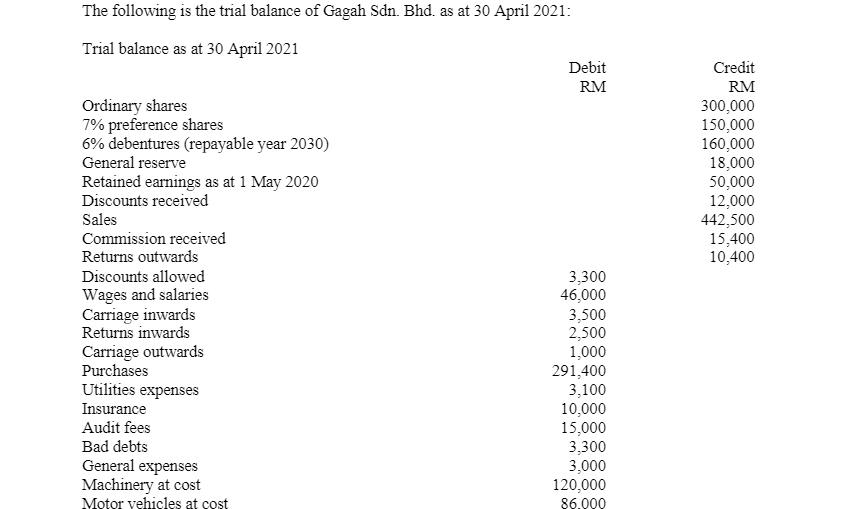

The following is the trial balance of Gagah Sdn. Bhd. as at 30 April 2021: Trial balance as at 30 April 2021 Debit RM Credit RM Ordinary shares 7% preference shares 6% debentures (repayable year 2030) General reserve Retained earnings as at 1 May 2020 Discounts received 300,000 150,000 160,000 18,000 50,000 12,000 442,500 15,400 10,400 Sales Commission received Returns outwards 3,300 46,000 3,500 2,500 1,000 291,400 3,100 10,000 15,000 3,300 3,000 120,000 Discounts allowed Wages and salaries Carriage inwards Returns inwards Carriage outwards Purchases Utilities expenses Insurance Audit fees Bad debts General expenses Machinery at cost Motor vehicles at cost 86.000

The following is the trial balance of Gagah Sdn. Bhd. as at 30 April 2021: Trial balance as at 30 April 2021 Debit RM Credit RM Ordinary shares 7% preference shares 6% debentures (repayable year 2030) General reserve Retained earnings as at 1 May 2020 Discounts received 300,000 150,000 160,000 18,000 50,000 12,000 442,500 15,400 10,400 Sales Commission received Returns outwards 3,300 46,000 3,500 2,500 1,000 291,400 3,100 10,000 15,000 3,300 3,000 120,000 Discounts allowed Wages and salaries Carriage inwards Returns inwards Carriage outwards Purchases Utilities expenses Insurance Audit fees Bad debts General expenses Machinery at cost Motor vehicles at cost 86.000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 14P

Related questions

Question

5. The directors have made the following provisions for the year ended 30 April 2021:

(i) A final dividend of RM0.10 per share is to be paid to ordinary shareholders.

(ii) Preference dividend to be paid in full.

(iii) Transferred RM4,000 to the general reserve account.

Question

Prepare the statement of changes in equity of Gagah Sdn. Bhd. for the year ended 30 April 2021.

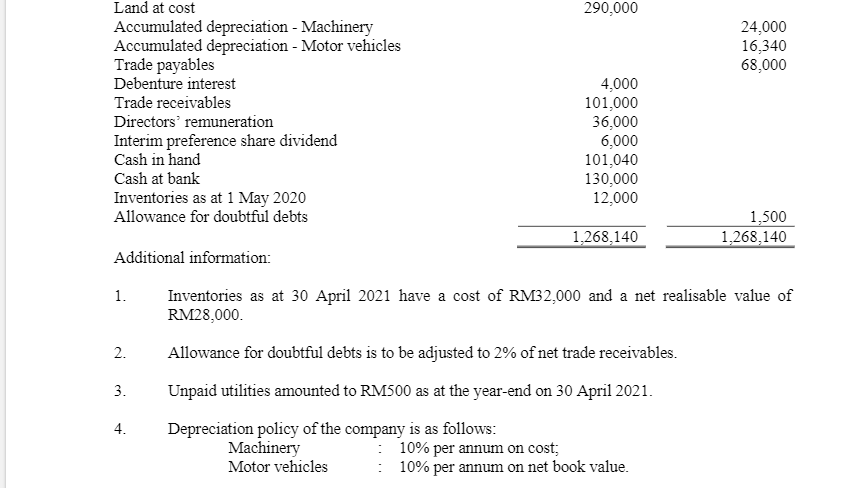

Transcribed Image Text:Land at cost

290,000

Accumulated depreciation - Machinery

Accumulated depreciation - Motor vehicles

Trade payables

Debenture interest

24,000

16,340

68,000

4,000

101,000

36,000

6,000

101,040

130,000

12,000

Trade receivables

Directors' remuneration

Interim preference share dividend

Cash in hand

Cash at bank

Inventories as at 1 May 2020

Allowance for doubtful debts

1,500

1,268,140

1,268,140

Additional information:

Inventories as at 30 April 2021 have a cost of RM32,000 and a net realisable value of

RM28,000.

1.

2.

Allowance for doubtful debts is to be adjusted to 2% of net trade receivables.

3.

Unpaid utilities amounted to RM500 as at the year-end on 30 April 2021.

4.

Depreciation policy of the company is as follows:

Machinery

Motor vehicles

: 10% per annum on cost;

: 10% per annum on net book value.

Transcribed Image Text:The following is the trial balance of Gagah Sdn. Bhd. as at 30 April 2021:

Trial balance as at 30 April 2021

Debit

Credit

RM

RM

Ordinary shares

7% preference shares

6% debentures (repayable year 2030)

General reserve

Retained earnings as at 1 May 2020

Discounts received

300,000

150,000

160,000

18,000

50,000

12,000

442,500

15,400

10,400

Sales

Commission received

Returns outwards

Discounts allowed

3,300

46,000

3,500

2,500

1,000

291,400

3,100

10,000

15,000

3,300

3,000

120,000

Wages and salaries

Carriage inwards

Returns inwards

Carriage outwards

Purchases

Utilities expenses

Insurance

Audit fees

Bad debts

General expenses

Machinery at cost

Motor vehicles at cost

86.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning