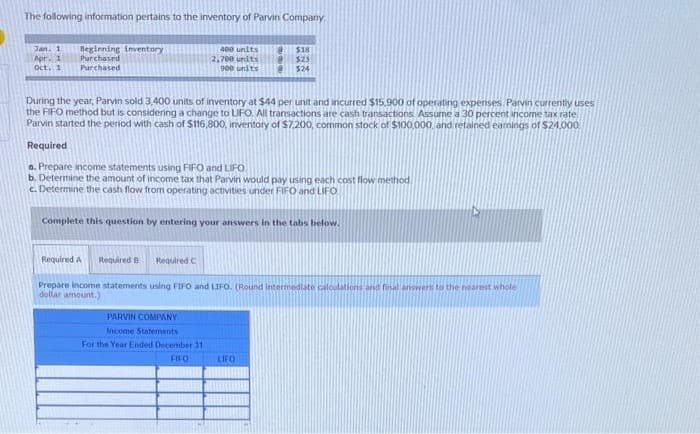

The following information pertains to the inventory Parvin Company. Jan. 1 Apr. 1 Oct. 1 400 units 2,700 units Beginning inventory Purchased Purchased During the year, Parvin sold 3,400 units of inventory at $44 per unit and incurred $15.900 of operating expenses. Parvin currently uses the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a 30 percent income tax rate Parvin started the period with cash of $116,800, inventory of $7.200, common stock of $100,000, and retained earnings of $24,000 Required a. Prepare income statements using FIFO and LIFO b. Determine the amount of income tax that Parvin would pay using each cost flow method c. Determine the cash flow from operating activities under FIFO and LIFO Required A Required B Complete this question by entering your answers in the tabs below. Required C @ $18 $23 900 units @ $24 PARVIN COMPANY Income Statements For the Year Ended December 31 FIFO Prepare income statements using FIFO and LIFO. (Round intermediate calculations and final answers to the nearest whole dollar amount.) LIFO

The following information pertains to the inventory Parvin Company. Jan. 1 Apr. 1 Oct. 1 400 units 2,700 units Beginning inventory Purchased Purchased During the year, Parvin sold 3,400 units of inventory at $44 per unit and incurred $15.900 of operating expenses. Parvin currently uses the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a 30 percent income tax rate Parvin started the period with cash of $116,800, inventory of $7.200, common stock of $100,000, and retained earnings of $24,000 Required a. Prepare income statements using FIFO and LIFO b. Determine the amount of income tax that Parvin would pay using each cost flow method c. Determine the cash flow from operating activities under FIFO and LIFO Required A Required B Complete this question by entering your answers in the tabs below. Required C @ $18 $23 900 units @ $24 PARVIN COMPANY Income Statements For the Year Ended December 31 FIFO Prepare income statements using FIFO and LIFO. (Round intermediate calculations and final answers to the nearest whole dollar amount.) LIFO

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 4RE: Refer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020....

Related questions

Question

Transcribed Image Text:The following information pertains to the inventory of Parvin Company

Jan. 1

Apr. 1

Oct. 1

Beginning inventory

Purchased

Purchased

During the year, Parvin sold 3,400 units of inventory at $44 per unit and incurred $15.900 of operating expenses. Parvin currently uses

the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a 30 percent income tax rate

Parvin started the period with cash of $116,800, inventory of $7.200, common stock of $100,000, and retained earnings of $24.000

Required

a. Prepare income statements using FIFO and LIFO.

b. Determine the amount of income tax that Parvin would pay using each cost flow method.

c. Determine the cash flow from operating activities under FIFO and LIFO

Complete this question by entering your answers in the tabs below.

Required A

Required B

400 units @ $18

2,700 units

$23

900 units • $24

Required C

Prepare Income statements using FIFO and LIFO. (Round intermediate calculations and final ariswers to the nearest whole

dollar amount.)

PARVIN COMPANY

Income Statements

For the Year Ended December 31

FIFO

LIFO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning