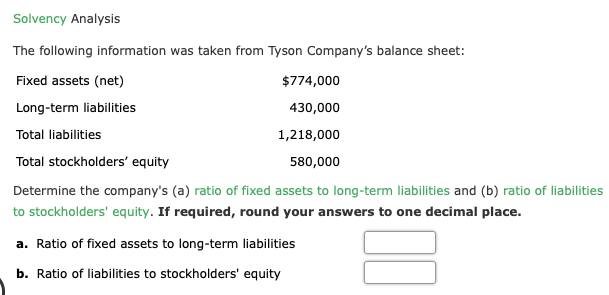

The following information was taken from Tyson Company's balance sheet: Fixed assets (net) $774,000 Long-term liabilities 430,000 Total liabilities 1,218,000 Total stockholders' equity 580,000 Determine the company's (a) ratio of fixed assets to long-term liabilities and (b) ratio of liabilities to stockholders' equity. If required, round your answers to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity

The following information was taken from Tyson Company's balance sheet: Fixed assets (net) $774,000 Long-term liabilities 430,000 Total liabilities 1,218,000 Total stockholders' equity 580,000 Determine the company's (a) ratio of fixed assets to long-term liabilities and (b) ratio of liabilities to stockholders' equity. If required, round your answers to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 6BE

Related questions

Question

Transcribed Image Text:Solvency Analysis

The following information was taken from Tyson Company's balance sheet:

Fixed assets (net)

$774,000

Long-term liabilities

430,000

Total liabilities

1,218,000

Total stockholders' equity

580,000

Determine the company's (a) ratio of fixed assets to long-term liabilities and (b) ratio of liabilities

to stockholders' equity. If required, round your answers to one decimal place.

a. Ratio of fixed assets to long-term liabilities

b. Ratio of liabilities to stockholders' equity

Expert Solution

Step 1

Ratio analysis is a method of measuring the financial position of the organization with different kinds of ratios such as liquidity ratio, profitability ratio, solvency ratio. These ratios help to compare two or more financial statements.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT