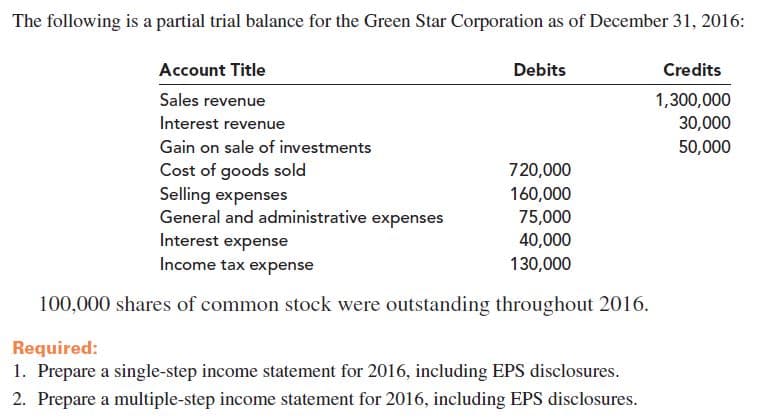

The following is a partial trial balance for the Green Star Corporation as of December 31, 2016: Debits Account Title Credits Sales revenue 1,300,000 Interest revenue 30,000 50,000 Gain on sale of investments Cost of goods sold Selling expenses General and administrative expenses 720,000 160,000 75,000 40,000 Interest expense Income tax expense 130,000 100,000 shares of common stock were outstanding throughout 2016. Required: 1. Prepare a single-step income statement for 2016, including EPS disclosures. 2. Prepare a multiple-step income statement for 2016, including EPS disclosures.

The following is a partial trial balance for the Green Star Corporation as of December 31, 2016: Debits Account Title Credits Sales revenue 1,300,000 Interest revenue 30,000 50,000 Gain on sale of investments Cost of goods sold Selling expenses General and administrative expenses 720,000 160,000 75,000 40,000 Interest expense Income tax expense 130,000 100,000 shares of common stock were outstanding throughout 2016. Required: 1. Prepare a single-step income statement for 2016, including EPS disclosures. 2. Prepare a multiple-step income statement for 2016, including EPS disclosures.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 5E: Multiple-Step and Single-Step In coin Statements The following items were derived from Gold...

Related questions

Question

Transcribed Image Text:The following is a partial trial balance for the Green Star Corporation as of December 31, 2016:

Debits

Account Title

Credits

Sales revenue

1,300,000

Interest revenue

30,000

50,000

Gain on sale of investments

Cost of goods sold

Selling expenses

General and administrative expenses

720,000

160,000

75,000

40,000

Interest expense

Income tax expense

130,000

100,000 shares of common stock were outstanding throughout 2016.

Required:

1. Prepare a single-step income statement for 2016, including EPS disclosures.

2. Prepare a multiple-step income statement for 2016, including EPS disclosures.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning