE

16,800.45

9,628.85

11,272.85

18,453.25

CHECKS AND DEBITS

DEPOSITS AND CREDITS

Date

No.

Anount

Date

Aпount

09/03

09/04

09/07

09/17

09/28

09/22

09/22

09/28

69/29

5888

1,e28.es

69/05

09/12

1,183.75

5982

719.90

2.226.90

5981

1,824,25

09/21

4,093.ee

2,351.7e

09/25

09/30

09/30

6e0.25 NSF

5985

937.00

12.5e IN

1,485.ee CM

5983

399.10

2,e90.ee

5984

5987

213.85

5989

1,807.65

From Chavez Company's Accounting Records

Cash Receipts Deposited

Cash

Date

Debit

1,183.75

2,226.90

4,093.ee

2,351.7e

1,682.75

Sep. 5

12

21

25

30

11,458.18

Cash Disbursenents

Check

Cash

Credit

1,824.25

No.

59e1

59e2

719.98

59e3

399.18

2,060.00

5904

59es

937.08

59e6

982.30

59e7

213.85

388.00

1,807.65

59e8

59e9

9,332.05

Cash

Explanation

Acct. No. 101

Date

PR

Debit

Credit

Balance

Aug. 31 Balance

15,278.15

26,736.25

17,484.20

Sep. 30 Total receipts

30 Total disbursements

R12

11,458.18

D23

9,332.05

Additional Information

Check No. 5904 Is correctly drawn for $2,090 to pay for computer equipment, however, the recordkeeper misread the

amount and entered It In the accounting records with a debit to Computer Equipment and a credit to Cash of $2060. The

NSF check shown In the statement was originally recelved from a customer, S. Nilson, In payment of her account. Its return

has not yet been recorded by the company. The credit memorandum (CM) Is from the collection of a $1,500 note for

Chavez Company by the bank. The bank deducted a $15 collection expense. The collection and expense are not yet

recorded.

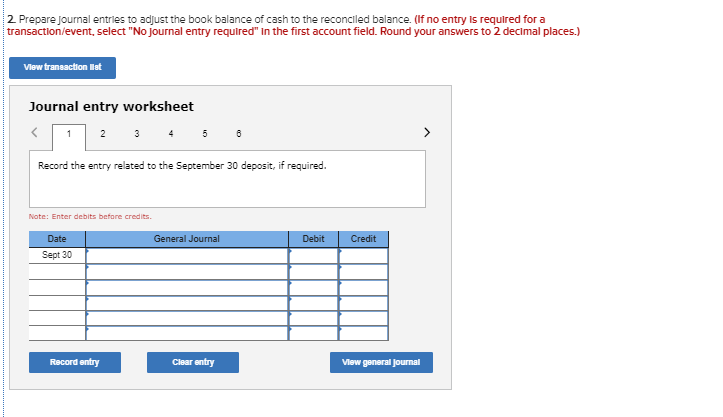

Transcribed Image Text:2 Prepare Journal entrles to adjust the book balance of cash to the reconcled balance. (If no entry is required for a

transactlon/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.)

View transaction liat

Journal entry worksheet

1

2

3

4

5

6

Record the entry related to the September 30 deposit, if required

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Sept 30

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning